Whether you know it as Square, Block, or the company that bought Afterpay, this fintech heavyweight has come a long way. Co-founded by Twitter’s Jack Dorsey, Block, Inc. has gone from a tiny startup with a smartphone credit-card reader to a USD$49 billion fintech ecosystem and it just earned a spot in the S&P 500 index. Now part of the big league, Block gives investors exposure to the booming digital payments arena. But with fierce competition and growth pains, is this block of fintech a solid building piece for your portfolio? Let’s find out.

- Block’s ecosystem spans Cash App, Square, and Afterpay, giving it a rare two-sided fintech model that generates revenue from both consumers and merchants.

- The company is now profitable after years of growth and delivered a record gross profit in Q1, but issued cautious guidance for the rest of the year.

- According to Bloomberg’s Analyst Recommendations, Block has 35 buy ratings, 10 holds, and 4 sells. The average analyst price target is USDUSD$73.41, signalling a -7% downside from current levels.

Explore BLOCK

The basics

Block, Inc. (formerly Square) is a financial technology company that started in 2009 by enabling small merchants to accept card payments with a simple smartphone dongle. It’s best known for its major products: Square, Cash App, and Afterpay. Led by Twitter co-founder Jack Dorsey, Block has long leaned into decentralisation, crypto, and financial empowerment, themes that continue to shape its strategy.

You may not have realised it, but at some point over the years, we’ve probably all paid for something using a Square terminal, those little white card readers that empowered small businesses to take card payments easily. Square was a game-changer for entrepreneurs and side hustlers, with its software even allowing smartphones and tablets to be turned into payment terminals. Square also announced this week it would allow merchants to start accepting bitcoin as payment.

On the consumer side is Cash App, which has become a fintech phenomenon in its own right. Cash App lets individuals instantly send money to each other. But it’s evolved into a broader personal finance app: users can get a Cash App debit card, receive wages, buy Bitcoin in the app, and use buy now, pay later via Block’s 2022 acquisition of Afterpay. Cash App’s user base skews younger and has grown rapidly, with about 57 million monthly active users as of late 2024. In fact, Block estimates that 1 in 5 Americans aged 18-21 used the Cash App Card last year, thanks to its popularity with Gen Z. In Australia, buy now, pay later remains highly appealing, with a recent report from retail.org.au showing that 90% of Gen Z shoppers and 82% of Millennials use Afterpay, a quite staggering set of figures.

Fast-forward to today, and Block has grown far beyond that original card reader with a rebrand from Square to Block in 2021, which was a nod to blockchain technology, with CEO Jack Dorsey’s passion for crypto as well as its multi-faceted business that reaches as far as music with its majority ownership of streaming service Tidal.

Early this month, Block hit a major milestone: it was added to the S&P 500 index. Block’s shares jumped 7% on the day given that being in S&P 500 will increase analyst coverage, institutional ownership will be bolstered from index funds and investor awareness will grow. While Block is US-based, Aussie investors can access it via its ASX listing under SQ2, a result of its 2022 acquisition of Afterpay.

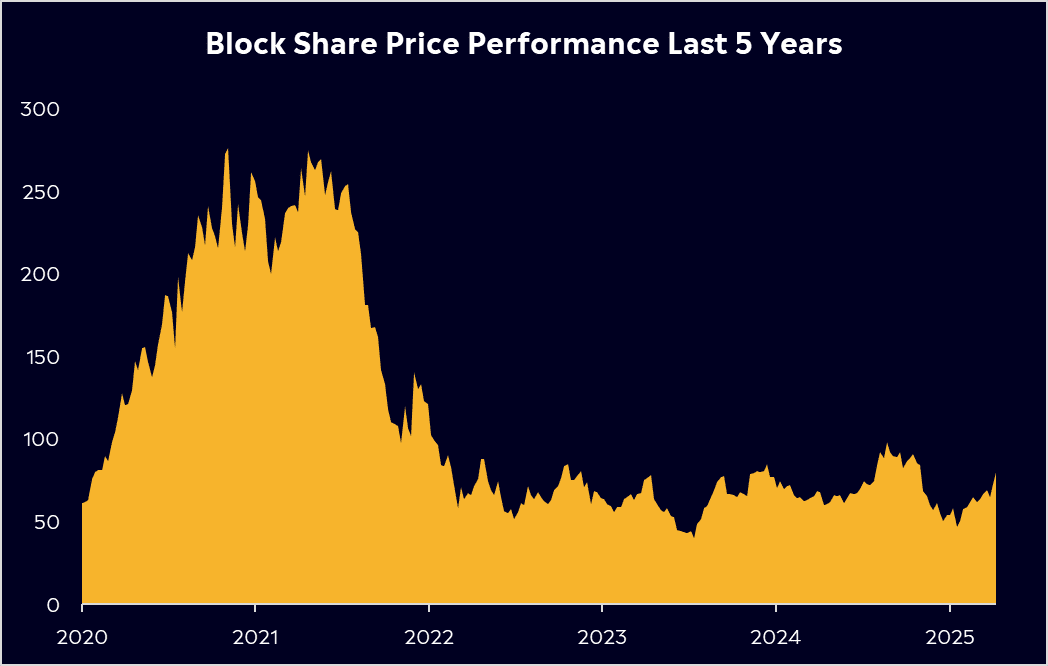

Past performance is not an indication of future results.

Competitor Diagnosis

Block sits at the crossroads of several fiercely competitive sectors: payment processing, crypto, consumer banking, and buy now, pay later (BNPL).

On the peer-to-peer payments side, Block’s Cash App competes directly with PayPal’s Venmo. Cash App and Venmo are neck-and-neck in US popularity, each with tens of millions of users, and both have become go-to apps for splitting bills and sending money. Venmo benefits from PayPal’s huge network and integration with e-commerce checkouts, while Cash App has tapped into cultural marketing to grow a younger fan base. Apple, with Apple Pay and Apple Cash, is pushing further into peer-to-peer payments and digital wallets. Big Tech’s entry is a real threat. Apple now lets U.S. iPhone users “tap to pay” with just a phone, effectively bypassing the need for a Square card reader for many small merchants.

In serving merchants, Block squares off against names like Fiserv and global processors such as Stripe, Adyen, and PayPal.Square’s advantage has been its simplicity and integration: from payment hardware to software to analytics, it’s a one-stop shop. A small business can start with a plug-in card reader and then easily adopt Square’s add-ons (online store, payroll, inventory, etc.) as they grow. This ecosystem approach builds loyalty – once a business has its payments, receipts, and customer data all running through Square, switching to a competitor’s system is a pain.

Block’s 2022 acquisition of Afterpay puts it in the ring with dedicated BNPL firms like Affirm and Klarna. BNPL became a hot trend for shoppers to split purchases into instalments, but the space has gotten crowded, and regulation has been front and centre. By embedding Afterpay into Cash App and Square’s merchant network, Block hopes to differentiate, for example, Cash App users can now retroactively split purchases into instalments on their Cash App Card. This cross-product integration could drive higher spending and keep users in Block’s ecosystem instead of using a rival BNPL app.

Block is surrounded by competition, from Wall Street banks to Silicon Valley tech giants. What gives Block a fighting chance is its ability to play on multiple fronts at once and make them work together. Few rivals have the breadth that Block does – a two-sided network of millions of merchants and millions of consumers under one corporate roof. Block has shown it can innovate to stay ahead by launching short-term loans, adding AI tools and expanding Square across Asia Pacific.

Financial Health Check

Block reports Q2 earnings on August 7th, and investors will be hoping for some more optimism following its Q1 earnings. Shares fell 18% in May after earnings, with the company issuing ‘cautious’ guidance for the year ahead. Revenue fell about 3% from USD$5.96 billion a year earlier and missed market expectations. Block provided weaker-than-expected profit guidance for the second quarter and full year, reflecting challenging economic conditions.

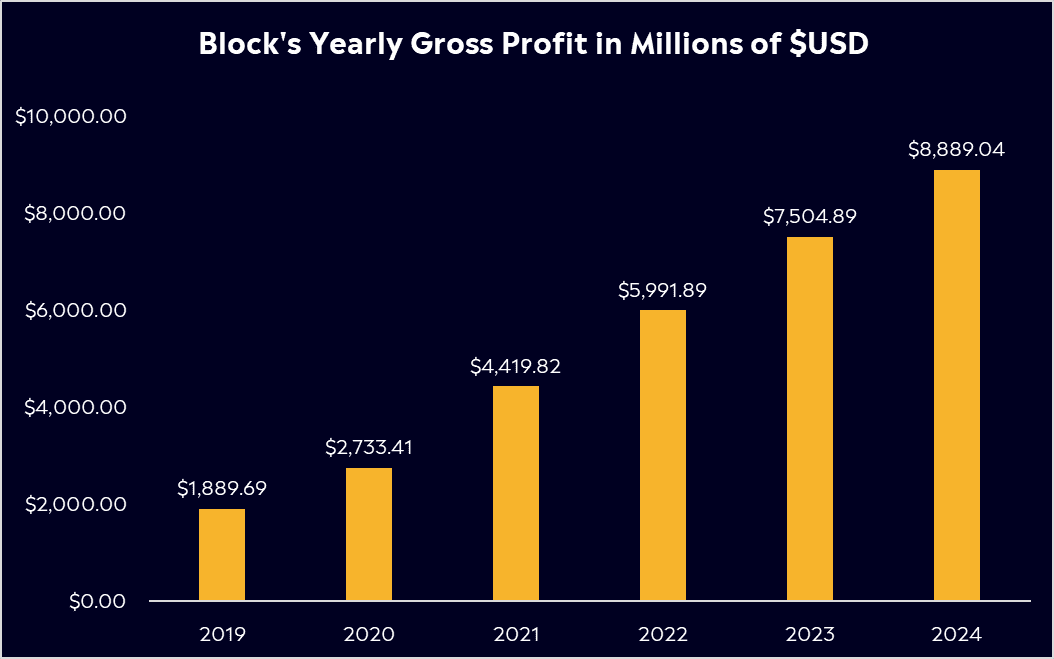

However, Block’s financial profile has matured, allowing it to deliver consistent profits, which is one reason it qualified to join the S&P 500. In 2024, Block’s gross profit was $8.89 billion, up a solid +18% from the prior year. Cash App contributed about $5.2B of that gross profit (growing +21% YoY) and Square about $3.6B (+15% YoY). This shows the Cash App side is now a bit larger and growing slightly faster than the seller side. By Q1 2025, Gross profit hit $USD2.29 billion last quarter, its most profitable quarter ever, showing efficiency across the business.

Despite cautious guidance, profit could pick up in the second half of the year, with the market expecting 12% gross profit growth for the full year, with momentum picking up as newer products like Cash App Card and Afterpay integration gain traction.

Block’s operating expenses have been growing much more slowly than in the past, as the company reins in costs. It achieved an adjusted EBITDA of $813 million in Q1, up 15% YoY, and a healthy adjusted operating margin near 19%. The Rule of 40 is a key goal for management now: they want the sum of gross profit growth (per cent) and adjusted operating margin to hit 40 or above by next year. For 2025, they’re tracking a bit below that and achieving this will likely require some re-acceleration in revenue and continued cost discipline.

Free cash flow has turned positive in recent years, and Block isn’t burdened by debt. It holds several billion in liquidity (cash and investments) that can fuel expansion or acquisitions. Shares are still down over 12% year-to-date, so a solid Q2 result will be needed to push shares out of the red.

Interestingly, Block generated over 42% of its USD$24 billion revenue. The market expects its bitcoin revenue to decline this year, but with bitcoin recently hitting a new record high of over USD$120,000, we could see a larger-than-expected revenue jump here. However, don’t be too excited by higher revenues. Although it’s a huge revenue driver, it brings in almost little to no profit.

Past performance is not an indication of future results.

Buy, Hold or Sell?

Block offers a two-sided fintech ecosystem: millions of consumers via Cash App and millions of merchants through Square. Its brands are strong. Cash App is a top peer-to-peer payment tool among young Americans, while Square is a go-to for small businesses, and its other brands, including Afterpay, remain exciting.

With Block now profitable and targeting 15–20% gross profit growth, some believe it’s entering a more mature phase after years of profit growth over 40%. Its valuation has jumped meaningfully in the last year, trading at 28x forward earnings, but that’s still cheaper than the broader Nasdaq 100, which trades at over 29x forward earnings. Inclusion in the S&P 500 this month is a tailwind, potentially reducing volatility and boosting institutional ownership over time.

Competition is arguably the biggest challenge. Block faces deep-pocketed rivals in every segment. If a company like Apple or PayPal aggressively undercuts Block or thwarts its progress in key markets, growth could stall. The macro environment is another concern: Block’s fortunes are tied to consumer spending and small business health. High inflation or a recession could hurt payment volumes. Ongoing regulatory scrutiny, particularly around crypto, BNPL, and data privacy, also remains a risk on the radar.

According to Bloomberg’s Analyst Recommendations, Block has 35 buy ratings, 10 holds, and 4 sells. The average analyst price target is USDUSD$73.41, signalling a -7% downside from current levels.

The investor takeaway?

Block is currently trading at close to USD$80, which suggests there may be limited upside in the near term. Mentioning near-term is important because analysts’ price targets typically extend 12 to 18 months into the future. But for long-term investors bullish on digital payments and fintech innovation, the fact that shares are still down 70% from their 2021 peak could present an attractive entry point.

Block has established itself as a fintech force, and it will be fascinating to watch the next chapters it writes in the evolving world of money. Its graduation to the S&P500 is a big win, and it’s a sign that the business is maturing, scaling, and being recognised among the world’s top companies. Now, the challenge is proving it can keep growing, stay profitable, and outpace fierce competition.

Explore BLOCK

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.