The Daily Breakdown looks at the fall in defense stocks, then takes a closer look at the charts for Salesforce as it hits resistance.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Markets started Wednesday on solid footing, but sentiment deteriorated as the session progressed. The Nasdaq 100 managed to eke out a modest 0.1% gain, while the other major US indices finished the day in the red. The Dow led the decline, with a 0.9% fall — but there were a lot of movers yesterday.

Trump’s Take

Throughout the day, President Trump weighed in on multiple industries, adding to market volatility. He first targeted housing, saying institutions would be barred from buying single-family homes. Institutional ownership is estimated at just 1% to 3% of the market, yet the comments still pressured homebuilding and construction ETFs such as XHB and ITB, while Blackstone and American Homes 4 Rent sold off.

Trump later turned to defense contractors, arguing they should be barred from paying dividends, buying back stock, and issuing outsized executive compensation until they boost investment in production capacity, increase deliveries, and improve maintenance. He singled out Raytheon, but the remarks weighed broadly on the sector, with Lockheed Martin, General Dynamics, and Northrop Grumman also falling. Notably, many of these stocks are rebounding sharply in pre-market trading on his comments calling for higher defense budgets.

Jobs

Yesterday’s labor data sent mixed signals. ADP private payrolls rebounded from last month’s negative reading but fell short of expectations. Meanwhile, the JOLTS report showed job openings at a one-year low and below estimates, though layoffs came in better than forecast. Attention now turns to Friday’s monthly jobs report.

Want to receive these insights straight to your inbox?

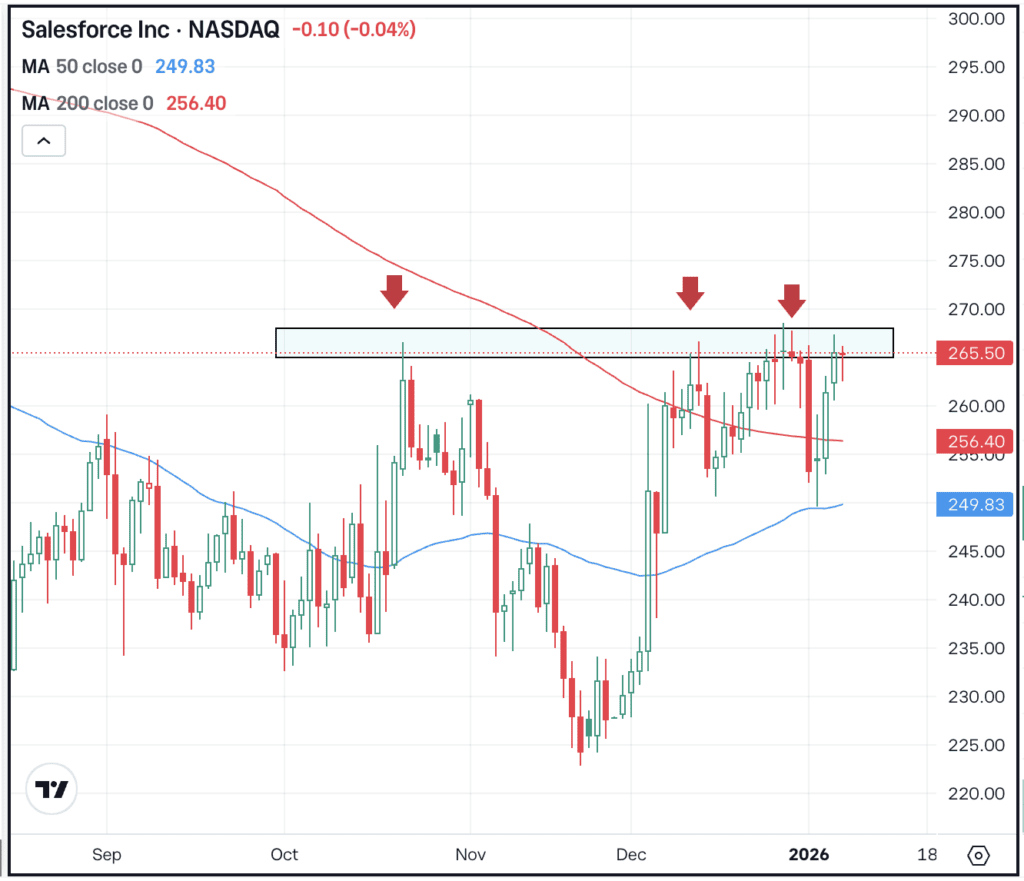

The Setup — Salesforce

AI has given a boost to tech stocks, but notably, not Salesforce stock. Instead, the name has been left behind, even though its business continues to grow. It’s something we discussed in our Deep Dive of CRM back in July. Now though, the stock is trying to find some traction.

The $265 area has been resistance for CRM over the last few months, while support has emerged from the $250 area. Now testing into resistance, bulls are hoping for an upside breakout, which could fuel a larger move higher. Bears are hoping resistance holds and CRM stock retreats.

Options

As of January 7th, the options with the highest open interest for CRM stock — meaning the contracts with the largest open positions in the options market — were the March $270 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

JPM

JPMorgan has agreed to take over Apple’s credit-card program from Goldman Sachs, assuming roughly $20 billion in balances and ending Goldman’s unsuccessful push into consumer lending. The deal strengthens JPMorgan’s dominance in credit cards while giving Apple a larger banking partner as digital payments continue to grow. Dig into the fundamentals for JPM.

INTC

Intel shares jumped after the company unveiled its Panther Lake chip at CES, its most significant manufacturing upgrade in a decade. The AI-centric processor, built on Intel’s advanced 18A process, is viewed as a critical test of the company’s long-awaited turnaround. Check out the chart for INTC.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.