The Daily Breakdown looks at Amazon as the stock attempts a multi-year breakout. We also examine the recent inflation results.

Thursday’s TLDR

- Inflation came in cooler than expected.

- Amazon stock teeters on a potential breakout.

- Broadcom announced a stock split.

What’s happening?

The S&P 500 and Nasdaq 100 erupted to new all-time highs on Wednesday morning as the CPI report came in below economists’ expectations. In fact, all the headline numbers from this inflation report missed estimates.

Investors cheered this for two reasons.

First, inflation has been a thorn in the Fed’s side for several years at this point and the bump in inflation to start the year was a concern. To see cooler numbers is reassuring that we’re avoiding a reflationary environment.

Second, investors want lower rates from the Fed. However, that will only happen if inflation comes down (or if the economy weakens too much). For now, the economy continues to do okay, so it’s the inflation side of the equation that needs to move lower and Wednesday’s report helped in this regard.

Expectations for lower rates also gave a lift to bonds, which is why we saw the TLT — the most traded long-term government bond ETF — jump higher. Crypto also likes lower rates, which is why Bitcoin was up 4% at one point yesterday.

While the Fed didn’t lower rates yesterday, they didn’t throw too cold of water on the bulls’ celebration either, allowing stocks to close at record highs.

The setup — AMZN

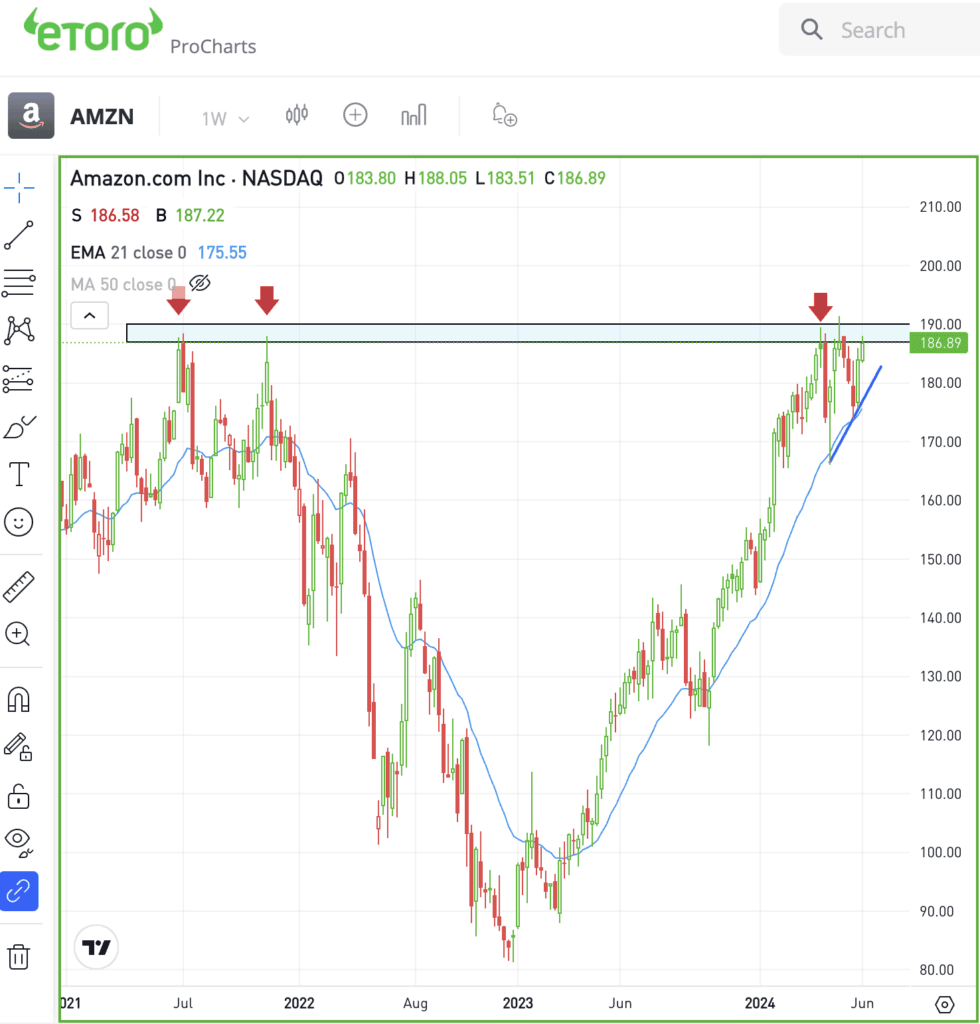

Amazon has traded well this year, up 23%. Even though the stock made new all-time highs at one point in 2024, it has continued to struggle with its prior bull market highs near $188.

That level was hit in July 2021 and then again in November 2021. The stock has now tested that level several times this year.

I don’t know if or when Amazon will be able to break out over this level. If it does though, it could trigger a significant rally to $200 and beyond.

That said, it’s completely possible that this level acts as resistance yet again. If that’s the case, see how it handles a pullback to the 21-week moving average, as this measure has been support so far this year. Below that and $175 has been a key support area as well.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, make sure to use enough time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AAPL — Apple is vying for its position as the world’s most valuable company. Earlier this week, it took back the No. 2 spot from Nvidia and at least for a moment on Wednesday, it reclaimed the crown from Microsoft at No. 1. Apple’s recent AI announcements from its WWDC event has sparked a major breakout for the stock.

AVGO — Shares of Broadcom are racing higher on Thursday morning after the firm delivered an earnings and revenue beat after the close on Wednesday. Management also raised its full-year revenue outlook and announced a 10-for-1 stock split.

SPCE — Speaking of splits, Virgin Galactic announced a 1-for-20 reverse stock split to meet NYSE listing requirements. That will be effective June 14 after the market close and trading will resume on a split-adjusted basis on June 17.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.