The Daily Breakdown takes a closer look at crypto as Bitcoin Cash hits 52-week highs, then pivots to JNJ as it marches higher too.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Despite a geopolitical flare-up between the US and Venezuela, markets have remained fairly calm. Energy prices have stayed stable, while precious metals like silver and gold continue to inch higher as momentum from 2025 carries into 2026. Geopolitics are certainly a potential risk this year, but so far, we are not seeing a spike in volatility.

Crypto and Stocks

Crypto has enjoyed a refreshing rally to start the year. While Bitcoin, Ethereum, and others are under some pressure this morning, the group has begun the year with a rebound. Remember, bulls want to see BTC clear $94K in the short term; so far, it is still acting as resistance. As for stocks, the S&P 500 and Nasdaq 100 are quietly moving higher, with the S&P 500 notching a new record high after yesterday’s 0.6% gain. However, small caps have started off hot, with the Russell 2000 up a quick 4% to start the year — easily outpacing other US indices.

What to Watch: Today we’ll receive the ADP report, which measures private-sector payroll growth, along with the JOLTS report, which tracks job openings, quit rates, and layoffs. Given the murkiness in recent economic data, these releases should help provide much-needed clarity on the state of the labor market before Friday’s monthly jobs report.

Want to receive these insights straight to your inbox?

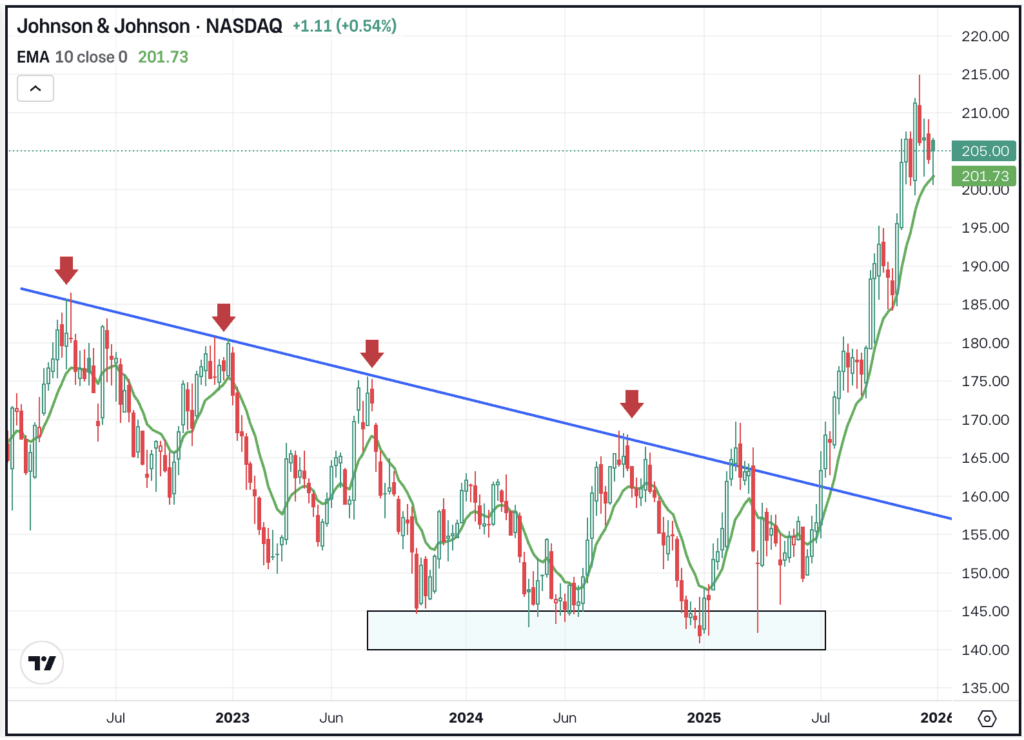

Chart of the Day: Johnson & Johnson

Johnson & Johnson stock lay dormant for several years before erupting last year. In Q2 2022, shares peaked near $187. In Q2 2025, it was still trying to find its footing around $150. Since breaking out though, shares have hit new record highs.

Obviously not all breakouts turn out like this, but it goes to show how technical analysis can help investors match quality companies with strong setups. When both fundamental and technical analysis turn into catalysts, there’s the potential for big moves.

Options

As of January 6th, the options with the highest open interest for JNJ stock — meaning the contracts with the largest open positions in the options market — were the January 16th $195 puts.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

After climbing 70% in 2025, SoFi Technologies began the year with a bang, climbing 11.8% in the first two days of 2026. However, shares tumbled yesterday, falling more than 8%. The decline comes amid a previously-announced capital raise for the firm. The stock has been volatile lately, but has done a nice job consolidating 2025’s big gains. Dig into the fundamentals for SOFI.

When companies like Tesla start making headlines for autonomous driving, stocks like Uber come under pressure. But when Nvidia talks positively about autonomous driving — like it did during this year’s CES event in Las Vegas — Uber shares react differently, like rallying more than 5% yesterday. That’s as Nvidia wants to see the entire auto sector embrace autonomous driving (and it helps that Uber and Nvidia are partners). Here’s our Deep Dive on Uber.

While most of the crypto space has been under heavy pressure over the past few months, Bitcoin Cash has quietly made new 52-week highs this week. Tagging $668.76, BCH hit its highest level since April 2024 and has been a leader in the space since mid-November. Check out the chart for BCH.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.