The Daily Breakdown takes a deep dive on PayPal, which just sold off after reporting earnings. Is Wall Street right or wrong on this one?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

In the previous bull market, PayPal was viewed as a high-quality growth company. But after a questionable acquisition strategy and a painful bear market, the stock has struggled to mount a meaningful rebound. While shares are up nearly 40% from their 2023 lows, PYPL stock remains more than 75% below its 2021 record high.

PayPal operates a global payments platform that enables digital transactions for consumers and merchants. Its brands include PayPal, Venmo, and Honey, among others — serving a wide range of use cases from peer-to-peer transfers to checkout, lending, and rewards.

Turnaround Takes Shape

Alex Chriss took over as CEO in September 2023, and the stock bottomed about a month later. Since then, he has steadily worked to turn the company around. While the stock fell more than 11% following last week’s earnings report, it was still a solid quarter.

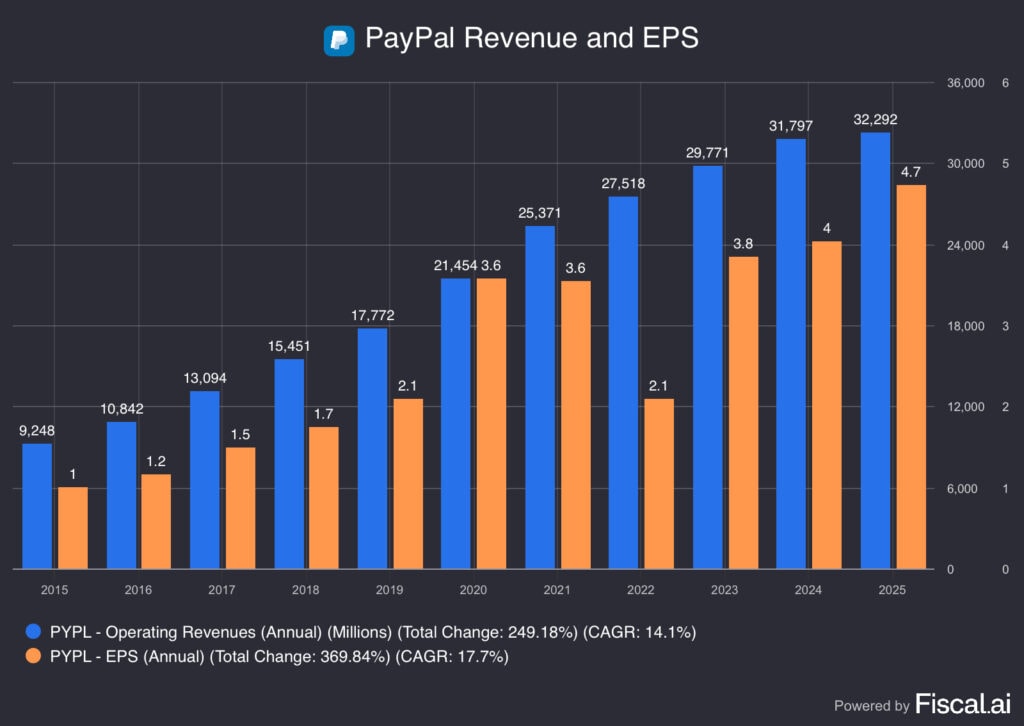

PayPal beat both earnings and revenue expectations, raised its full-year EPS outlook, and reaffirmed plans for $6 billion in share buybacks this year — nearly 10% of its market cap at current prices. Venmo also stood out, with 20% revenue growth, far outpacing the company’s overall sales growth of 8.2%.

Looking at the longer-term picture, analysts expect adjusted earnings to grow around 10% to 12% annually through fiscal 2028, with revenue growing at a mid-single-digit pace. As earnings growth outpaces revenue, PayPal’s buyback can give the bottom line a boost and operating margins — which are at a record high for the company — can continue to expand.

Want to receive these insights straight to your inbox?

Diving Deeper — PYPL Valuation

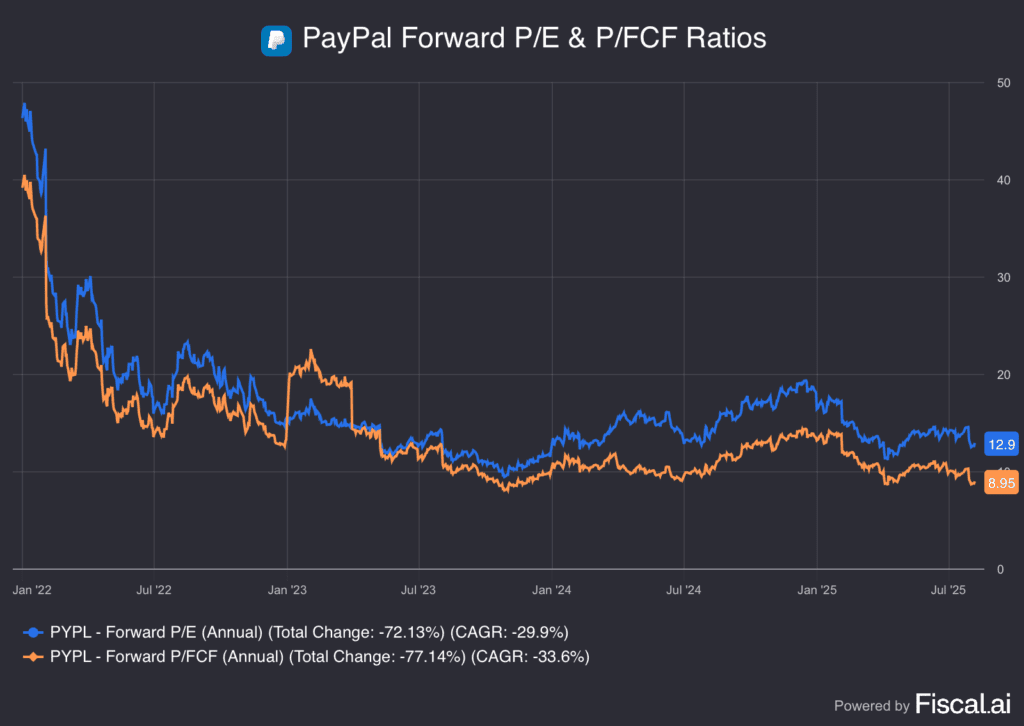

As Warren Buffett once said, “Price is what you pay, value is what you get.” Whether it’s a growth stock, a turnaround story, or a blue-chip stalwart, valuation plays a crucial role in determining whether investors are getting a good deal. Based on historical valuation metrics — such as forward price-to-earnings and price-to-free-cash-flow — PayPal stock appears relatively cheap.

Risks

It’s easy to see double-digit earnings growth forecasts and what appears to be an attractive valuation and think, “This stock is a no-brainer!” But it’s important to remember that PayPal has had a depressed valuation for several years now. While the business is in better shape than it was two years ago, that doesn’t guarantee the stock will be rewarded with a higher multiple.

Also, look no further than 2025 for a reminder that PYPL is not a flight-to-safety value stock. Shares fell from the $90s to the $50s in just a few months. While that period was marked by heightened volatility, it’s a useful reminder: if the broader economy weakens, investors may once again turn away from this name.

If you want to upgrade your investing knowledge this summer, make sure to join our eToro Academy Learn & Earn Challenge, where you can take courses, pass quizzes, and earn up to $20 in rewards. Terms and conditions apply.

What Wall Street’s Watching

Apple unveiled a new $100 billion investment to expand US manufacturing and research — a move that could shield it from President Trump’s proposed tariff on chip imports. The plan includes strengthening chip supply chain partnerships and ramping up domestic iPhone component production — part of Apple’s broader push to localize operations amid mounting trade pressure from the Trump administration. Analysts have an average price target of $134 for AAPL stock.

Bitcoin, Ethereum, Ripple, and other cryptocurrencies are jumping this morning on news that President Trump will sign an executive order aimed at expanding the available investment products in US retirement accounts. It will reportedly include cryptocurrencies, real estate, and private equity. Check out the chart for Bitcoin.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.