Draft trading options on eToro involve three steps: logging in to your account, choosing your option, and creating your draft trade.

When starting off trading a new market or type of

Log In to Your Account

First, log in to your eToro account. If you haven’t already signed up for options trading on eToro, you will need to register for an Options account by answering a few questions to make sure that you fit the profile of an options trader.

This extra step might be required because options trading is a separate feature within the eToro platform. It is specifically designed to support trading in options contracts.

Tip: After registering for an eToro Options account, make sure that it is “verified” before starting to book draft trades.

Choose Your Option

Next, search for the options relating to your favorite stocks and

Tip: The price of options is determined by price moves in the underlying security, such as a stock.

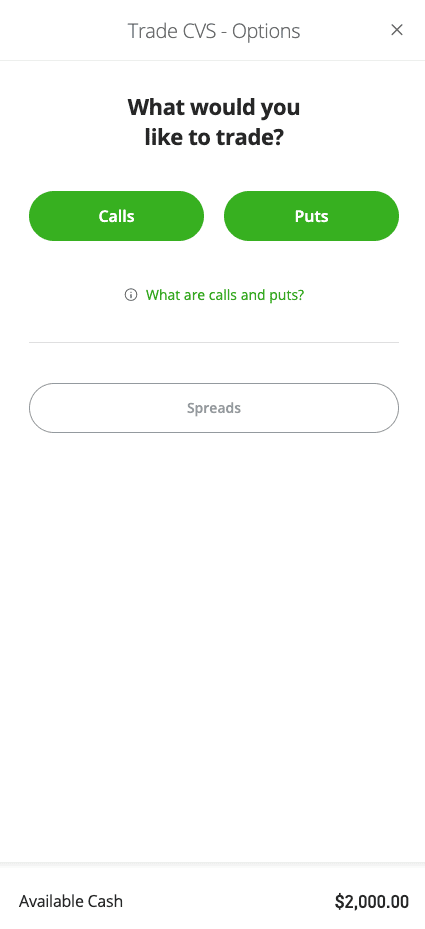

You can choose between calls and puts, which appreciate in value depending on whether the

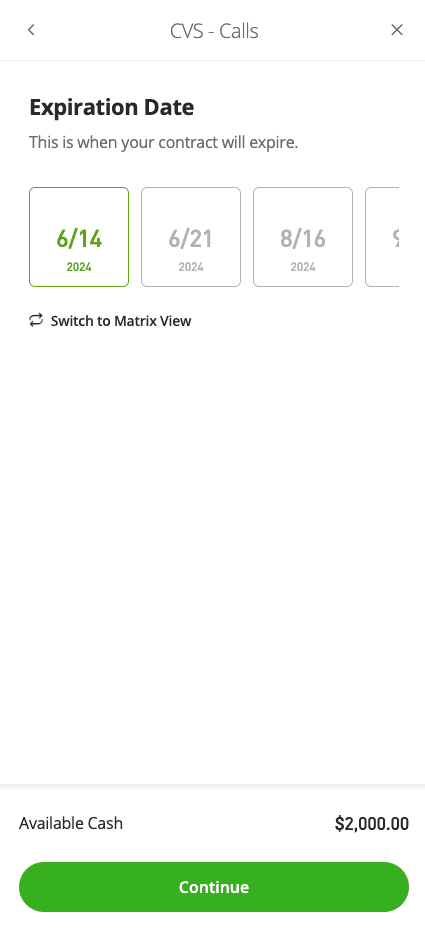

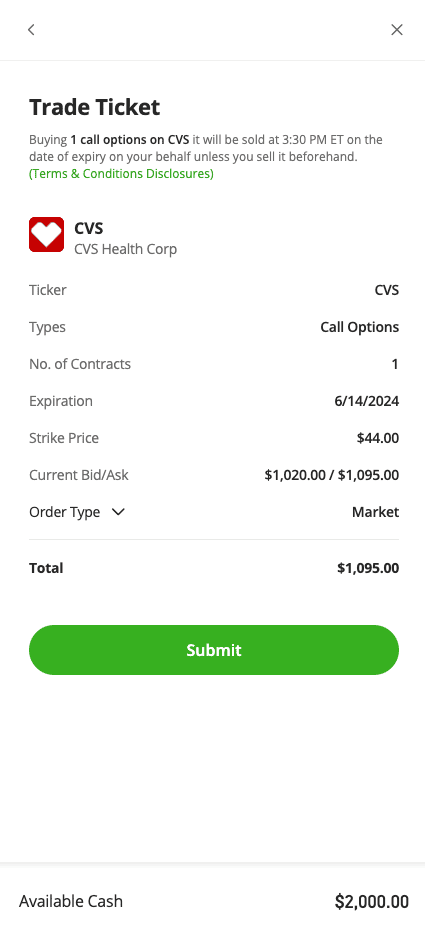

Once you’ve picked your option, it’s time to get into the details. Choose the expiration date of the contract and the strike price that best fits your strategy.

You’ll be presented with the prices of the available options, but don’t worry — with draft trading, you won’t risk any real cash.

Whether you’re a beginner learning about options or an experienced trader researching a new approach, you might want to try booking different trades and testing multiple strategies in separate draft trades, just to see how they work.

Create Your Draft Trade

Review your option and hit the “Save as draft” button. You can view your saved draft trades on the Options portfolio screen.

Then, you can either wait until the expiry date to see what happens, delete your draft, or turn your draft trade into a real trade at any time. Hit the three dots icon next to your open draft trade to see your choices.

To see how your draft trade is doing, you may want to look at the P/L section in your options portfolio. From there, you can see what you would have made or lost if your option was sold or expired at that moment.

Final thoughts

Draft trading offers an excellent way to develop new skills and a greater understanding of how the options markets work. The fact that draft trading involves virtual funds makes it accessible for those wanting to learn about the mechanics of trading options.

It is important to remember that stepping up to trading with real cash can result in your decision-making being influenced by the fact that real funds are now at stake.

Want to learn more about options? Head over to the eToro Academy today.

FAQs

- What is the difference between options and futures?

-

The key difference between options and futures is that options give you the right to convert your option into the underlying security, but with futures, you are obligated to convert on the contract’s expiry date.

- What other ways are there to learn about options trading?

-

If you want to carry out more research to back up your hands-on draft trading, visit the eToro Academy to access the free options course, which provides more information on how the market works.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.