Whether you call it Macca’s, Mickey D’s, Maccies, or just McDonald’s, there’s no denying it’s one of the most recognised brands on the planet, and let’s be honest, most of us have eaten there more than once. But while it’s famous for Big Macs and fries, the real story is a powerful franchise and real estate model that’s helped it grow into a USD$220 billion juggernaut. So, with earnings just around the corner, is McDonald’s still a Happy Meal for investors? Let’s find out.

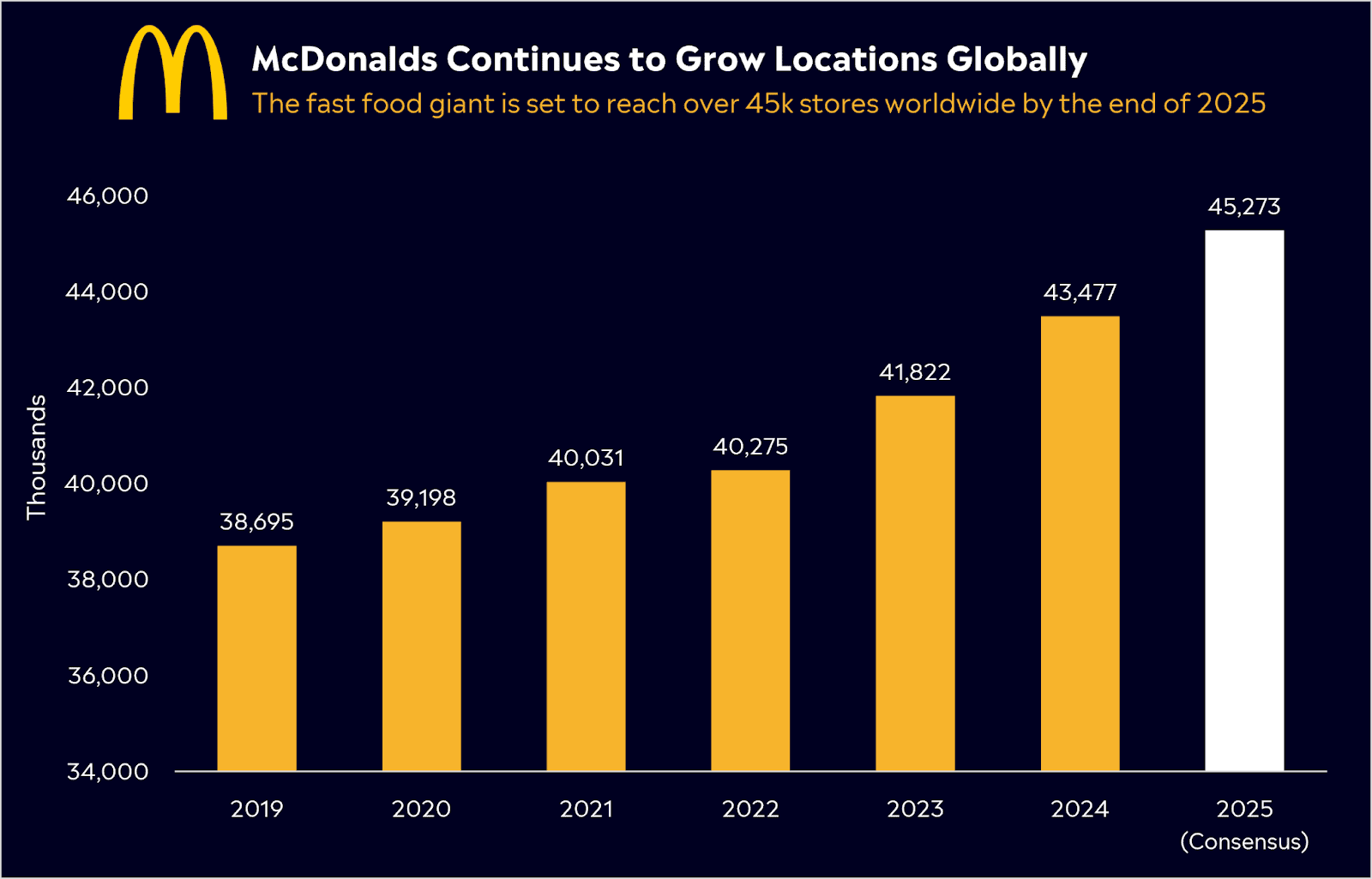

- McDonald’s real strength lies in a global franchise network and a powerful real estate model driving steady, high-margin cash flow with over 43,000 locations across the world.

- While rising prices and weight-loss drugs pose challenges, McDonald’s scale, brand loyalty, and value offerings continue to give it an edge in a rapidly shifting fast-food landscape.

- According to Bloomberg’s Analyst Recommendations, McDonald’s has 23 buy ratings, 17 holds, and 1 sell. The average analyst price target is USD$330.90, signalling a 10% upside from current levels.

Explore McDonald’s

The basics

McDonald’s Corporation is the world’s largest fast-food restaurant chain, known for its iconic burgers and other ‘fast-food’ meals. It operates over 43,000 restaurants in over 100 countries, making it a truly global foodservice giant. It all started back in the 1940s with brothers Maurice and Richard McDonald in Chicago, then in 1961, Ray Kroc bought out the McDonald brothers after opening a franchise store and soon went on to list McDonald’s publicly in the US in 1965 at $22.50 a share. Ray saw the potential with the McDonald’s brand and went on to build one of the most powerful real estate models in the world. (A great movie called ‘The Founder’ goes into more detail about Ray Kroc finding and growing the business.)

Essentially, McDonald’s isn’t just about fast food. About 95% of its over 43,000 locations are run by independent franchisees rather than the company itself, meaning local operators run the day-to-day business while McDonald’s owns (or leases) the land and building. This franchised model underpins McDonald’s business strategy and financial success.

It’s often said McDonald’s is a real estate company that just happens to sell burgers, and with USD$43 billion in land and property on its books, it’s not far from the truth. In 2024, systemwide sales topped USD$130 billion, with operating margins around 45%. Those are ‘tech-like’ margins and extraordinarily high for a restaurant business, most restaurant companies have low double-digit or single-digit margins. This is mainly because over 60% of McDonald’s revenue comes from franchise fees and rent, whereas franchisees bear the costs of running the restaurants. This model delivers reliable cash flow and strong returns, making the Golden Arches one of the most efficient and scalable business models in the world.

Shares have had a solid 12 months, returning nearly 20% including dividends, double that of the S&P500 over the same period. It’s set to report earnings at the start of next month, and results will be key for its recent performance to continue.

Fun Fact: McDonald’s serves around 70 million people every day, nearly triple Australia’s population! And their most popular item? Fries, of course!

* Past performance is not an indicator of future results.

Competitor Diagnosis

McDonald’s competitors are pretty obvious, from KFC to Burger King, Pizza Hut to Domino’s and Chipotle to Wendy’s, all are brands you would have likely heard of in the past. The reason McDonald’s sits at the head of the fast-food industry is scale. With over 43,000 locations under one brand, it far exceeds these competitors, giving it unmatched brand visibility, supply chain efficiency, and marketing reach.

The McDonald’s brand is one of the most recognised on the planet, with a menu of core items from Big Macs, Chicken McNuggets and Fries that have a near-cult following. Decades of consistent quality and marketing, we all know the “I’m Lovin’ It” phrase, have built exceptional brand loyalty. Many customers reflexively choose McDonald’s over other options, giving McDonald’s pricing power and resilience. The business has also done exceptionally well at staying relevant over the years, whether that’s through Happy Meal partnerships with Minecraft, influencer deals with Travis Scott or localised food across the world (you can get rice at a McDonald’s in Bali!)

Over the years, they’ve been a front-runner in embracing digital technology among fast-food peers. The company invested heavily in self-service kiosks, mobile app ordering, and a global loyalty program, creating a segfamless digital ecosystem. These efforts have paid off: across McDonald’s top markets, a large portion of sales now comes through digital channels (mobile, kiosk, or delivery). In the first quarter of 2025, McDonald’s reported over USD$8 billion in digital sales via 170 million loyalty members, a testament to how many customers are engaging via the app.

Depending on where you grew up in the world, a McDonald’s drive-thru is pretty iconic, a quick and convenient food option after a road-trip or a long day at work. Its drive-thru operations are industry-leading, often faster and more consistent than peers, thanks to continuous investments in lane design, staffing, and now AI technology. Delivery services have also changed the game over recent years, and while virtually all major chains use services like Uber Eats/DoorDash, McDonald’s benefits from higher order volumes (making them a priority partner for delivery firms) and allowing them to negotiate better terms.

Arguably, one of the biggest challenges facing McDonald’s now and in the years ahead is the emergence of weight-loss drugs and the broader wellness wave. These medications suppress appetite, leading users to eat less and cut back on high-calorie, convenience foods. Analysts estimate McDonald’s could lose up to $500 million in annual sales if this trend grows. The competitive landscape is likely to evolve if more consumers shift toward smaller portions or healthier choices, rivals with wellness-forward menus may gain ground. McDonald’s may need to lean further into healthier options, or high-margin digital offers to stay ahead.

Financial Health Check

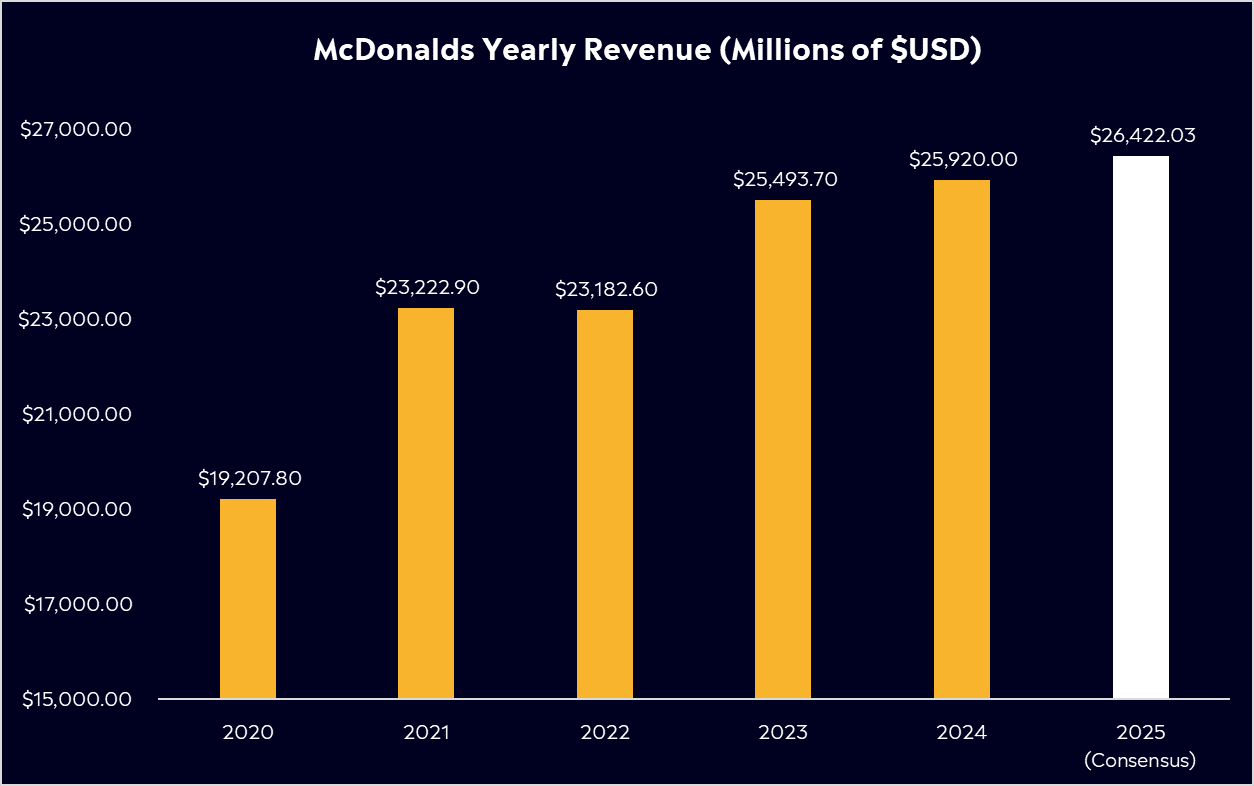

McDonald’s reported its Q1 earnings in May, and they were mixed amid a challenging consumer environment. Global sales were down 1% year-over-year. Total revenues came in at USD$5.96 billion, about 3% lower than a year ago, reflecting softer store sales and currency headwinds. The US market saw sales decline 3.6%, as high menu prices and lower traffic weighed on sales.

On the bottom line, net income was USD$1.87 billion for the quarter (a 3% drop YoY). Notably, even with slightly lower sales, McDonald’s remained highly profitable. Its operating income for Q1 was USD$2.65 billion, equating to an operating margin in the mid-40% range.

Flat quarterly sales followed solid growth driven by post-pandemic recovery, price increases, and promotions. While guest counts declined in the US due to some consumer pushback on higher prices, average spend per visit rose, softening the impact. International results were mixed, with strong sales in Japan and the Middle East offset by softness in the UK and parts of Europe. The flat result suggests McDonald’s is holding onto its pandemic-era gains despite tighter consumer spending.

Looking ahead, analysts expect low-single digit revenue growth through 2025–26, supported by roughly 4% restaurant expansion and a refreshed US value menu. International markets may benefit from strength in China and the Middle East, while Europe and Australia could remain a drag. Operating margins may improve slightly, though investments in technology and digital will continue to weigh on near-term profitability.

McDonald’s has long been a favourite of dividend-focused investors. It is a Dividend Aristocrat with an unbroken streak of annual dividend increases since 1976, nearly 49 years of consecutive increases. The company currently pays a quarterly dividend of $1.77 per share (as of Q2 2025), which translates to an annualised dividend of $7.08 per share and a 2.3% dividend yield. McDonald’s strong free cash flow and balance sheet support an increase to its dividend and greater share buybacks in 2025. For investors, McDonald’s offers a rare combination of yield and a long growth track record, delivering annualised returns of 15% over the past 20 years, with only four negative years in that time. Pretty solid, if you ask me.

*Past performance is not an indicator of future results.

Buy, Hold or Sell?

McDonald’s isn’t a high-flying growth stock, but it is a steady compounder with global dominance in its field, giving it a compelling investment case.

McDonald’s shares have long been a strong performer and trade at a premium to the broader market and its fast-food peers. It currently trades at around 25 times forward earnings, above the S&P 500 average and higher than rivals like Wendy’s or Restaurant Brands International. That premium reflects McDonald’s defensive appeal, brand strength, and reliable cash flow. While its dividend yield of 2.3% isn’t exactly mind-blowing, it’s consistent and backed by nearly 50 years of uninterrupted growth.

Its scale, brand loyalty, and highly successful franchise model allow it to navigate economic turbulence better than most. Like any business, there are risks. Rising menu prices could deter traffic, and a more health-conscious consumer alongside weight-loss drugs remain an overhang moving forward, but its push toward digital, delivery, and international growth should support growth. Also, let’s be very frank: McDonald’s will likely remain a staple for most people for many years.

According to Bloomberg’s Analyst Recommendations, McDonald’s has 23 buy ratings, 17 holds, and 1 sell. The average analyst price target is USD$330.90, signalling a 10% upside from current levels.

The investor takeaway?

While it’s unlikely to double overnight, McDonald’s remains a core holding for those seeking steady growth, dividends, and resilience in their portfolio. McDonald’s might not deliver explosive gains like Bitcoin or Nvidia, but it offers something just as valuable: consistency. The Golden Arches remain a high-quality cornerstone in any portfolio. It’s not flashy, but it’s a reliable performer in any market cycle.

Explore McDonald’s

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.