The Daily Breakdown looks at some of the strong performers from Q1 – like gold, bonds and European equities – as US stocks struggle.

Tuesday’s TLDR

- Q1 is (finally) in the books

- European stocks look for support

- Energy was a top performer

What’s happening?

It wasn’t a very good quarter for US stocks, with the S&P 500 falling 4.6% in Q1 and the Nasdaq 100 falling more than 8%. The Dow did better, down just 1.3%, but the Russell 2000 was the worst performer, tumbling 9.8%.

There were positives from Q1, though.

For instance, 9 of the 11 S&P 500 sectors outperformed the index. Or the fact that gold rallied almost 20% in Q1. The Bloomberg Aggregate Bond Index returned 2.8%, while the TLT ETF — the most traded long-term government bond ETF on the market — climbed over 4%.

What am I getting at?

It wasn’t a fun quarter. But for investors who had exposure outside of tech and consumer discretionary — two sectors that fell more than 11% in Q1 — there were plenty of safe spots to gather near.

Stocks tumbled at the open yesterday, but Monday ended up being a much better session by the close of trading. We’re not out of the woods yet, particularly on the trade war front, but let’s see if we can get some more constructive price action over the next few weeks and months.

Want to receive these insights straight to your inbox?

The setup — Europe

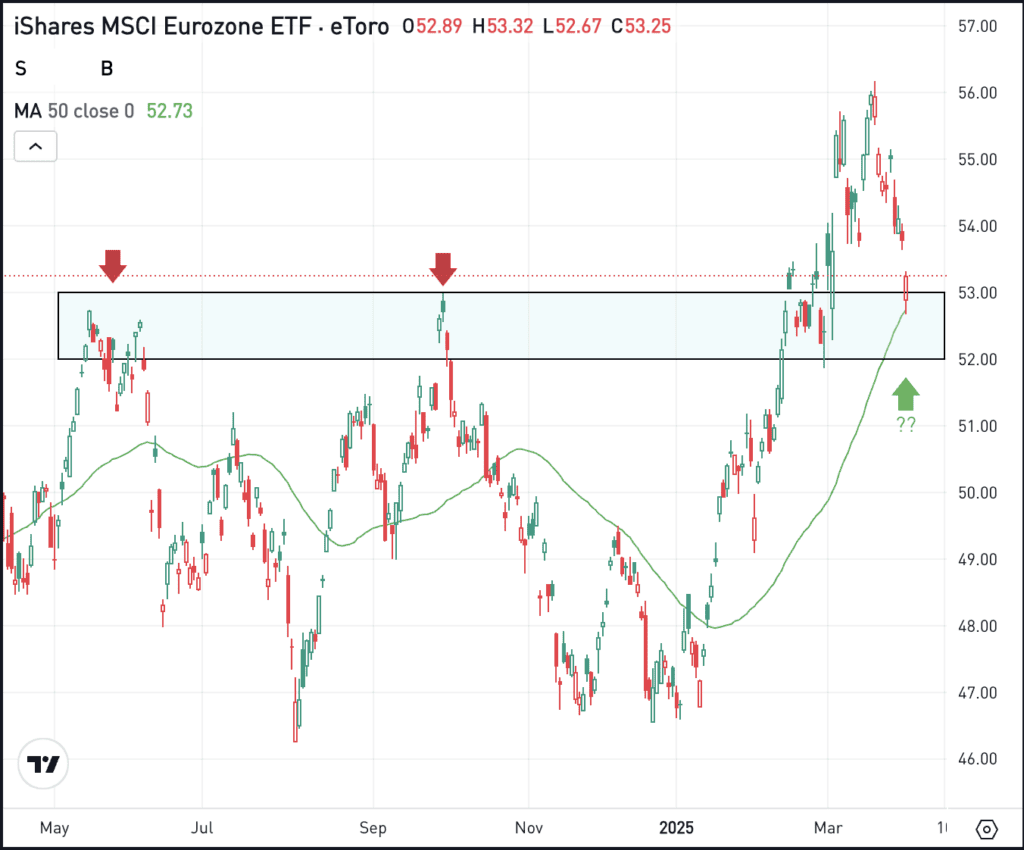

Outside of US equities, other asset groups have been working. Take the EZU ETF for instance, which covers large- and mid-cap European stocks.

This ETF was up almost 13% in Q1, easily outperforming the S&P 500. But it’s worth noting that it was basically flat in 2024, while the S&P rallied more than 20%.

Either way, it’s worth taking a look at the technicals as the ETF retests a key area on the charts and the 50-day moving average.

The $52 to $53 area was resistance in 2024 but acted as support in 2025. Now pulling back after a run to new one-year highs, can this area act as support alongside the 50-day moving average?

If it can, bulls will hope for a larger rebound to the upside and continue to utilize EZU as a way to diversify their portfolios amid a volatile stretch in US stocks.

However, if support fails to materialize, then EZU may continue to experience selling pressure as investors take profits in European stocks and look to put that money to work elsewhere.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

XLE – Energy was the best-performing S&P 500 sector in Q1, as the XLE ETF rallied more than 9%. On the flip side, the Consumer Discretionary ETF — XLY — was the worst performer, falling 12%. Will we see more of the same in Q2 or some reversion in the opposite direction?

META – Down 1.6% in Q1, Meta was the best-performing Magnificent 7 holding and the only one to outperform the S&P 500 in the quarter. The next-best performer was Microsoft, which fell 10.9%, while the worst performer was Tesla, down almost 36%.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.