“Risk-on” assets enjoyed a strong Q2, with Bitcoin somewhat quietly leading the way. The Daily Breakdown digs into the trend.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Tuesday’s TLDR

- BTC gained more than 25% in Q2

- It also led the “risk-on” rally

- Tesla, Apple & Oracle in focus

What’s Happening?

While everyone’s focused on the big quarter from tech (up 21.8%), the Nasdaq (up 17.6%) and the S&P 500 (up 10.6%), no one seems to be talking about the great leadership we saw from Bitcoin last quarter.

In Q2, BTC rallied more than 25% — an outstanding quarter for any asset type.

Not only did it outperform equities in the quarter, but it took a leadership role. In the beginning of the quarter in early April, Bitcoin closed positive on April 3rd and 4th, when the SPY and QQQ ETFs both fell 10% in those two-day spans.

That was the first thing that made me say “hmm 🤔” for risk assets when markets seemed to be teetering on a cliff. Then Bitcoin sped off to all-time highs in mid-May, well before the US stock market was able to do so in late June as institutions desperately snapped up equities ahead of the end-of-quarter.

Not that anyone seems to be talking about it, but other cryptocurrencies had a good quarter too. Ethereum climbed 36% and Bitcoin Cash jumped 66.7%. Solana and Aave did well too, climbing 24% and 72%, respectively.

So now that leads me to this question: Can Bitcoin help lead a rebound in crypto and lead the way for risk assets as we kickoff Q3?

Want to receive these insights straight to your inbox?

The Setup — Bitcoin

I wanted to take a closer look at Ripple, but given the context from above, perhaps Bitcoin is more appropriate.

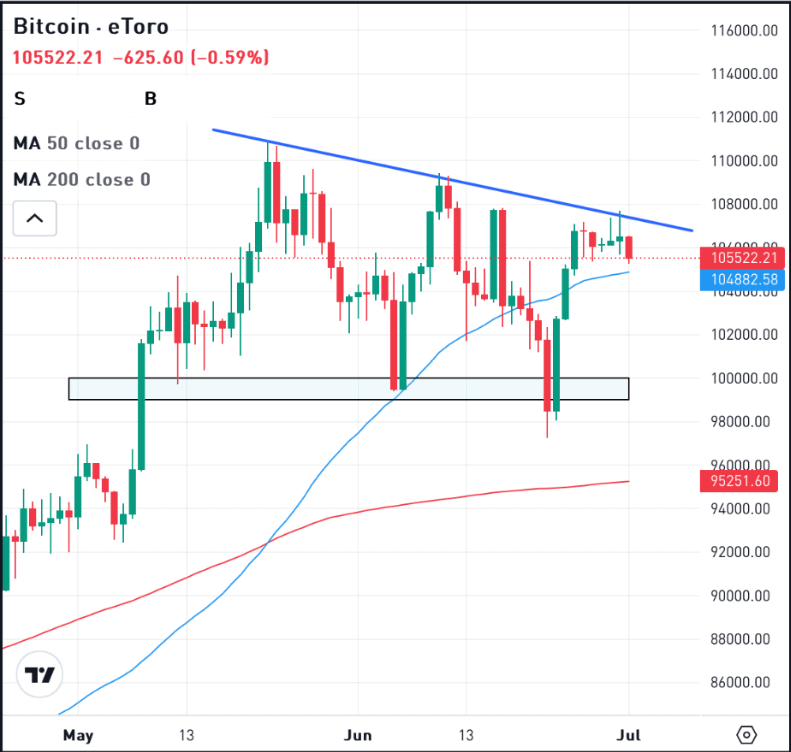

When we look at the daily chart, we can see that BTC — for the most part — is staying above the key $100K mark. However, it’s also putting in a series of lower highs, highlighted by the blue line on the chart below:

This is known as “consolidation” and it’s often considered healthy price action after a large rally.

If BTC breaks below $100K in the coming days or weeks, there are other potential support areas to watch in the mid-$90K range. However, bulls are keeping a close eye on the upside, waiting to see if Bitcoin can break over downtrend resistance and make a run at new record highs sometime this quarter.

Options and ETFs

For investors who can’t trade or aren’t comfortable trading cryptocurrencies outright, they can consider ETFs for BTC and ETH. On the BTC front, IBIT remains the largest ETF by assets, while also supporting options trading.

Bulls can utilize calls or call spreads to speculate on upside, while bears can use puts or puts spread to speculate on downside. In either case, investors may consider using adequate time until expiration.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street Is Watching

Shares of Oracle popped higher on Monday on news that the company had secured a new cloud contract worth $30 billion annually, set to begin in 2028. For context, the company’s total revenue in 2024 was $53 billion. To dig into Oracle’s financials, check out the stats page.

Tesla stock is sinking this morning, down about 5% in pre-market trading. That’s after President Trump made comments about Elon Musk being a beneficiary of government subsidies, suggesting that the Department of Government Efficiency (DOGE) should take a closer look at his companies. Check out the charts for Tesla.

Apple was the worst-performing Magnificent 7 holding last quarter, falling more than 8%. It was also the only component within the group to decline last quarter. However, shares popped yesterday on reports that the firm may seek outside AI collaboration from Open AI or Anthropic to power Siri.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.