Fixed-income investments provide a fixed return over a period of time, like bonds or bond ETFs. These investments are generally considered less risky than stocks and can be a reliable source of income for investors seeking stability and predictable returns.

- What is fixed-income investing?

- Why include fixed-income investments in your portfolio now

- The different types of fixed-income investments

- Fixed-income investing terms to know

- What are bond ETFs

- Fixed-income investing risks to know

- Diversifying your portfolio with fixed-income investments

- Final thoughts

- FAQs

Fixed-income investing is a low-risk strategy that aims to generate regular payments from your investments. Although fixed-income assets are generally safer than growth-oriented investments like stocks, they still carry some level of risk. Here’s what you should know about fixed-income investing.

What is fixed-income investing?

When you invest in fixed-income investments, you are essentially lending money to a company or the government for regular interest or coupons. These rewards are usually paid monthly or quarterly, and you’ll receive your initial investment when the

This type of investing is called “fixed-income” because the returns on these investments are typically fixed or predictable.

For instance, if you buy a 10-year bond worth $10,000 with an annual interest rate of 5%, the bond will pay you $500 in interest per year.

Typically, bonds make interest payments in fixed intervals, such as semiannually or annually. If this bond pays you interest semiannually, every six months, you would receive an interest payment of $250 twice per annum.

At the end of the bond’s term, you would also receive the initial invested amount of $10,000.

Though inventors can buy and sell a bond for a profit, most focus on its steady payments instead of capital gains. However, not only bonds offer fixed income. The investment model can be used with assets like stocks, treasury bills, and bank certificates of deposits. But for many, bonds are the go-to choice.

Tip: The most common types of fixed-income securities include bonds, certificates of deposit (CDs), and Treasury bills.

The main benefit of fixed-income investing is its relative stability compared to other investment options. Since the income generated from the investment is predictable, it can provide a steady cash flow and cushion the effect of unfavorable economic conditions.

Fixed-income investing can also create a balanced investment portfolio by

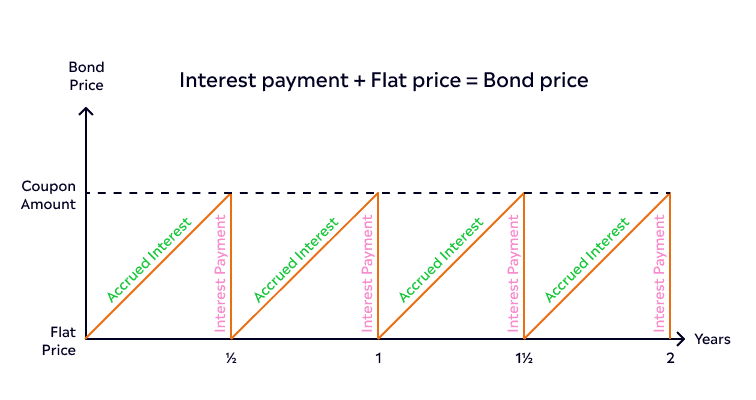

The graph below shows how a bond’s price is determined by a combination of its flat price and accrued interest over a period. This ultimately forms the actual or full bond price, and the bond investor receives their full coupon payment at intervals.

Fixed-income investments are a smart addition to your investment mix, especially when paired with riskier assets like stocks. They offer stability, protect your capital, and deliver predictable returns. At eToro, you can easily tap into this asset class through ETFs, gaining all the advantages of fixed-income products in a hassle-free way.

Why include fixed-income investments in your portfolio now

For the last several years, interest rates have been very low. Bond coupons are paid to investors based on fixed interest rates, so these were also low. When combined with high inflation, this devalued bonds’ principal value, making bonds a less attractive option for investors.

However, recently things have begun to change. The

When interest rates are high, the yields on fixed-income investments tend to be more attractive. This is because bond issuers offer higher interest rates to entice investors, making these investments more appealing.

During high-interest rate periods, fixed-income investments may offer the opportunity to reinvest at higher rates. As existing bonds mature, you can reinvest your money into new bonds with higher yields, taking advantage of the improved interest rate environment.

What are some other benefits of investing in fixed-income assets? These investments can act as a cushion against market

Adding fixed-income investments can help diversify your portfolio, which can help spread risk and enhance the stability of your overall investment strategy.

The different types of fixed-income investments

Numerous types of fixed-income investments exist and all are worth understanding. The most popular types include treasury bills, long-duration bonds, corporate bonds, and mortgage-backed securities. Whichever one you choose, the investment process involves lending money to a fixed-income security in return for a fixed yield.

Let’s take a closer look at the different types of bonds.

Treasury Bills (T-Bills) are short-term debt securities issued by the government. You’ll typically buy a T-Bill at a discount and get the full value when they mature.

The maturity period for T-Bills can be less than a year. It ranges from 4 to 52 weeks, making it flexible for any investment strategy. Shorter-term bills usually have less volatility and are less likely to be affected by interest rate changes.

Overall, T-Bills are considered very low risk because the government backs them with full faith and credit.

Tip: T-Bills help preserve capital and offer predictable returns. Remember, all investments come with risks, so do your homework before investing.

Long-duration bonds, which are also backed by the US government, have a relatively long maturity period, typically over ten years. While they may experience price volatility, they can still provide a solid return on your investment over the long haul.

Tip: Interest rates, inflation, and currency changes can affect bond values. If you’re willing to hold onto your investment until maturity, long-duration bonds can be a valuable, low-risk addition to your portfolio.

Corporate bonds are issued by companies to raise capital. They’re often riskier than government bonds because they don’t have the backing of government funds, but they typically offer higher yields to make up for the added risk.

Still, when investing in corporate bonds, keep an eye on bond ratings. These ratings assess the likelihood of getting a repayment. Be cautious of investments like

Tip: Bond ETFs offer the advantage of diversified exposure to multiple instruments. This helps minimize the impact of a single entity defaulting if that were to occur.

However, bonds aren’t the only type of fixed-income investment. Here are some other popular investments that earn a steady return:

Certificates of deposit (CDs) are fixed-income deposits offered by banks and credit unions. When you buy a CD, you agree to keep your money invested for a specific period or term. In return, you receive a fixed interest rate that is typically higher than regular savings accounts.

Money market funds invest in short-term, low-risk debt securities, such as T-bills, corporate bonds, and CDs.

Preferred stock represents an ownership interest in a company. Unlike common stock, preferred stockholders have a priority on the company’s earnings. Preferred stockholders usually receive fixed dividend payments, similar to bond interest, and are paid before common stockholders. Although preferred stock carries less risk than common stock, it’s still relatively risky.

Mortgage-backed securities (MBS) are made up of a pool of mortgage loans, providing a way for investors to earn income from mortgage loans. MBS can be issued by government-sponsored enterprises like Fannie Mae, Freddie Mac or private issuers.

Fixed-income investing terms to know

When considering bonds and fixed-income investments, it’s important to think about the key factors – including maturity date, face value, and duration. However, there are several other important terms to know:

- Bond market: Where bonds are bought and sold, including primary and secondary markets.

- Face value: The amount the issuer repays to the investor at bond maturity.

- Coupon rate: The fixed interest rate paid by the issuer, expressed as a percentage of the face value.

- Maturity date: The bond’s expiration date and when the investor is repaid.

- Yield to maturity (YTM): Expected annual return if the bond is held until maturity.

- Duration: Measures a bond’s sensitivity to interest rate changes.

- Call option: Allows the issuer to redeem the bond before maturity if rates have fallen.

- Credit rating: Assess the issuer’s creditworthiness, reflecting repayment ability.

- Default risk: The risk of the issuer being unable to repay the bond’s face value.

What are bond ETFs

Bond ETFs (exchange-traded funds) are ETFs that invest in fixed-income securities. They are similar to bond mutual funds and stock ETFs, and can be passively traded on global exchanges. When it comes to investing in bonds, there are two main options: individual bonds and bond ETFs.

Individual bonds involve buying a specific bond from a company or government, offering a fixed interest rate and maturity date. If held until maturity, investors receive the initial investment plus accumulated interest.

Bond ETFs, on the other hand, hold a diversified portfolio of bonds. They combine the features of bonds and ETFs, providing diversification and liquidity.

When you invest in an ETF, your money is spread across a variety of bonds from different issuers, sectors, and maturities. This diversification helps reduce the risk associated with investing in a single bond.

Because ETFs trade on stock exchanges, you can buy or sell them throughout the trading day. This flexibility allows you to invest whenever you want without worrying about finding a buyer or seller, as can be the case with individual bonds.

Bond ETFs often have lower investment minimums compared to buying individual bonds. This makes them more accessible to a wider range of investors.

Choosing between individual bonds and bond ETFs depends on investment goals and preferences. Individual bonds suit those seeking predictability, while bond ETFs offer diversification and accessibility.

Many retail investors may find investing in bond ETFs more accessible, as they require less capital.

Tip: Investors should consult with an independent financial advisor and carefully consider their investment goals, risk tolerance, and other factors before making a decision.

Fixed-income investing risks to know

One of the key perks of fixed-income investing is diversification. Diversification can help to minimise risk. However, there are also risks, such as changes in interest rate and inflation, the level of liquidity, or if your buyer is not able to fulfil their payment obligation.

Like any investment, bonds do carry risks. Here are some key considerations:

- Interest rate risk: Bond prices can fluctuate based on changes in interest rates.

- Inflation risk: Inflation can diminish the value of fixed interest payments.

- Call risk: The issuer may redeem the bond before maturity, potentially affecting returns.

- Liquidity risk: Some bonds may be difficult to sell or may not have enough buyers in the market.

- Credit risk: There’s a chance that the issuer may not fulfill their payment obligations.

Before diving into bonds, it’s important to assess risks and their potential impact on your investment. The below table details the percentages of different grade bonds you might expect to hold if you bought a US bond fund termed ‘Intermediate Core.’

| Credit Rating | % of US Intermediate Core Bond Funds (Median) |

|---|---|

| AAA | 64% |

| AA | 4% |

| A | 12% |

| BB | 16% |

| BBB and below | 4% |

Diversifying your portfolio with fixed-income investments

Before you invest in any asset, determine your risk tolerance and investment goals. Fixed-income investments tend to be less volatile than stocks, making them suitable for conservative or income-focused investors.

Once you understand your risk tolerance, decide on the percentage of your portfolio that you want to allocate to fixed-income investments.

A common rule of thumb is to subtract your age from 100 to determine the percentage of your portfolio that should be allocated to stocks, with the remainder allocated to fixed-income investments.

The U.S. bond market is massive, worth over $50 trillion, offering various fixed-income investment opportunities. Bonds are a popular choice — and include government bonds, corporate bonds, municipal bonds, and international bonds. Each type has its own risk and return profile, so consider diversifying across different bond types to spread risk.

If you prefer a more diversified approach to fixed-income investing, bond ETFs can be a good option.

Once you’ve diversified your portfolio with fixed-income investments, it’s important to regularly review and rebalance your investments. Market conditions, interest rate changes, and your investment goals may require adjustments over time.

Rebalancing ensures that your portfolio remains aligned with your risk tolerance and investment objectives. Remember, diversification does not guarantee profits or protect against losses, but it can help lower overall risk.

Final thoughts

Bonds, valued at around $130 trillion globally, are the most traded asset class. While they previously lost popularity due to low interest rates and high inflation, there are new investment opportunities now that interest rates are beginning to rise.

Bond ETFs offer an appealing option for investors, combining the benefits of bonds and exchange-traded funds, including diversification and liquidity.

Visit the eToro academy to learn more about fixed-income investing.

FAQs

- What is fixed-income investing?

-

The practice of investing in assets that provide a steady stream of income. These investments typically include bonds, bond ETFs, and other debt instruments that generate regular interest or coupon payments.

- Why should you include fixed-income investments in your portfolio?

-

Fixed-income investments provide a stable source of income, making them suitable for individuals seeking regular cash flow. They’re also generally considered to be lower risk compared to stocks, making them valuable for diversifying a portfolio and reducing overall investment risk.

- What are the different types of fixed-income investing?

-

Some common examples of fixed-income investments include government bonds, corporate bonds, municipal bonds, Treasury Inflation-Protected Securities (TIPS), and certificates of deposit (CDs).

- What are Bond ETFs?

-

Bond ETFs, or Exchange-Traded Funds, are investment funds that trade on stock exchanges and provide exposure to a diversified portfolio of bonds.

- Are fixed-income investments suitable for all types of investors?

-

Fixed-income investments can be suitable for a wide range of investors, including those who are seeking stable income, preserving capital, or diversifying their portfolios. All you have to do is determine if it suits your investment strategy.

- What are the risks associated with fixed-income investments?

-

Credit risk, interest rate risk, and inflation risk are common risks associated with fixed-income investments. There’s also the risk of default by the issuer, particularly with corporate bonds.

- How do I assess the creditworthiness of a bond issuer?

-

Bond ratings such as AAA, AA, A, and so on signify the issuer’s ability to meet their debt obligations. Higher-rated bonds are generally considered lower risk, while lower-rated bonds carry higher risk but may offer bigger returns.

- Can I lose money with fixed-income investments?

-

While fixed-income investments are generally considered less risky than stocks, there is still the potential for losses. Factors such as changes in interest rates, default risk, and inflation can impact the value of fixed-income investments.

- Are fixed-income investments affected by changes in interest rates?

-

When interest rates rise, the market value of existing fixed-income securities tends to decline as newer bonds with higher interest rates become more attractive. Conversely, when interest rates fall, the value of existing fixed-income securities may increase.

- Can I sell my fixed-income investments before maturity?

-

Yes, fixed-income investments can be sold before maturity. However, the market value of the investment may be higher or lower than the initial purchase price, depending on various factors such as changes in interest rates, credit quality, and market conditions.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.