The Daily Breakdown takes a closer look at the latest trade policies out of Washington as Wall Street remains awash in volatility.

Wednesday’s TLDR

- Tariffs are back in focus

- Utility stocks eye breakout

- JNJ stock tumbles

What’s happening?

The first day of Q2 was a good one for stocks, as they built on Monday’s gain. That said, investors aren’t breathing a huge sigh of relief — after all, US equities are still down notably on the year as the S&P 500 flirts with correction territory.

It doesn’t help that stocks are under pressure in pre-market trading ahead of today’s new set of tariffs.

President Trump’s long-teased “reciprocal tariffs” will take effect immediately after today’s “Liberation Day” announcement, according to the White House. The only issue? Details remain vague, but the move could hit multiple countries at once. It’s part of a broader tariff push that already includes autos and metals. Markets are watching for specifics — and possible global trade reactions.

Reportedly, the details of this plan will be announced at 4 p.m. ET today. The question becomes, has the market fully priced these tariffs in with the recent selloff or is there still more room to the downside?

Investors will want to see if the recent lows continue to hold. For the S&P 500 ETF — SPY — that’s the $545 to $550 range. For the QQQ ETF, that’s roughly $455.

Want to receive these insights straight to your inbox?

The setup — Utilities

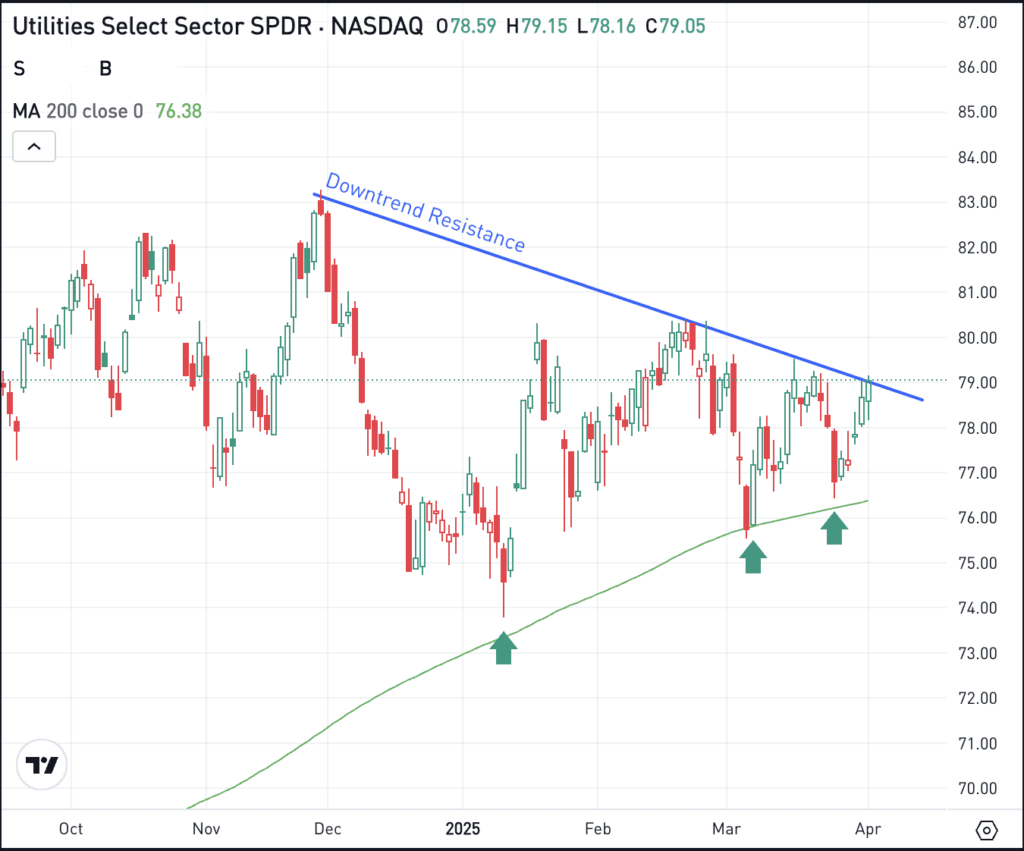

It might be hard to trust breakouts in this environment, because that’s a bullish technical setup in a broader market that has had bearish technicals. However, utilities are showing some constructive patterns on the chart when we look at the XLU ETF.

Notice how XLU has made a series of higher lows, as highlighted by the green arrows on the chart. Also notice how the 200-day moving average continues to act as support, as XLU repeatedly tests into downtrend resistance.

Aggressive bulls might consider buying the ETF now and waiting for a breakout. However, conservative bulls might prefer to wait for a breakout first, before getting long. As long as support in the $75 to $76 area continues to hold, this bullish setup can remain intact.

Should that $75 to $76 area fail as support though, then the setup is broken and more downside could ensue.

It’s worth pointing out that the XLU pays out a 2.9% dividend yield and is up 4.4% so far on the year.

Options

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

JNJ – Johnson & Johnson took it on the chin yesterday, falling more than 7% on Monday. The decline comes after a judge rejected the company’s $10 billion proposal to settle thousands of lawsuits that claim J&J’s baby powder and other talc-based products caused cancer. This was the company’s third attempt with this method. Check out the charts for J&J.

BB – At one point, BlackBerry stock was up 65% in 2025. After hitting its high around the same time the S&P 500 did in mid-February, shares have been crushed, falling about 40%. Earnings aren’t helping either, with BlackBerry down about 10% in today’s pre-market trading session. Despite an earnings beat, disappointing guidance is weighing on the stock.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.