Timing the market is close to an impossible task, even if you’re an experienced investor.

Past performance is, of course, no guarantee for future returns. Acknowledging that, people have different options to consider in how they want to invest, as far as the amount and frequency.

Should you invest one large lump sum all at once or spread your investment in smaller increments over time?

Luckily, you can do both on eToro.

Timing the market vs. time in the market

If you’re more interested in the latter, dollar-cost averaging may be the option for you. It’s a strategy that rewards consistency over timing, allowing you to protect against the unpredictable nature of markets.

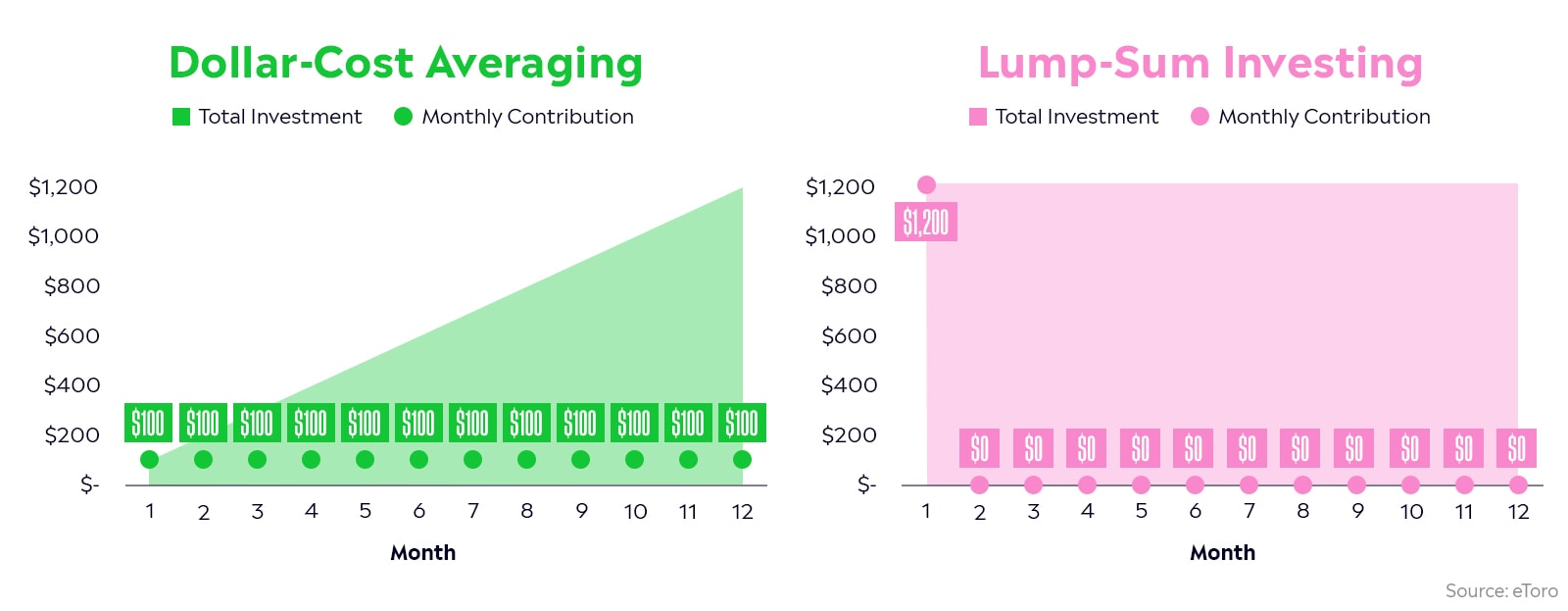

Dollar-cost averaging involves spreading out your investments over time, typically in even increments. Say you wanted to invest $1,200 into a stock, cryptocurrency, or portfolio. You could, of course, just invest that lump sum all at once. With dollar-cost averaging, however, you could invest $100 every month for a year, which could reduce your immediate exposure in the event of a market downturn.

DCA made easy with recurring deposits

Investors using dollar-cost averaging can also establish a consistent investment plan, essentially like any other life routine.

To accommodate this and similar investing strategies, eToro has an option for recurring deposits. This feature allows investors to set up continuous, automated payments on their eToro accounts without having to manually add funds. Recurring deposits can be scheduled on a weekly, twice-a-month, or monthly basis.

In addition to managing your risk, setting up recurring deposits to implement a dollar-cost averaging strategy can also help eliminate the mental barriers of investing. When you set up recurring deposits, it’s easier to follow an investing plan to the end because it becomes an automated process.

Sign up for recurring deposits

Compounding and consistency

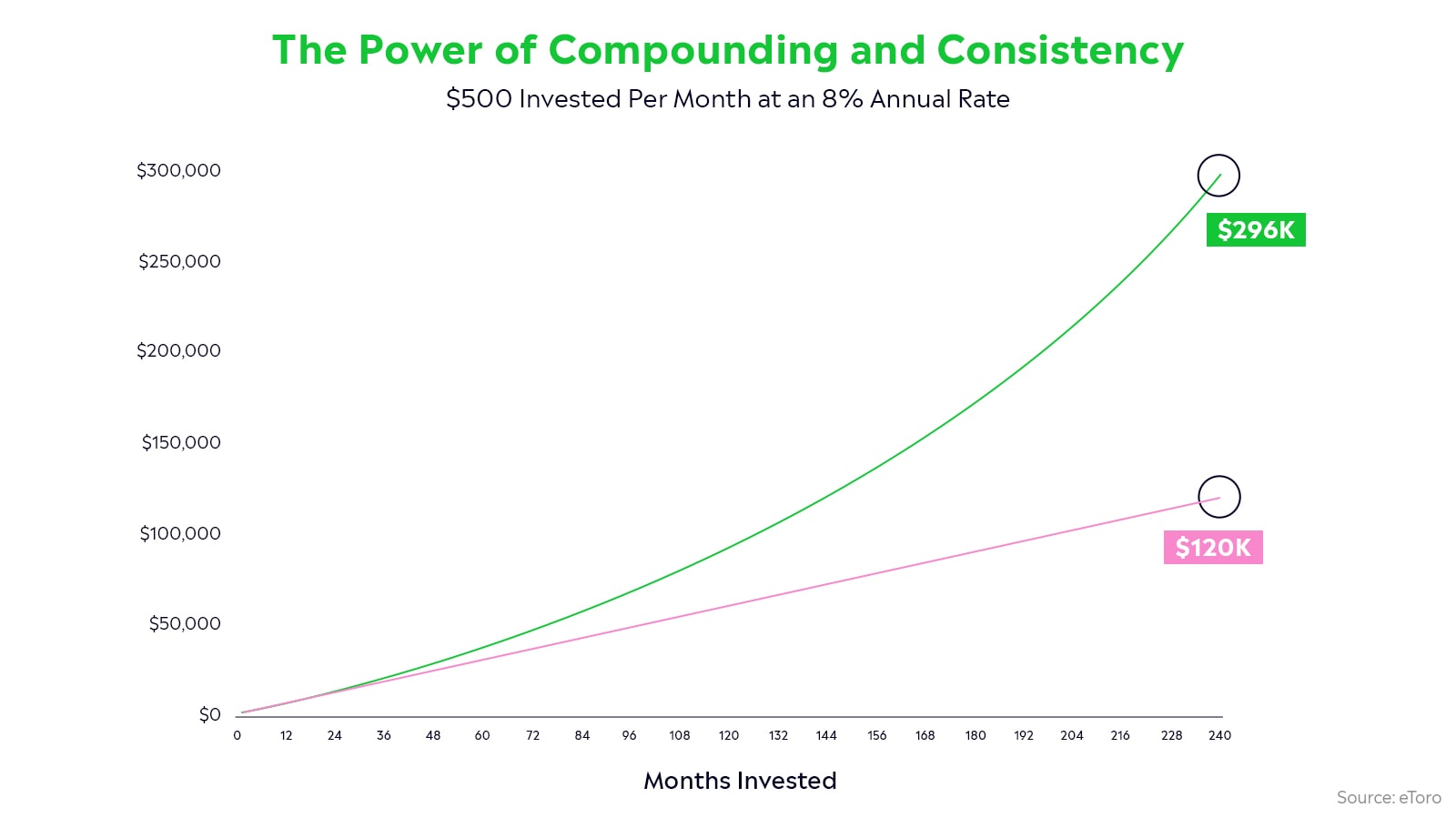

Compounding ― the ability of an investment asset to accrue capital gains or interest ― is one reason it’s so important to invest early and consistently, through a dollar-cost averaging strategy or otherwise. The earlier you start investing, the more you could benefit from compounding over the long term.

Think about this: If you started investing $500 every month and your investments grew by 8% a year, you’d have about $296,000 at the end of 20 years.

The catch? You have to be able to think long term. If your goal is to invest for 20 years, try not to invest money you might need back next week. Stick to your plan and your goals.

Bottom line

Ultimately, how you invest your money is highly personal. And there are a bunch of pros and cons to consider with every investing strategy. But even if you’re just looking for a more automated way to fit investing into your routine, you may want to consider dollar-cost averaging.