Markets have been under pressure as investors await word from Federal Chairman Jerome Powell. The Daily Breakdown looks at expectations.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Tomorrow morning isn’t a Fed meeting, but Chair Powell will give a speech at 10 a.m. ET from the Fed’s annual Jackson Hole summit.

Powell, who normally holds his cards close when talking Fed policy, has been more open at times when speaking from Jackson Hole. For instance, in last year’s Jackson Hole speech, he told investors it was time for the Fed to alter its interest rates plans — in other words, it was time to lower interest rates.

The Fed cut rates by 50 basis points at the next meeting, then did two 25 basis point cuts over the next few months.

Will we get similar transparency tomorrow? Eh…

While Powell might tip the Fed’s hand yet again, the dynamics are different right now. Inflation is rising and the labor market is decelerating. Both of those metrics are moving in the opposite direction from the Fed’s dual mandate — which are stable prices (i.e. inflation) and maximum employment.

The Bottom Line: Whatever Powell says (or doesn’t say) could move markets. With the market currently pricing in about an 80% chance of a rate cut at the Fed’s September meeting, investors may be hoping for some confirmation tomorrow. But investors will be listening for other clues too, trying to decipher how the Fed will navigate the rest of this year. That could have an impact on markets with investors now expecting two rate cuts by year-end.

Want to receive these insights straight to your inbox?

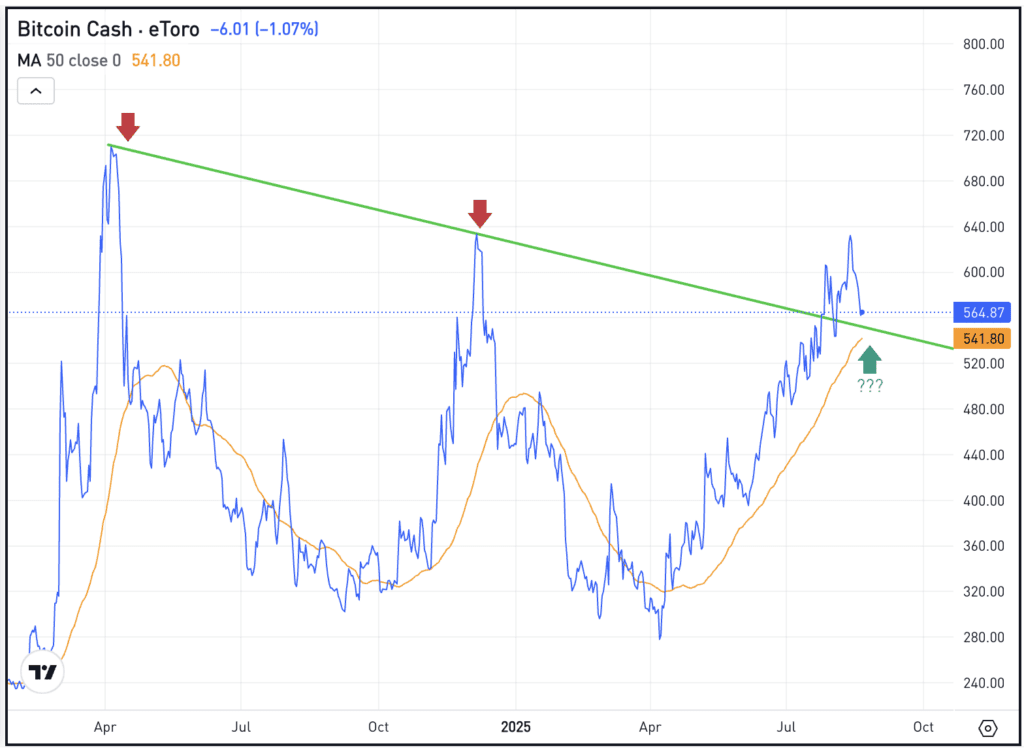

The Setup — Bitcoin Cash

With the big rallies we’ve seen in crypto over the last six weeks, Bitcoin Cash seems like it’s been lost in the shuffle.

Now pulling back, bulls are wondering if buyers will step in near the $550 area. Not only does this area bring the rising 50-day moving average into play, but it also retests the prior downtrend resistance line (marked in green). This measure kept BCH in check through June, before a breakout in July sent Bitcoin Cash above this mark.

Even if investors aren’t planning to trade BCH right now, they can add it to their watchlist or set alerts right from the asset page.

What Wall Street’s Watching

WMT

Shares of Walmart are slipping lower this morning after the retailer reported earnings. While revenue and same-store sales expectations beat analysts’ estimates, earnings of 68 cents a share missed estimates of 74 cents a share. Coming into the report, shares were up more than 12% on the year and up 37.5% over the past 12 months. Dig into Walmart’s fundamentals.

INTC

Intel has been incredibly volatile lately. Shares tumbled 7% on Wednesday, after rising 7% on Tuesday and falling 3.7% on Monday. In fact, last week, Intel stock rose more than 20%. There’s been a lot of headlines driving Intel stock lately, but without question shares have been more volatile. Check out the chart for INTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.