Inflation is on the rise, while The Trade Desk is getting added to the S&P 500. The Daily Breakdown explores these developments.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Wednesday’s TLDR

- Inflation keeps Fed on pause

- TTD added to the S&P 500

- ASML falls on earnings

What’s Happening?

Month-over-month inflation data came in below economists’ expectations for a fifth straight month. On the surface, that might have investors feeling pretty good about inflation and pounding the table for a rate-cut from the Fed.

On the other end of the spectrum though, year-over-year inflation climbed to 2.7% last month — coming in above economists’ expectations. That was the highest figure since March and the worry is that we’re starting to see tariff-induced inflation come back into the markets.

We’ll find out if that’s the case in subsequent inflation reports this summer. In the short term though, yesterday’s report all but dashed any remaining hopes of a July rate cut from the Fed.

Bank earnings continue to roll out, with Bank of America, Goldman Sachs, and Morgan Stanley all reporting this morning. BAC and GS are trading higher after generating record trading revenues in the quarter.

10-year Treasury yields spiked on Tuesday, climbing to 4.49%. That sent bond prices lower, with the TLT ETF hitting its lowest level in more than a month. Investors are keeping a close eye on the 4.5% level. If the 10-year yield gains steam above this level, it could be another headwind for US stocks.

Want to receive these insights straight to your inbox?

The Setup — TTD

The Trade Desk is a well-known stock among growth investors, but may otherwise fly under the radar. It’s a founder-led firm in the ad-tech space that has done a phenomenal job at growing its revenue, profit, and free cash flow. That’s allowed its market cap to swell to nearly $40 billion.

The only downside? The stock can be volatile. However, long-term bulls are hoping that this week’s good news will help remove some of that volatility now that it’s being added to the S&P 500 index, which will go into effect on Friday. Investors generally view this as a positive catalyst, as funds that own the index will now need to allocate money to a position in TTD.

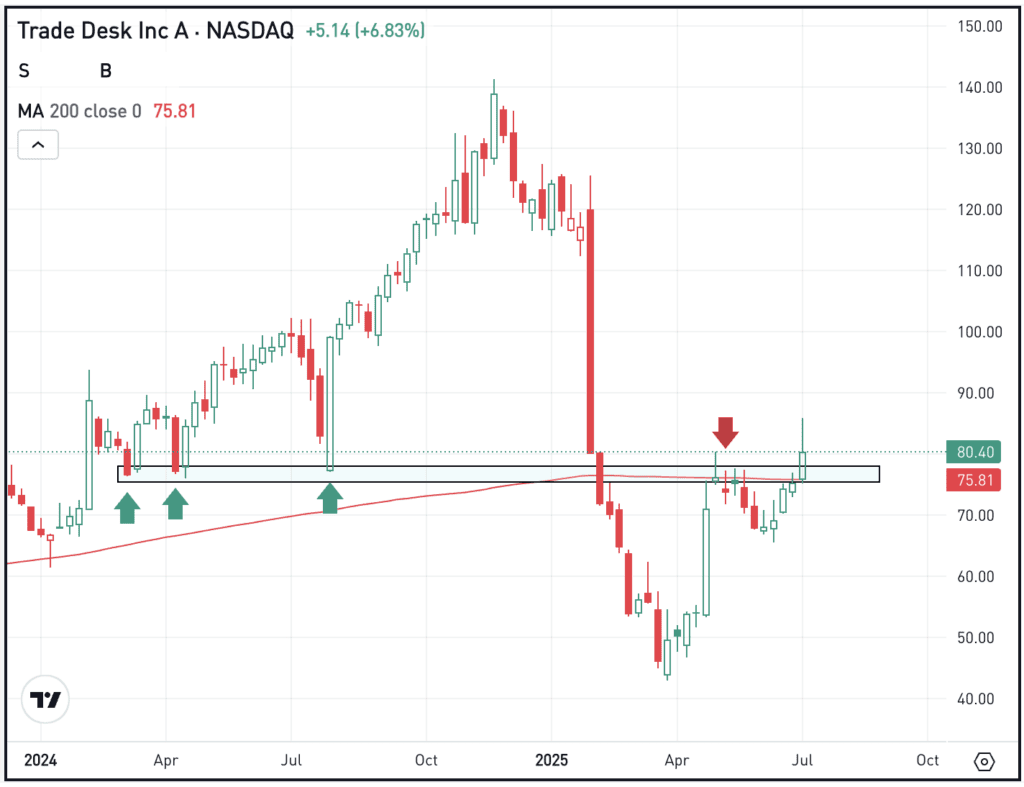

At one point, TTD was up more than 14% on the news yesterday, although the stock finished higher by “just” 6.6% on the day. With the rally, shares were able to regain the key $75 level. Bulls are hoping that the stock can stay above this level — which has become a key support/resistance level, as noted on the chart with red and green arrows — and the 200-week moving average.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

Shares of ASML are down in pre-market trading, despite the firm reporting a pretty strong quarter. Q2 revenue and earnings cruised past analysts’ expectations, but management’s outlook for Q3 was below consensus estimates as they took a more conservative outlook due to the ongoing trade-war uncertainty.

While most of crypto took a break on Tuesday following a huge weekend rally, Bonk kept on going. It climbed more than 10% yesterday and is up an additional 12% as of this morning. Bulls are now looking for a fourth straight weekly rally. Check out the charts for Bonk.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.