It’s a busy week with bank earnings due up and a key inflation reading. Here’s what we’re watching at The Daily Breakdown.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Markets are starting the week on the wrong foot, with all major US stock indices lower in pre-market trading — led by the Nasdaq 100, which is down roughly 0.7%. At the same time, silver and gold are pushing to record highs.

Part of the equity weakness may stem from increasing pressure by the administration on the Federal Reserve. On Friday, the Justice Department served the Fed with subpoenas related to renovations at its headquarters. Chair Powell suggested the move reflects frustration that the Fed has not lowered rates as quickly as the administration would like.

Busy Week Ahead

On the economic front, we will receive the CPI inflation report on Tuesday, followed by the monthly retail sales report on Wednesday. Together, these releases should provide a much-needed update on the inflation backdrop and the health of the consumer.

Earnings season also accelerates, with the major banks kicking things off. JPMorgan, Bank of America, Citigroup, Wells Fargo, Goldman Sachs, and Morgan Stanley are all set to report. We will also hear from companies such as BlackRock and Delta Air Lines.

Want to receive these insights straight to your inbox?

The Setup — Lyft

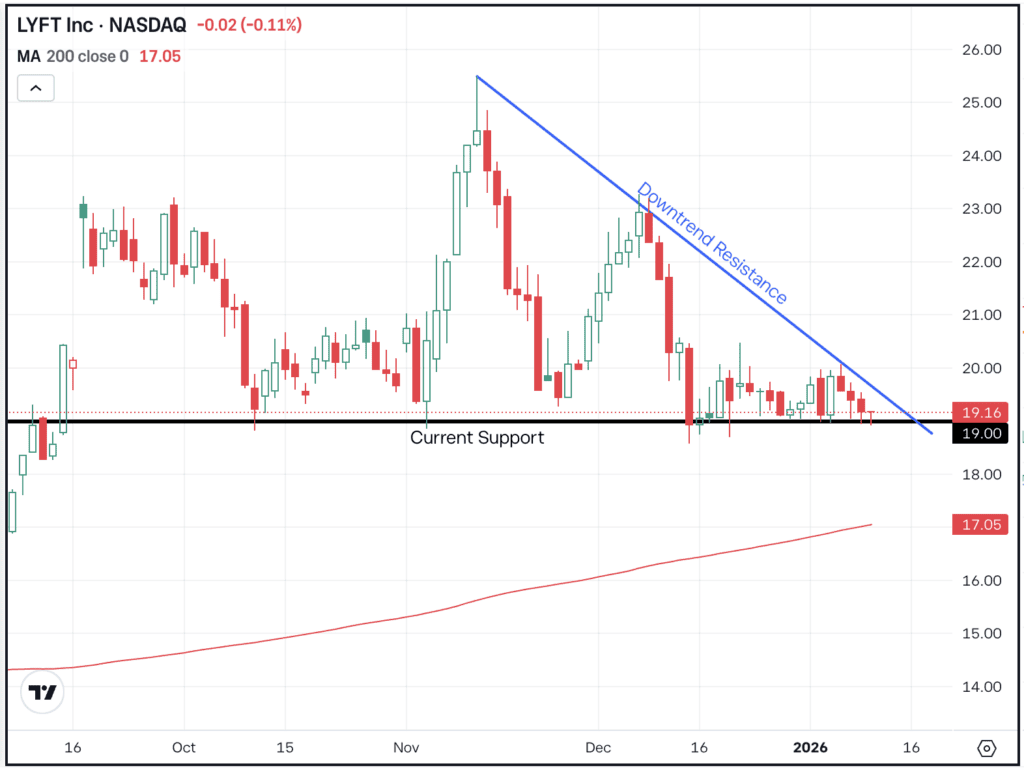

Lyft had a great 2025, rising 50%. However, shares have been mixed lately, down about 6.4% over the past month and 2% over the past three months.

Since the start of the fourth quarter, $19 has served as a key support level for Lyft. However, the broader trend has turned lower since the stock peaked in November, with each subsequent rally failing at a lower high.

Bears are looking for a decisive break below $19, which could open the door to further downside — including a potential move toward the 200-day moving average. Bulls, on the other hand, are hoping support holds and that Lyft can break above downtrend resistance, which could pave the way for a recovery to higher levels.

Options

As of January 9th, the options with the highest open interest for LYFT stock — meaning the contracts with the largest open positions in the options market — were the March $25 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

XLF

Financials are under pressure this morning, with the XLF ETF down about 1.3% in pre-market trading. Big banks are lower, but credit card companies are leading the decline with Visa and MasterCard down about 2%, American Express down about 4%, and Capital One Financial and Synchrony Financial down about 9%. The decline comes as President Trump says these companies need to cap their interest rates at 10%.

WMT

After transferring from the New York Stock Exchange to the Nasdaq last month, shares of Walmart are jumping about 4% this morning as the company will be added to the Nasdaq 100. Another catalyst may be Walmart’s move to team up with Google on the rollout of AI-powered shopping tools. WMT stock is set for record highs this morning. Check out the chart.

BCH

As Bitcoin and other cryptocurrencies look to gather some momentum, Bitcoin Cash just registered a new 52-week high over the weekend. Clearing $686 on Saturday, it was BCH’s highest price since April 2024. Bulls hope to see the crypto space enjoy more upside in Q1.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.