Gold GOLD

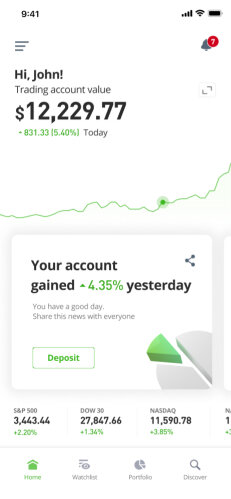

$5,111.2242.82(0.84%)(1D)

Invest in Gold

Today

Today

Create an eToro account to buy and sell Gold on a secure, user-friendly trading platform.

Gold GOLD

Trending commodities

See the top-trending assets with the highest trading volumes and price movements.

Gold News

TipRanks • 12.03.26 • 22:40

Premier1 completes EIS-backed drilling push at high-priority Yalgoo gold targets

TipRanks • 12.03.26 • 21:55

High-Tech Metals drills high-grade gold and advances Wagtail development studies

TipRanks • 12.03.26 • 21:46

Imperial Metals Delivers Record 2025 Revenue and Sharp Debt Reduction on Strong Copper and Gold OutputGOLD Price Chart

2.60

Past Month

1D

1W

1M

6M

1Y

3Y

MAX

Sign up for full charts powered by

*Past performance is not an indication of future results

The Gold price is stable this week.

i

A ‘rising’ price indicates that the weekly price has increased by more than 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

The Gold price today is $5,111.22, a 0.84% change in the last 24 hours and 0% in the past week. Gold price changed by 0% in the past year.

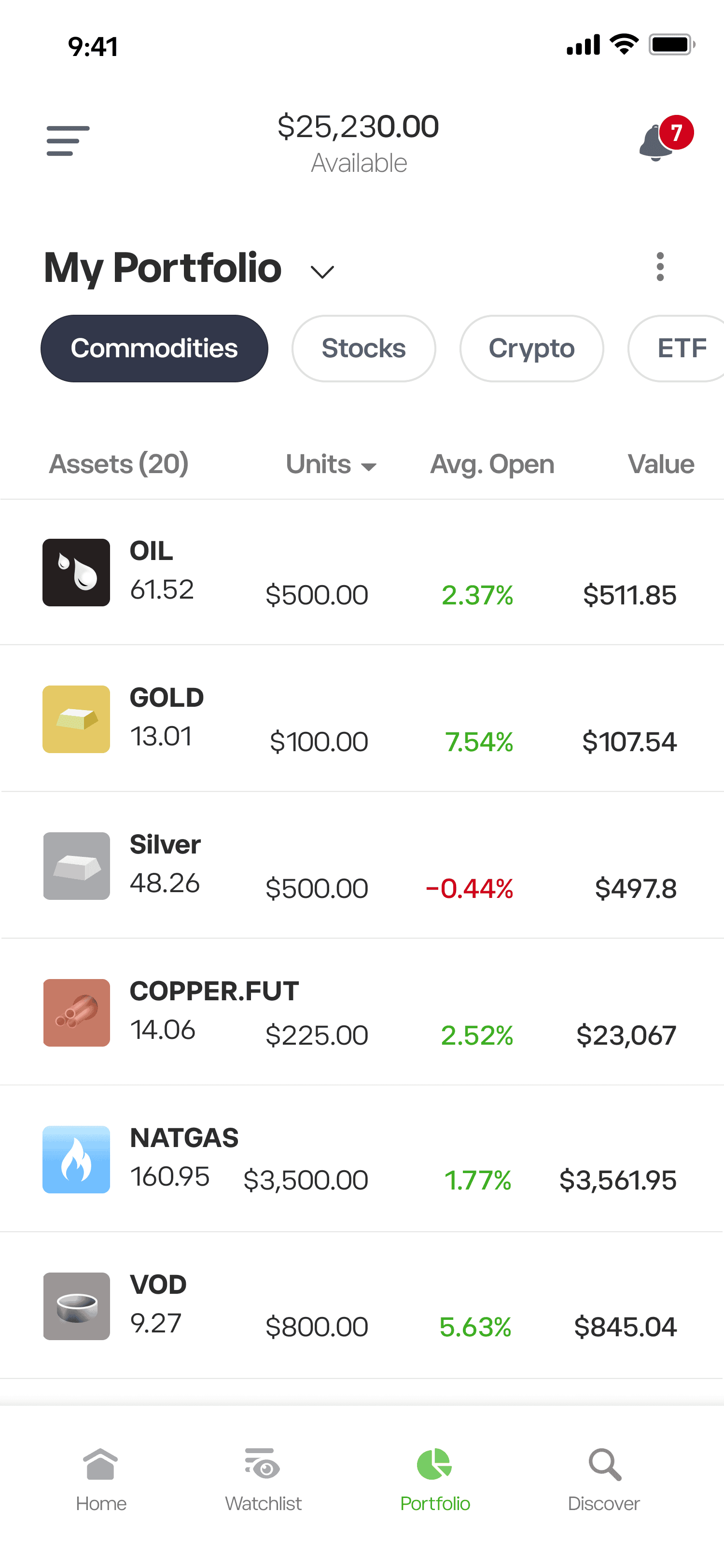

GOLD Key Metrics

Prev Close

i

The final price of this asset at the end of the last trading day.

$5068.4

Day's Range

i

Shows the high and low prices of the day.

$5071.17 - $5127.73

52 Week Range

i

Shows the high and low prices of the last year.

$2536.64 - $5594.73

1Y Return

i

A measure of this asset's return on investment over the last year.

70.69%

Price Change YTD

i

The amount the price of an asset has changed in the current calendar year.

17.23%

All time high

i

The highest recorded price of an asset since its launch.

$5594.73

How can I buy Gold?

To purchase Gold:

01

Create an eToro account:

Sign up for an eToro account and verify your identity.02

Deposit funds:

Deposit funds into your eToro account using your preferred payment method.03

Search and purchase:

Search the Gold (GOLD) page and place an order to buy Gold.Looking for more information? Check out our guides on Academy.

What Is Gold?

Gold has a long history within the financial sector, having been used in the jewellery industry and as currency for centuries. More recently, gold has been used in a range of modern industrial applications, such as catalysts, electronics, windshields, and pacemakers.

Gold acts as a currency stabiliser and as a store of value by central banks around the world. It is also used as a guarantee and leverage tool. Investors use gold and other precious metals to hedge against inflation, deflation, or devaluation. However, the price of gold can be affected by monetary policy, geopolitics, natural disasters, and the U.S. dollar. Geopolitical risk is a key driver of gold, and in times of uncertainty, gold prices have a tendency to rise. Historically the gold price has been impacted by sensitive political issues, referendums, or civil wars.

Gold is one of the most widely followed commodities in the financial market and is mined on every continent except Antarctica. The commodity was first traded on the stock market in 1974 on the COMEX exchange. You can trade Gold through CFDs, which track the price of gold as a ‘spot’.

Follow the development of the price of GOLD by adding it to your eToro virtual portfolio.

Gold acts as a currency stabiliser and as a store of value by central banks around the world. It is also used as a guarantee and leverage tool. Investors use gold and other precious metals to hedge against inflation, deflation, or devaluation. However, the price of gold can be affected by monetary policy, geopolitics, natural disasters, and the U.S. dollar. Geopolitical risk is a key driver of gold, and in times of uncertainty, gold prices have a tendency to rise. Historically the gold price has been impacted by sensitive political issues, referendums, or civil wars.

Gold is one of the most widely followed commodities in the financial market and is mined on every continent except Antarctica. The commodity was first traded on the stock market in 1974 on the COMEX exchange. You can trade Gold through CFDs, which track the price of gold as a ‘spot’.

Follow the development of the price of GOLD by adding it to your eToro virtual portfolio.

Top Guides

Our top picks for the most relevant guides from the eToro Academy

What Is Leverage and Margin?

Read MoreLeverage means using capital borrowed from a broker when opening a position. Sometimes traders may wish to apply leverage in order to obtain more exposure than the amount deposited, as part of their investment strategy.

How To Set Up Stop-Loss & Take-Profit Orders

Read MoreA detailed rundown of exit orders & stop losses, how they work & how you can use them to compliment your strategy when trading stocks & other assets.

Shorting and Closing: What’s the Difference

Read MoreLearn the crucial difference between closing a trade and shorting on eToro. Master short selling, position management, and avoid costly trading mistakes.

Invest in Gold

Today

Today

Create an eToro account to buy and sell Gold on a secure, user-friendly trading platform.

FAQ

The current price of Gold (GOLD) is $5,111.22

Gold's all-time high is $5,594.73

Select the "1D" or "1W" timeframe on the eToro chart and zoom out to see the historical price movements of Gold. The price of Gold has ranged between $2,536.64 and $5,594.73 over the last year.

Gold is very secure. Cryptocurrencies are encrypted using cryptography, which means that Gold transactions cannot be tampered with.

To buy Gold, visit the "Gold (GOLD)" page. Once you have created an account and deposited funds, click the "Trade" button and decide how much Gold you want to purchase. You can also place an order that will buy Gold (GOLD) at a specific price in the future.

Daily Movers

Today's biggest gainers and losers.