The Daily Breakdown takes a closer look at Amazon as the company kicks off a special four-day Prime Day event.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Tuesday’s TLDR

- Prime Day is now four days long

- SOFI shares approach $20

- XRP hits multi-month high

What’s Happening?

I find myself saying this a lot lately: “How has it already been 10 years?” Now, I can add the start of Amazon Prime Day to that list as well.

In July 2015, the company kicked off its first ever Prime Day as a way to drum up sales and drive revenue higher. Possibly inspired by the Singles’ Day holiday in China, Amazon now racks up a tremendous revenue figure during this stretch.

In fact, the company has had so much success with its Prime Day event, it added a second one in the fall (last year it was in early October), and this year, the July Prime Day event has been extended to four full days.

From July 8th through July 11th, the company will be boasting all sorts of sales — and so will many others. While Prime Day is an Amazon event, other retailers, like Walmart, Best Buy, Target, and others, will look to jump in on the action too.

They sort of have to.

If Amazon is going to offer massive deals across the board, how can its biggest competitors not try and capture some of those sales themselves?

Want to receive these insights straight to your inbox?

The Setup — Amazon

Long-term bulls have remained constructive on Amazon because the company has continued to find ways to grow beyond its online retail presence. Whether that’s Amazon Prime memberships, or advertising, or cloud computing, the company continues to innovate.

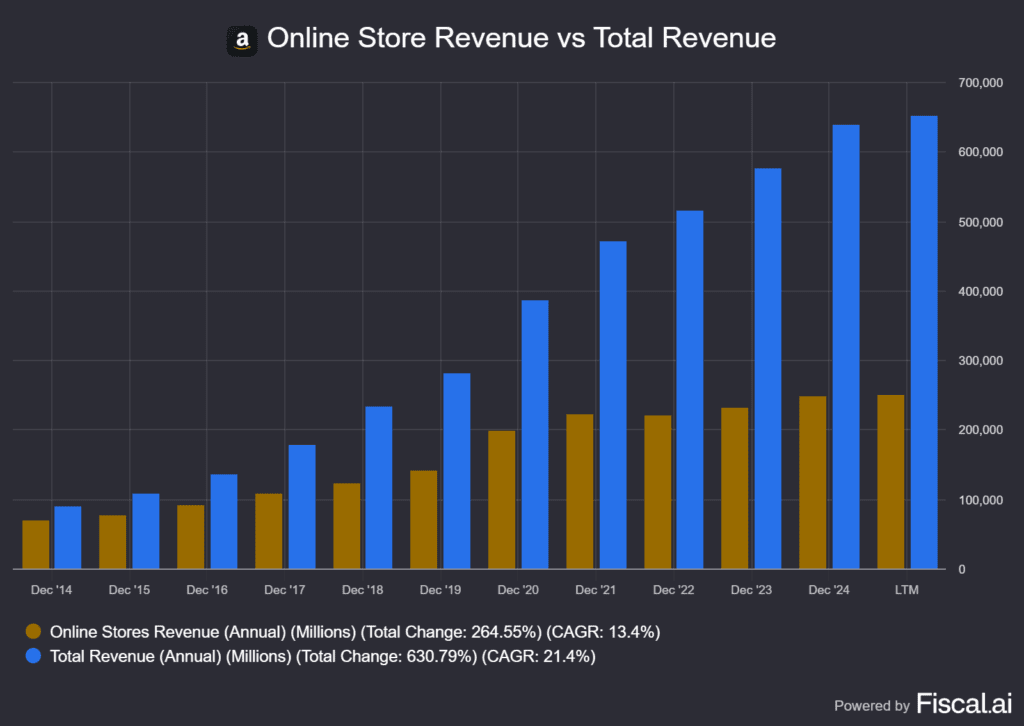

Look at the chart below, which highlights how online store revenue and total revenue were nearly equal in 2014. Now though, total revenue is more than double online store revenue — the latter of which has seen its growth level off after a notable spike in 2020.

One criticism of Amazon stock had been its valuation, but that argument has waned over the years as Amazon’s forward valuation has become lower than Walmart’s.

While the stock is vulnerable to certain risks — like a recession, trade-war issues, and antitrust concerns as a $2.4 trillion giant — long-term bulls have remained optimistic.

Because of this year’s extended Prime Day sale, analysts expect it to bring in over $12.9 billion in revenue, up more than 53% year over year. Will that move that stock?

Options

Remember the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or bull call spreads to speculate on further upside, while bears can use puts or bear put spreads to speculate on the gains fizzling out and AMZN rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

On Monday, Ripple hit its highest level since late May as it tries to find some bullish momentum. Investors are keeping a close eye on XRP to see if it can break out over resistance, as it continues to consolidate its gains from Q4. Check out the setup here.

Booking Holdings, the parent company of online travel brands like Booking.com, Kayak, OpenTable, Priceline and more, hit a fresh record high on Monday. Shares are quietly up more than 17% so far this year and almost 50% over the past 12 months, as BKNG approaches a $200 billion market cap.

SoFi Technologies stock continues to claw its way higher, as it hit a multi-year high on Monday of $19.29. Shares are moving higher this morning in pre-market trading, as bulls hope for an eventual rally to $20 — and eventually beyond. Check out the charts for SOFI.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.