The Daily Breakdown takes a look at travel stocks by building a custom 15-stock basket of names within the industry.

Friday’s TLDR

- Consumers are looking toward their summer getaways.

- And BEACH stocks have done well lately.

- Delta leads airline stocks, but can it continue higher?

The Daily Breakdown + The Bottom Line

We’re officially less than one week away from the first day of summer, but many BEACH stocks have already been trading like they’re on summer vacation.

eToro took a closer look at BEACH stocks — which include companies in bookings, entertainment, airlines, cruises, and hotels — to see where there was strength. Specifically, we created an equal-weight 15-stock BEACH basket (which can be found here for those who are curious).

While the group returned a modest 34% over the past five years, it had a much more impressive gain of 46% over the past year — topping the S&P 500 and Nasdaq 100’s total returns of 24% and 31.3%, respectively.

For what it’s worth, global equities returned a mere 7% in that span.

There’s no doubt that travel has been picking up — that’s clear whether we’re looking at the stock prices for some of these companies or queuing at the airport.

Airline traffic, hotel bookings and cruise reservations are up significantly, so it’s no surprise that companies like Delta, Carnival Cruise, Royal Caribbean, Intercontinental, and Hilton, among others, have done so well.

The question is, can this group continue to climb during a seasonally strong period of travel? It’s hard to say how the stocks will perform, but if current travel trends are any indication, it could bode well for the group.

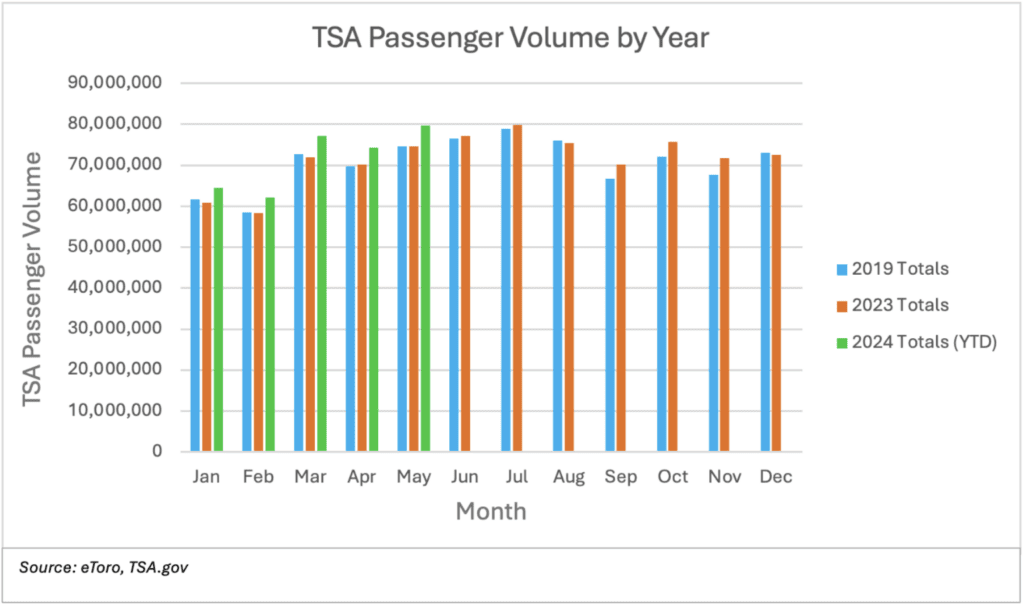

Year to date, total passengers screened by TSA has eclipsed both the 2023 and 2019 (pre-pandemic) totals each month through May.

Notice how 2019’s monthly totals topped 2023 in five of the first six months, but in the second half of the year, 2023’s monthly totals topped 2019 in five of the last six months as travel trends accelerated.

The trend has not only continued in 2024, but has accelerated. At the very least, this group will have a nice tailwind should that trend continue.

The Bottom Line

Like a stock that rallies hard into a positive earnings report and then falls — referred to as “selling the news” — it’s possible that travel stocks will underperform throughout the summer even if travel trends remain strong.

At the very least though, it’s worth keeping an eye on this space due to the trends we typically see through the summer and as consumers seem to be putting a larger emphasis on experiences over goods.

Lastly, note how strong the travel trends have been through the first half of 2024. Short of a meaningful deceleration in the labor market, bulls have a case to make for these trends continuing through year-end. Of course, that doesn’t mean the stocks will cooperate.

Want to receive these insights straight to your inbox?

The setup — DAL

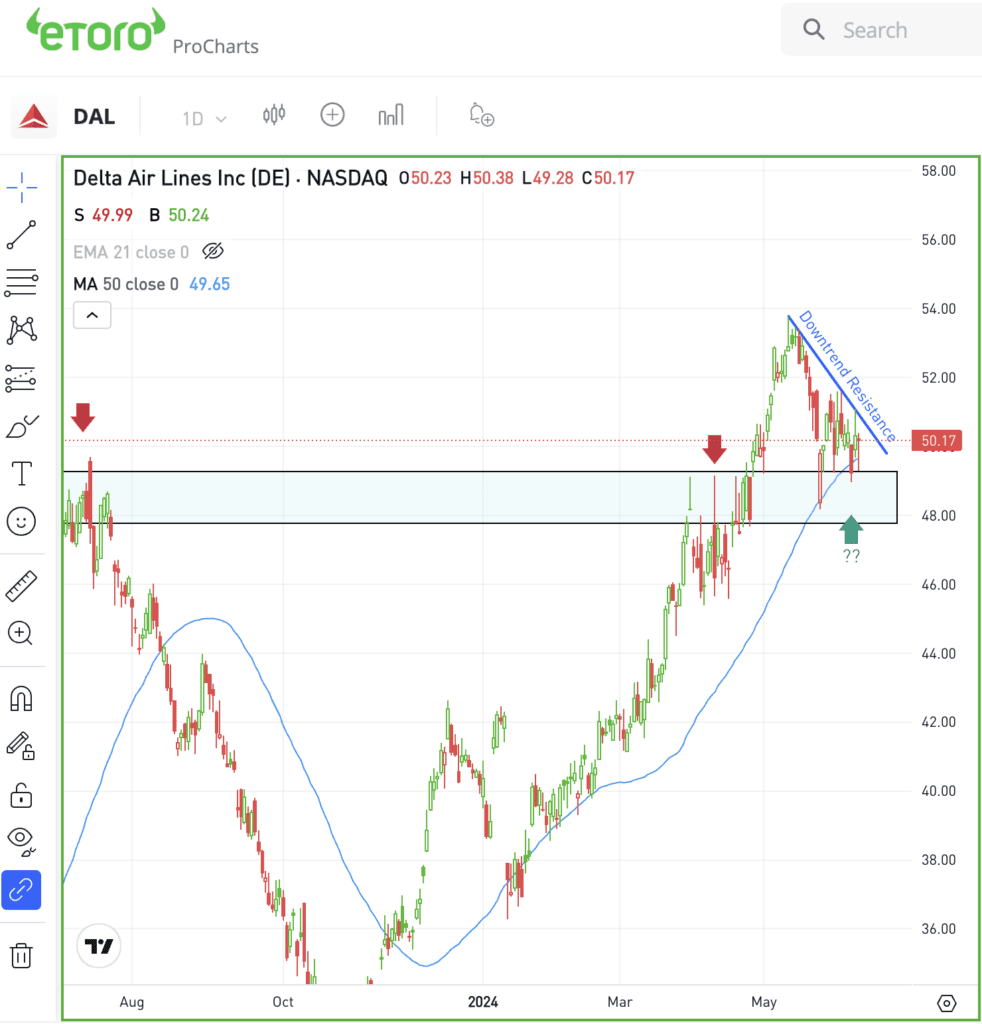

Delta stock has been a leader within the airline space, outperforming others like American Airlines, United Airlines, and Southwest Airlines both in 2024 and over the past 12 months.

The stock recently rallied to its highest level since February 2020 and has since pulled back. The dip has investors wondering if Delta’s prior high from 2023 and the 50-day moving average will be strong enough support.

If the stock can hold support and clear downtrend resistance, Delta could potentially rally to new 52-week highs.

However, if support gives out and shares trade lower, bears could harness more momentum.

Options

For options traders, calls or call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.