The Bitcoin halving event and subsequent four-year cycle can have a significant impact on prices in the crypto market. As it is a predetermined event that follows set trajectories, traders and investors should formulate strategies in advance.

With the Bitcoin halving occurring approximately every four years and demonstrating such a strong influence on the price of Bitcoin, it is worth studying previous halving events when making strategic decisions.

There have been three previous halving events, which have demonstrated recurring themes. If these trends and price movements repeat themselves in the upcoming Bitcoin halving event, they could potentially present some good trading opportunities.

Four-year cycle strategies

Bitcoin’s four-year cycle, also known as the halving, is one of the blockchain’s most significant events. After the Bitcoin halving (every time 210,000 blocks are created), Bitcoin mining rewards are cut in half. The halving event often increases

This has been the pattern after every four years. To create and implement a strong trading strategy for the four years, it is important to know more about the different stages of Bitcoin’s periodic cycle. Here is more information on how the different cycle phases operate.

| Phase | Market reaction |

|---|---|

| Pre-halving | As the halving approaches, media and retail interest rise in anticipation of a new |

| Post-halving | Like all markets, supply and demand forces ultimately determine Bitcoin’s price. Reducing the supply of new Bitcoins by 50% through halving typically confirms the start of a new bull market. |

| Parabolic peak | As buying pressure builds and the Bitcoin price rises, euphoria often grows and pushes the price higher. Also, there’s usually additional interest in the wider crypto market as money flows into altcoins such as Ethereum, Cardano and Polygon. |

| Bear phase | As Bitcoin investors take profits or shy away from the coin’s higher valuation, the price falls. This has happened historically over the previous halving event, and the period is often referred to as the “crypto bear market”. Sometimes, a |

| Accumulation phase | As the price consolidates at a new, lower level, long-term investors will often take the opportunity to “buy the dip” in anticipation of the next Bitcoin halving. |

Lessons from the 2024 Bitcoin halving

Studying the effects of the 2024 halving can offer insights into how a future halving might act as a catalyst for price movements.

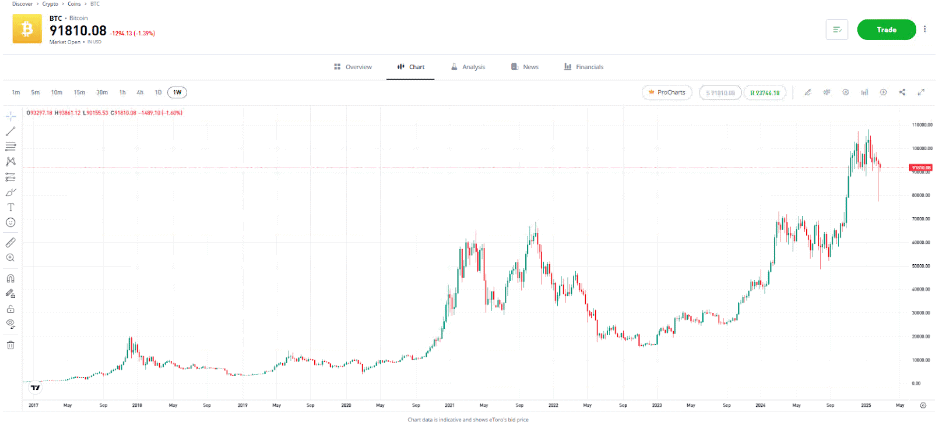

The BTC price chart example below demonstrates some of the stages of the four-year cycle more clearly. The 2024 halving took place on April 19, but a pre-halving rally occurred roughly 30 days prior. The pre-halving surge saw Bitcoin setting a high of $70,184 on March 1.

For illustration purposes only. Past performance is not an indication of future results.

Source: eToro

The Bitcoin price saw two huge spikes in the post-halving phase of the cycle, eventually reaching a new all-time high of $76,999 in November 2024.

Bitcoin spiked again in mid-November after the re-election of Donald Trump as president, this time reaching over $91,000.

Psychological factors that impact Bitcoin trading decisions

To understand exactly how the Bitcoin halving creates a four-year cycle, it is important to consider some of the psychological factors that might influence investment decisions.

Fear and greed

All investors are at risk of feeling fear and greed when investing. However, these feelings can be made more intense by the significant returns from some Bitcoin investors during the post-halving price surge. When this happens, it’s called FOMO.

In crypto, “FOMO” — otherwise known as the “fear of missing out” — can cause some investors to chase trends or remain in positions for too long in the hope of making additional profits.

In addition, when upward trends reverse, criticisms surrounding the viability and longevity of the crypto sector resurface, which can cause increased selling pressure.

Self-fulfilling prophecies

The widespread reporting of the Bitcoin halving process and how it follows a pattern suggests that Bitcoin’s four-year cycle is a self-fulfilling prophecy. This means that the price moves happen, at least in part, because market participants think that they will.

There is also a common saying among investors: “Buy the rumour, sell the fact.” Potential upcoming events or changes can be priced into the market before an official announcement is made. This can cause people to take profit following the announcement, forcing prices lower, even if the headline is a positive one. The same can also be said for bad news.

Tip: Investors who take a long-term view of Bitcoin’s prospects and resist the temptation to sell positions are called “HODLers”.

Market sentiment factors that impact Bitcoin trading decisions

Investor sentiment can influence prices in all markets, including the crypto market. New investors, especially those focused on more traditional asset classes, often become more interested in Bitcoin and other cryptoassets when the halving is gathering momentum.

This is no surprise since any market that experiences an inflow of capital will experience upward price movements.

Speculative investors who are trading during the halving event instead of sticking to the buy-and-hold approach are more likely to be moved out of positions, though. Unlike long-term investors, the higher number of speculative investors in a market can lead to sharp price crashes and increased volatility.

External impacts on Bitcoin trading decisions

Although the Bitcoin halving can have a significant impact on the Bitcoin price and the broader crypto market, other factors also apply.

Fundamental analysis factors can influence the price of Bitcoin – and this has been proven historically. For example, a decision from crypto regulators can potentially influence the general market prices.

For instance, in 2019, China restricted the trading and mining of Bitcoin, resulting in a significant price crash. Conversely, the relaxation of regulations in other countries has encouraged increased mainstream crypto adoption, which might lead to price changes.

Final thoughts

The Bitcoin halving draws more attention to Bitcoin and the broader crypto market. However, since it is a predetermined event that follows set trajectories, traders should prepare their strategies in advance.

Nothing is ever guaranteed in the financial markets or with cryptos, though. This is why carrying out research for key crypto events, such as the halving, is one of the golden rules of investing.

Visit the eToro Academy to learn how to create trading strategies.

FAQs

- Will all Bitcoin halvings take place every four years?

-

The timing of future Bitcoin halving events is determined by the rate at which miners successfully extract new blocks. At its current rate, the halving takes place approximately every four years. However, if the block production rate increases, the halving event will take place sooner.

- Can you day trade bitcoin?

-

Yes, it is possible to day trade Bitcoin. This involves opening buy and sell positions on the same day. However, due to the massive volatility of the crypto market, traders can lose more than 10% of their investments within a single day.

- How many bitcoins are mined each day?

-

On average, 900 new coins are mined on the Bitcoin blockchain each day. Using the current reward rate for Bitcoin, this equates to roughly 144 new blocks created every 24 hours.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.