Micron Technology, Inc. MU

392.90$-4.68(-1.18%)(1D)

• Prezzi posticipati da NASDAQ • in USD

Investi in Micron Technology, Inc.

oggi

oggi

Crea un account eToro per acquistare azioni MU su una piattaforma di trading multi-asset, intuitiva e sicura.

Micron Technology, Inc. MU

Titoli di tendenza

Scopri quali sono i titoli che vantano i più elevati incrementi giornalieri di volume se comparati alla rispettiva media a tre mesi.

Notizie su Micron Technology, Inc.

Teleborsa • 19.01.26 • 12:55

Micron acquisirà uno stabilimento di produzione di chip a Taiwan per 1,8 miliardi di dollariGuruFocus • 22.01.26 • 19:55

Micron (MU) Positioned for Gains Amid AI-Induced Memory ShortageGuruFocus • 22.01.26 • 15:29

Darwin Wealth Management, LLC Sells 149 Shares of Micron Technology Inc (MU)Grafico del prezzo delle azioni MU

40.30

Ult. mese

1D

1W

1M

6M

1Y

3Y

MAX

Iscriviti per visualizzare i grafici completi forniti da

*Le prestazioni passate non sono indicative dei risultati futuri

Il prezzo delle azioni Micron Technology, Inc. sale questa settimana.

i

Un prezzo ’in rialzo’ indica che si è verificato un aumento di oltre lo 0,5% su base settimanale.

Un prezzo ’in ribasso’ indica che si è verificata una diminuzione di oltre lo 0,5% su base settimanale.

Un prezzo ’stabile’ indica che è variato in una forbice tra -0,5% e 0,5% su base settimanale.

Un prezzo ’in ribasso’ indica che si è verificata una diminuzione di oltre lo 0,5% su base settimanale.

Un prezzo ’stabile’ indica che è variato in una forbice tra -0,5% e 0,5% su base settimanale.

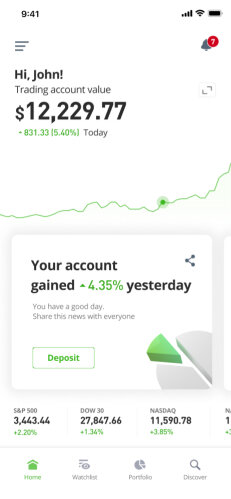

Il prezzo di Micron Technology, Inc. oggi è 392.90$, un cambiamento di -1.18% nelle ultime 24 ore e 8.13% nell'ultima settimana. Il prezzo di Micron Technology, Inc. è cambiato di 280.22% nell'ultimo anno.

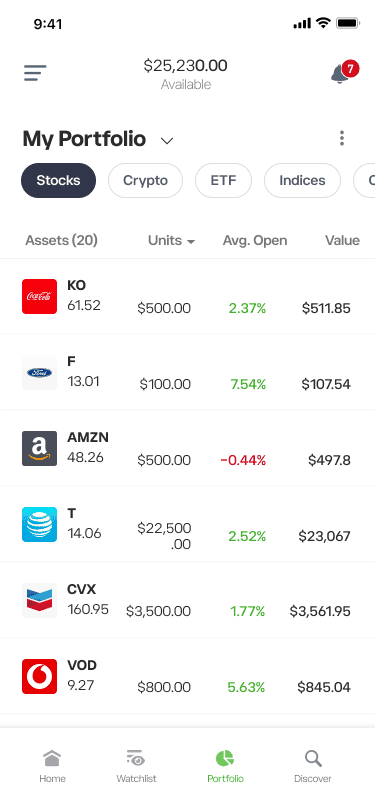

Indicatori chiave di MU

Capitaliz. di mercato

i

Il valore totale dei titoli di una compagnia, calcolati moltiplicando il prezzo dell'azione per il numero totale di azioni.

-

Oscillazione giornaliera

i

Mostra il massimo e il minimo di giornata.

391.09$ - 395.9$

Oscillazione a 52 sett.

i

Mostra il massimo e il minimo dell'ultimo anno.

61.49$ - 403.39$

Volume medio (3 mesi)

i

Il numero medio di azioni scambiate al giorno negli ultimi tre mesi.

-

Rapporto prezzo-profitti

i

Il risultato del prezzo dell'azione di questo asset diviso per i guadagni per azione.

-

Ricavo

i

I profitti totali generati dai prodotti e servizi di questa compagnia nell'ultimo anno.

-

Dividendo (Rend.)

i

Quello che una società paga annualmente in dividendi rispetto al prezzo delle sue azioni.

-

Chiusura precedente

i

Il prezzo finale di questo asset al termine dell'ultima giornata di scambi.

397.58$

EPS

i

Utile complessivo di una società diviso per il numero di azioni emesse.

-

Beta

i

Parametro che stima la possibilità che il prezzo di un asset fluttui assecondando o disattendendo l’andamento generale del mercato.

-

Come posso acquistare azioni Micron Technology, Inc.?

Per acquistare Micron Technology, Inc.:

01

Crea un account eToro:

Registrati su eToro e verifica la tua identità.02

Deposita fondi:

Deposita fondi sul tuo conto eToro utilizzando il tuo metodo di pagamento preferito.03

Ricerca e acquisto:

Cerca nella pagina Micron Technology, Inc. (MU) e effettua un ordine per acquistare Micron Technology, Inc..Cerchi ulteriori informazioni? Consulta la nostra guida nell’Academy.

Che cos'è Micron Technology, Inc.?

Micron Technology Inc. è stata fondata nel 1978 e offre soluzioni di memoria attraverso i suoi marchi globali: Micron, Crucial e Ballistix. Micron Technology produce tecnologie di memoria e archiviazione come le memorie DRAM, NAND, NOR e 3D XPoint ™ e opera in una vasta gamma di settori, tra cui Automobilistico, Beni di consumo, Integrato, Federale, Finanziario, Industriale, Mobile, Networking e altri. I risultati del terzo trimestre fiscale 2018 della società include un aumento dei ricavi del 40%, a $7,80 miliardi. Aggiungi questo strumento al tuo portafoglio e investi in MU.

AD

Sanjay Mehrotra

Dipendenti

53K

Fondazione

1978

Sede centrale

Boise, Idaho, US

Le migliori guide

Le guide più rilevanti della eToro Academy selezionate da noi

Le migliori azioni con dividendi 2025

Maggiori informazioniPreparati al 2026 con le migliori azioni da dividendo. Scopri il potenziale di J&J, Chevron, Coca-Cola, Verizon, Eni, A2A con l’analisi esperta di eToro.

Le azioni migliori per il 2025

Maggiori informazioniPreparati al 2026 con le migliori azioni. Tuffati nel potenziale di Banco BPM, Amazon, Microsoft, TSMC, Costco e Eli Lilly grazie all’analisi esperta di eToro.

Azioni IA da considerare per il 2025

Maggiori informazioniPreparati al 2026 con le azioni IA. Sfrutta il potenziale di Nvidia, Broadcom, Amazon, ASML, Alphabet e Micron grazie all’analisi esperta di eToro.

Investi in Micron Technology, Inc.

oggi

oggi

Crea un account eToro per acquistare azioni MU su una piattaforma di trading multi-asset, intuitiva e sicura.

Domande frequenti

Il prezzo attuale delle azioni MU è di 392.90$.

Il target di prezzo medio per le azioni Micron Technology, Inc. è di 392.90$. Iscriviti su eToro per previsioni dettagliate degli analisti e obiettivi di prezzo.

Gli analisti offrono previsioni per le azioni Micron Technology, Inc. basate su tendenze di mercato, rapporti finanziari e crescita prevista. Consulta le previsioni recenti per i futuri movimenti dei prezzi.

La capitalizzazione di mercato di Micron Technology, Inc. è (I dati non sono disponibili in questo momento)

Movers giornalieri

Scopri i maggiori mover azionari sul mercato.