Apple stock has rebounded over the last few months, but has lagged the Magnificent 7 leaders. The Daily Breakdown dives deep.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Down over 7% so far this year, Apple is the second-worst-performing Magnificent 7 component of 2025, trailing only Tesla. Despite this, Apple is one of just three firms with a market cap of $3 trillion or more, sitting behind Nvidia and Microsoft.

However, Apple has found some momentum lately, rallying more than 12% over the past three months. Is this a sign that Apple is back — or just a bounce after a flailing start to the year?

Digging Into the Business

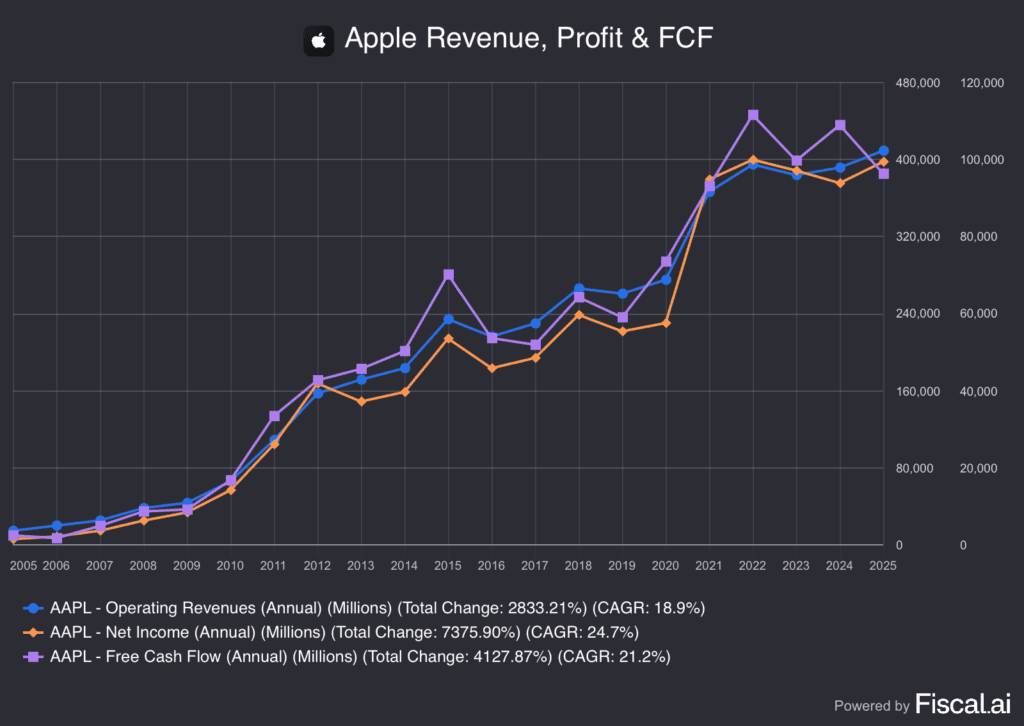

We know Apple as the iPhone maker — and the company behind Macs, AirPods, iPads, and more. Thanks to its massive success, which really dates back to the iPod and Apple Music (remember that?), Apple has built a fortress balance sheet and generates immense cash flow.

One problem though? Growth.

While Apple has enjoyed strong growth over the years, revenue and profit growth have struggled over the last several years. That has forced some investors to look for growth in other areas — for instance, with stocks like Amazon and Nvidia — even if that means accepting more volatility.

Risks and Opportunities

When we look at the valuation, Apple trades at just under 30x forward earnings. This is more expensive than the overall market, but bulls argue that Apple still deserves a premium. As for whether it’s expensive or cheap based on its own historical range, Apple stock sits somewhere in between. Over the last five years, shares have typically been considered “cheap” at around 22x to 25x earnings and “expensive” above 32x.

Investors are now turning their attention to Apple’s products, with an iPhone refresh due in the coming months and a growing focus on AI.

AI advancements were expected to elevate the user experience, but delays have left both investors and customers wondering whether Apple can deliver. Investors can still expect a steady stream of upgrades over the years — including new iPhones, iPads, Macs, and more — but it’s the AI component they’re most eager to see take shape.

The company is reportedly working on “an ambitious slate of new devices, including robots, a lifelike version of Siri, a smart speaker with a display, and home-security cameras,” according to Bloomberg.

Of course, there are risks to this approach — including delays, products that fail to launch, or disappointing customer reactions. Investors will have to weigh Apple’s historically strong business against their expectations for future revenue and profit growth.

Want to receive these insights straight to your inbox?

Digging Deeper — Apple’s Services Business

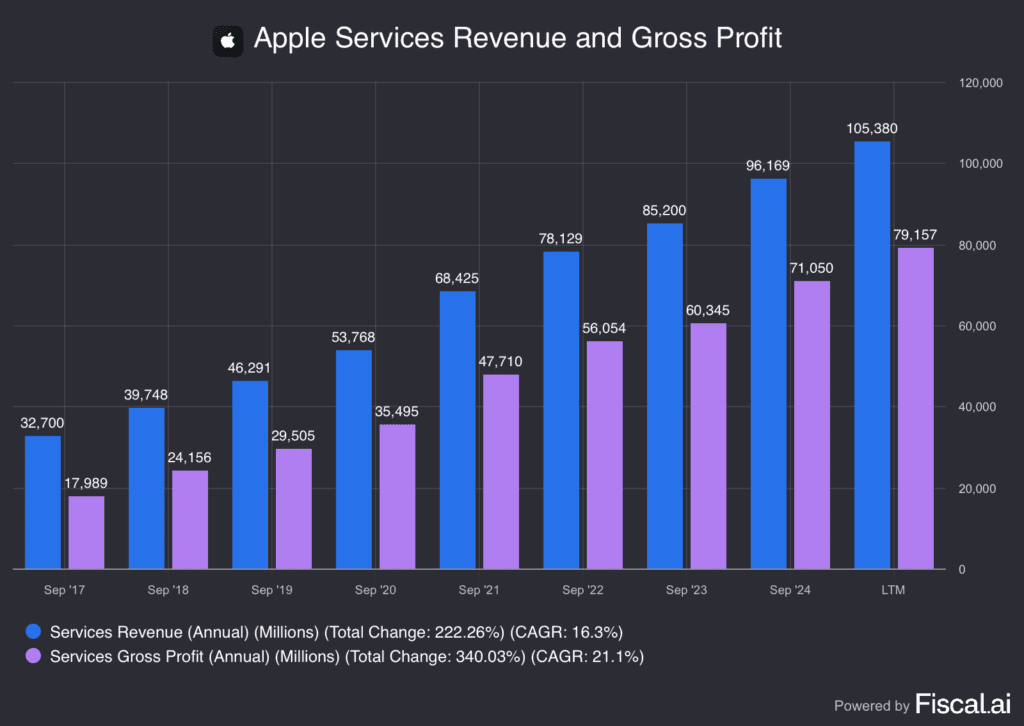

Apple’s hardware business may be searching for new growth outlets, but its Services business — which includes the App Store, Apple Music, iCloud, Apple Pay, and more — continues to hum along nicely.

Revenue continues to grow at a solid pace, while gross profits — which command 75% gross margins and are more than double the margins achieved with its Products business — also continue to grow. So even though it’s a much smaller revenue footprint, this segment makes up more than 40% of gross profit and continues to grow at a steady clip.

This is one reason (of several) why Apple has been able to remain so committed to its massive share repurchase plan, which elevates its earnings per share — (despite slow profit growth, a shrinking share count allows earnings per share to increase).

What Wall Street’s Watching

Shares of Target are under pressure this morning, down almost 10% after the retailer reported earnings. The company beat on earnings and revenue estimates, but sales remain under pressure. Further, CEO Brian Cornell announced he is stepping down and being replaced by COO Michael Fiddelke. Target stock pays a dividend yield north of 4.3%.

Hertz stock is rallying on reports that it will sell used cars online through a partnership with Amazon Autos. Customers who live within 75 miles of four major cities — Dallas, Houston, Los Angeles and Seattle — will be able to use the new service. HTZ stock is up more than 40% year to date.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.