The first half of the year has drawn to a close, and it was anything but quiet. From tariffs to tech, geopolitical tensions to gold, that first 6 months felt like it had it all.

- The RBA cut the cash rate twice, with more cuts likely to follow as inflation eased.

- Anthony Albanese’s Labour government was re-elected for a second term.

- New US President Donald Trump shocked markets with tariffs, stoking fears of a full-blown trade war, sending stocks tumbling and driving investors to safe havens.

- Gold hit a new record high of US$3,500/oz after the VIX reached its highest level in five years.

- In Europe, the ECB and BOE continued to cut rates, helping drive equity outperformance. Defence stocks were a clear standout winner in Europe.

An unlikely V-shaped recovery

The S&P500 gained 5.5% in the first half of the year, despite falling as much as 19% in April, with a V-shaped recovery that not many would have predicted in early April. The end of the first half of 2025 also marks the end of the financial year in Australia, with the ASX200 closing out FY2025 with a 9.2% gain, including dividends.

Cyclical sectors on the ASX 200 staged a strong rebound during the Q2 market recovery, with Technology and Financials leading the gains. In contrast, Materials underperformed, along with traditionally defensive sectors like Utilities, Health Care and Consumer Staples. Our recent Retail Investor Beat survey showed that 35% of Australian retail investors planned to reposition their portfolio by increasing investments in gold. While market volatility has retail investors on alert, not all of them are alarmed. Many see recent market dips as buying opportunities, which signals a level of confidence in long-term market resilience.

The risk of being out of the market altogether is something savvy investors are acutely aware of. The recent rebound in global equities since April has reinforced that view, even in uncertain times. For Aussie investors, this means balancing risk by adding exposure to gold, while leaning into sectors and markets they understand best.

Now, attention turns to July’s events. The US earnings season is just around the corner, which will be a key catalyst for driving markets higher or putting the brakes on the recent rally. Meanwhile, geopolitical tensions will remain centre stage with Trump’s tariff deadline set to come into effect on July 9th. Investors will also have one eye on Australia’s full-year results set to kick off at the end of the month.

With that backdrop in mind, here are four stocks to keep on your radar in July:

#1: Northern Star Resources (NST.ASX)

Sector: Materials

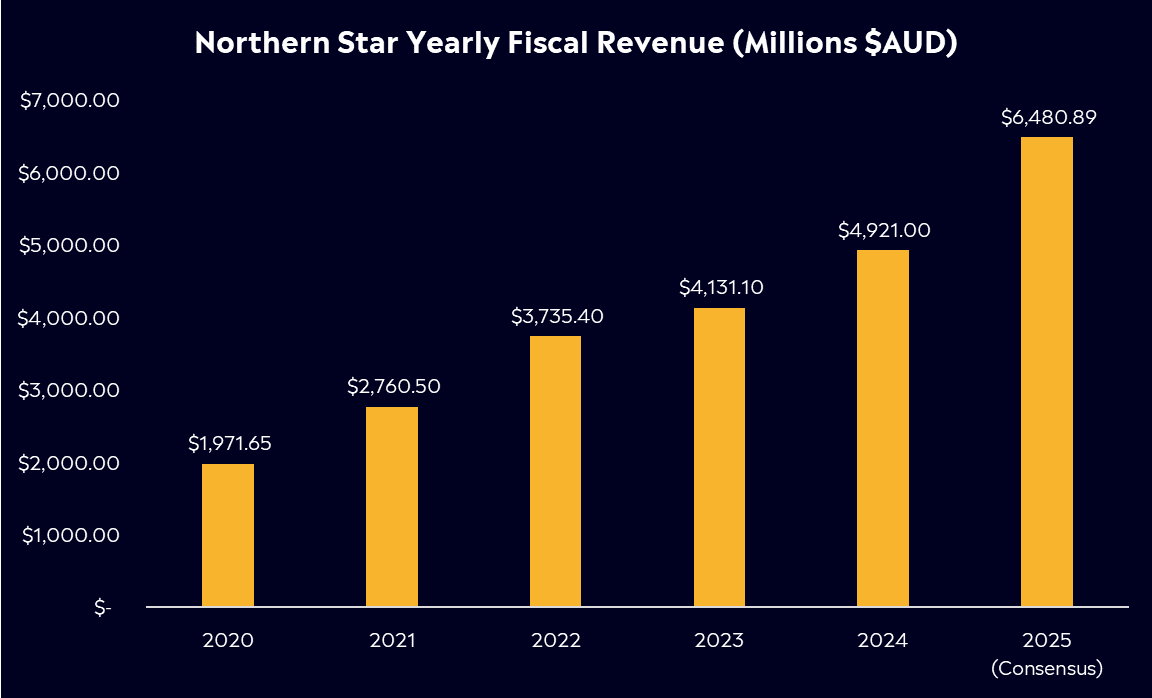

Australia’s top gold miner Northern Star is shining brightly amid global uncertainty. Gold prices have surged to record highs, around US$3,500/oz, as investors seek safety from economic and political turmoil. Northern Star has leveraged this strength to expand its portfolio, recently acquiring developer De Grey Mining for AUD$5 billion adding the giant Hemi gold project to its pipeline. This deal cements Northern Star’s status as the leading ASX-listed gold company and even a “top 10 global gold major” by production.

Looking ahead, Northern Star’s growth outlook is compelling. The Hemi deposit is slated to begin producing in the coming years and could boost the company’s annual output by 30% once fully ramped. With gold near all-time highs and Northern Star’s balance sheet strengthened, analysts see room for further upside. Any bouts of market volatility (e.g. recession fears or geopolitical flare-ups) could keep gold in demand – a positive backdrop for Northern Star. After a year of strong performance, July will be about execution: investors will watch for quarterly production updates and progress on integrating De Grey’s projects. Northern Star offers a play on continued safe-haven demand for gold, with an added bonus from its transformational acquisition and expanding global scale.

Explore Northern Star

#2: Amazon.com (AMZN)

Sector: Consumer Discretionary / Technology

E-commerce giant Amazon, the fourth most-held stock by Australian eToro users, enters July with a big month ahead. First up is Prime Day 2025, which Amazon has supersized into a four-day shopping extravaganza this year (July 8–11). This is set to be one of Amazon’s largest ever sales events, driving a surge in orders for electronics, home goods, and more. Strong Prime Day results could signal resilient consumer spending and boost confidence in Amazon’s retail segment, especially as inflation moderates in the US and Australia. Its Prime Day performance will be a reflection of what’s to come in Q3 earnings, something investors will be eager to hear.

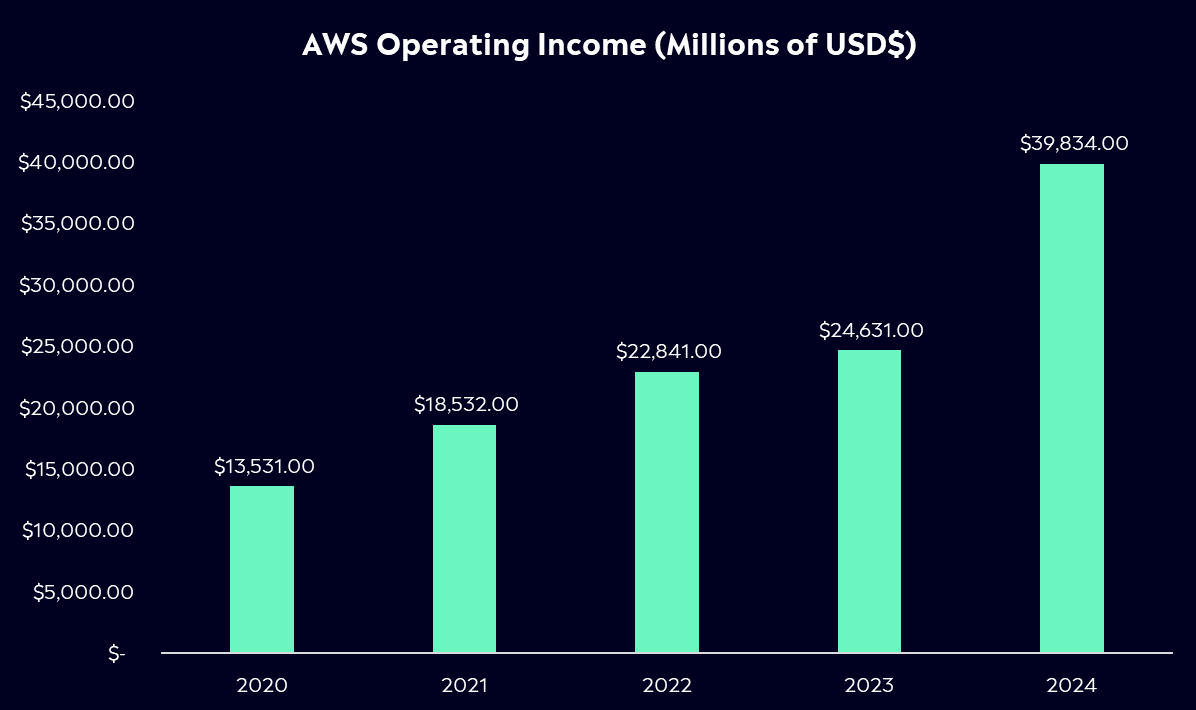

Later in the month, Amazon will report its Q2 earnings. Last time out, Amazon reported revenue growth of 8.4%, but the market was disappointed by its forecast for the second quarter, with rising uncertainty around tariffs sending shares lower following the report. Amazon’s cloud division, AWS, remains a key driver and is now the focal point every time the tech giant reports, more so this quarter because it won’t have any impact from tariffs. Amazon has been aggressively investing in AI startups and its own custom AI chips to maintain AWS’s lead. CEO Andy Jassy noted that AWS’s AI services are seeing “triple-digit” revenue growth and that Amazon is “not dabbling” in AI but going “all-in” across the company.

For July, keep an eye on any guidance updates from Amazon. If management confirms that consumer demand is holding up, with minimal impact from any tariffs or macro headwind, and that cloud/AI momentum is building, shares could build some momentum for a rally after being flat so far in 2025. However, any disappointment in Prime Day or a cautious outlook could bring volatility. Amazon is a stock to watch this month with the view of robust consumer demand and the longer-term AI growth story remaining front and centre.

Explore Amazon

#3: REA Group (REA.ASX)

Sector: Communication Services

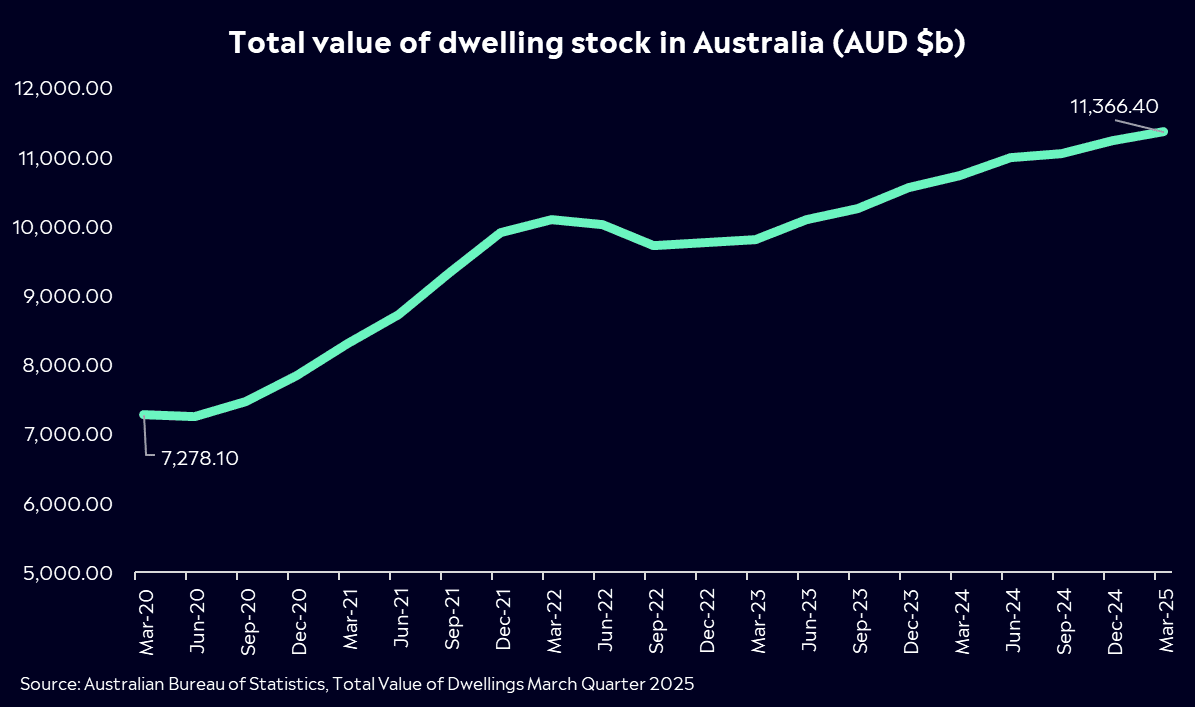

REA Group is the operator of realestate.com.au, Australia’s largest online property portal. It generates revenue from listing subscriptions, ads, and data services for agents, developers and banks. Australian property prices climbed for the fifth consecutive month in June, edging up 0.6%. The first rate cut from the RBA in February, followed by another cut in May, has been a boon for house values. With the view of further cuts to come this year, investor sentiment around listings and transaction volumes has improved.

Its closest competitor, Domain, has arguably dropped the ball over the last 12 months, allowing REA to gain a greater market share. However, competition is likely to grow with the US giant CoStar acquiring Domain back in May. REA is set to report Q4 and full-year results on 9 August, and given that house prices haven’t dropped since January, these results could be promising. REA is also benefiting from increased agent competition and premium listing uptake, as well as expansion into Southeast Asia via its ownership of PropertyGuru. With real estate activity heating up and a high-quality digital business model, REA is a strong large-cap to watch ahead of its results.

Explore REA Group

#4 Rheinmetall AG (RHM.DE)

Sector: Defence

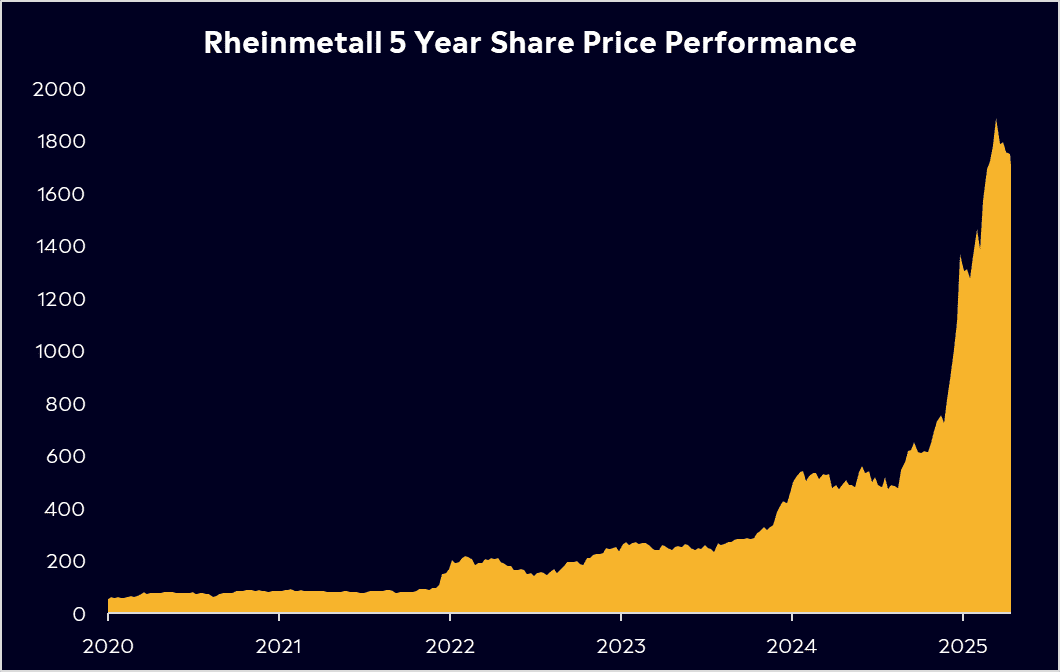

Rheinmetall is a German arms manufacturer and a major beneficiary of Europe’s military build-up. Best known for its armoured vehicles and ammunition, the company is enjoying unprecedented demand as Western governments boost defence spending. Shares have rallied over 2000% in the last 5 years, making for a pretty insane chart.

Rheinmetall’s order backlog hit a record €63 billion at the end of the first quarter, thanks to huge new contracts, locking in years of revenue. The company has forecasted 25–30% sales growth for 2025 after a 36% jump last year. They’re even eyeing new mega-contracts, with in being in the race to build the U.S. Army’s next infantry fighting vehicle.

With geopolitical tensions still high and countries lifting budgets, investors should watch how Rheinmetall capitalises on its contract momentum heading into July’s mid-year updates. Also in July, we will continue to see the US negotiate with countries around tariffs, and Trump has continued to push for countries to ramp up their military spending, so watch for any news that could be catalysts. Riding a once-in-a-generation defence upswing, Rheinmetall remains a stock to watch as its order boom translates into rapid growth.

Check out eToro’s new Smart Portfolio for more on the defence sector.

Explore Rheinmetall

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.