The Daily Breakdown highlights three major themes to watch this week, then charts Philip Morris, which is up more than 70% over the past year.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Monday’s TLDR

- Trade-war worries flare up

- Tesla falls on Musk’s new party

- PM stock looks for support

What’s Happening?

After the long holiday weekend, we’re back to a full week of trading. Here are a few things we’re watching for this week.

First, trade-war headlines.

The Trump Administration’s original deadline was July 9th, and while that date is still in focus for investors, it now appears that many countries will have until August 1st. Maybe it’s the ebb and flow of the entire ordeal. Or perhaps it’s the reality that trade tensions could worsen in the weeks ahead.

Either way, US stocks are trading lower this morning, at least partly in response to these headlines.

Second, earnings.

While earnings season doesn’t officially begin until July 15th when the big banks kick things off, we’ll get a couple of reports this week. One of those reports will be Delta Air Lines on Thursday.

Third, record highs.

Stocks surged to record highs on Friday, with the IWM and QQQ ETFs leading the way with 1% gains. Usually one week a month has an absence of major economic reports and in July, this is that week.

Can stocks continue to drift higher into earnings season or will trade worries have investors hitting pause?

Want to receive these insights straight to your inbox?

The Setup — Philip Morris

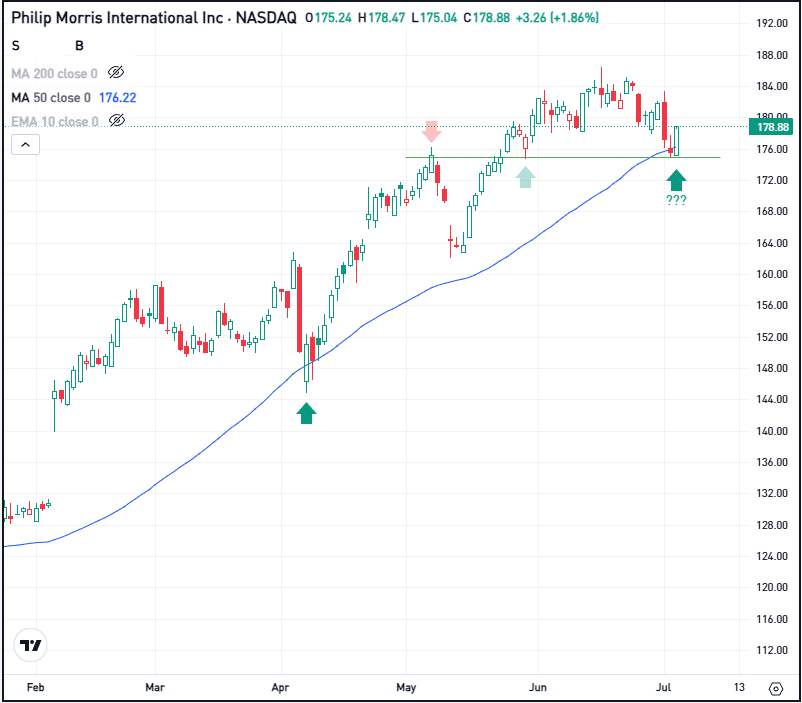

Philip Morris may not get a lot of discussion, but its stock has done well. Shares of PM are up 48.5% so far this year and have climbed more than 70% over the past 12 months.

Despite the huge rally, shares still pay a respectable dividend yield of 3%. Analysts expect roughly 10% earnings growth this year, as well as in fiscal 2026, 2027, and 2028. On the revenue front, consensus estimates call for high-single-digit growth between 6.5% and 9% from 2025 through 2028.

Shares recently pulled back about 5% from the highs, testing down into the 50-day moving average — which has been an active area of support.

Along with the 50-day moving average, shares are also finding support near $175, which was resistance in early May but support later in the month.

If PM can hold this level, bulls will look for a further bounce to the upside, potentially back up toward the recent highs near $187. On the flip side, a break of $175 could usher in more downside, as the momentum becomes more bearish in the short term.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding on a pullback. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

Shares of Tesla are under considerable pressure this morning, falling about 6% in pre-market trading after CEO Elon Musk says he is starting a new political party in the US. The news adds tension to an already contentious political rift between Musk and the Trump Administration.

Bitcoin continues to consolidate between $100K and $110K, as bulls were hoping for a key breakout over the weekend. While BTC continues to flirt with a move to new highs, it has not taken out the May 22nd high yet. Will it happen this week? Check out the chart for BTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.