- Adoption increased across all ages, experiences, portfolio sizes and genders

- AI is the top subject retail investors plan to learn about

- Majority (57%) expect prices of AI-related stocks to rise in 2025

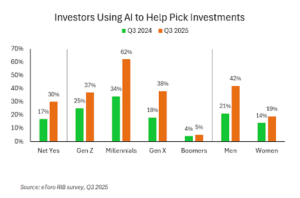

October 1, 2025 – US retail investors are increasingly adopting AI tools to build their portfolios (58%), according to the latest quarterly Retail Investor Beat from trading and investing platform eToro. The research, which surveyed 1,000 American retail investors, revealed that 30% now use AI tools to pick or alter investments in their portfolios, up 75% in one year. The proportion of investors that are open to adopting these technologies dipped slightly to 28%, compared to 33% last year.

This trend spans generations, experience levels, portfolio sizes, and genders: more investors in every group are already using or open to using AI tools. Across generations, millennials are now the most likely to use these tools at 88% compared to 70% a year ago, surpassing Gen Z (75% vs 76%). Boomers are still behind at 29%, remaining stable from 27% in Q3 2024.

Year-over-year growth in AI adoption

When asked why they are open to letting AI pick their investments, retail investors said:

| It will save me time on research | 48% |

| I think AI is the future of investing | 46% |

| It will make better decisions than me | 38% |

| I think it will pick better investments than a fund manager | 30% |

| It’s cheap compared to a fund manager | 25% |

Commenting on the data, eToro U.S. Investment Analyst, Bret Kenwell, said: “The barrier to entry has continued to be lowered for retail investors, who increasingly have greater access to investing tools and research. With AI at the forefront of the next technological revolution, DIY investors have a new and powerful tool to help close the gap with institutions. It’s no surprise that the tech-savvy younger investors are openly embracing AI when it comes to their investments, and they will likely lead that charge into the future.”

Retail investors are hungry for knowledge on AI

The research reveals that AI is the leading topic that retail investors plan to learn more about over the next year (24%), followed by cryptoassets and blockchain technology (22%), tax rules (22%) with real estate investing, investment fees, and economic indicators & macroeconomic trends all ranked at the third leading topic (16%).

Certain generations are more eager to learn about AI-powered investment strategies than others. Millennials (34%) and Gen X (32%) are the most interested in learning about AI-powered investment strategies. The top choice for Gen Z (32%) and Boomers (17%) is tax rules. Millennials showed a slightly stronger preference for crypto and blockchain, with 35% reporting a desire to learn more about these topics.

Retail investors bullish on AI stocks

The latest Retail Investor Beat highlights that retail investors are not only ready to embrace AI tools but also remain bullish about the AI sector as an investment. The majority (57%) expect the price of AI-related stocks to increase in 2025, while 16% believe they will stabilize, and only 12% anticipate a decline.

AI, and digital transformation in general, top the list of long-term themes that retail investors consider when making investment decisions, cited by 30%, followed by the ageing population (29%), clean technology (27%), the growth of the middle class (27%), and robotics and automation (24%).

Bret Kenwell commented: “Whether retail investors are using AI to assist with portfolio decisions or seeking exposure to AI stocks as part of their strategy, one thing is clear: they want to better understand the space. As AI technology evolves at a rapid pace, learning how to leverage it, or where to invest in it, is top of mind. Many investors watched the internet and cloud computing reshape the tech landscape, and they have no intention of missing out on what they see as the next major revolution.”

ENDS

Notes to editors

About this report

The latest Retail Investor Beat was based on a survey of 1,000 retail investors across the United States.

The survey was conducted from August 5 – August 19, 2025 and carried out by research company Opinium. Retail investors were defined as self-directed or advised and had to hold at least one investment product including shares, bonds, funds, investment ISAs or equivalent. They did not need to be eToro users.

The figures and results presented in this survey are based on the responses of participants at the time the survey was conducted. They reflect responders’ opinions, views and perceptions and should not be interpreted as investment advice or a guarantee of future performance. Percentages and results may not be representative of the broader population and are subject to change as market conditions and sentiment evolve.

Media contacts

pr@etoro.com

About eToro

eToro is the trading and investing platform that empowers you to invest, share and learn. We were founded in 2007 with the vision of a world where everyone can trade and invest in a simple and transparent way. Today we have 40 million registered users from 75 countries. We believe there is power in shared knowledge and that we can become more successful by investing together. So we’ve created a collaborative investment community designed to provide you with the tools you need to grow your knowledge and wealth. On eToro, you can hold a range of traditional and innovative assets and choose how you invest: trade directly, invest in a portfolio, or copy other investors. You can visit our media centre here for our latest news.

Disclaimers:

Securities trading is offered by eToro USA Securities Inc., member of FINRA and SIPC, a self-directed broker-dealer that does not provide recommendations or investment advice. Options involve risk and are not suitable for all investors. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading. Content, research, tools, and stock symbols on eToro’s website are for educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results. Cryptotrading is offered by eToro USA LLC. This entity is not a registered broker-dealer or FINRA member and your cryptocurrency holdings are not FDIC or SIPC insured. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary. FINRA Brokercheck © 2023