The December meeting will mark the last interest rate decision of 2025. Markets expect the Fed to cut and The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

At 2 p.m. ET today, the Fed is expected to lower interest rates by 25 basis points. It would mark the third consecutive rate cut and bring 2025’s total interest rate reduction to 75 basis points. However, there’s more in focus today than just rates.

That’s as the Fed will also issue its Summary of Economic Projections (SEP), which it does four times a year. In that release, investors will get a look at the committee’s latest long-term projections for interest rates, GDP, inflation, and unemployment. This outlook will be in focus as investors try to gauge what’s in store in 2026.

Finally, Chair Powell will speak at 2:30 p.m. ET.

On the earnings front, Chewy reports this morning, while Oracle, Adobe, and Synopsys will report after the close.

Want to receive these insights straight to your inbox?

The Setup — Home Depot

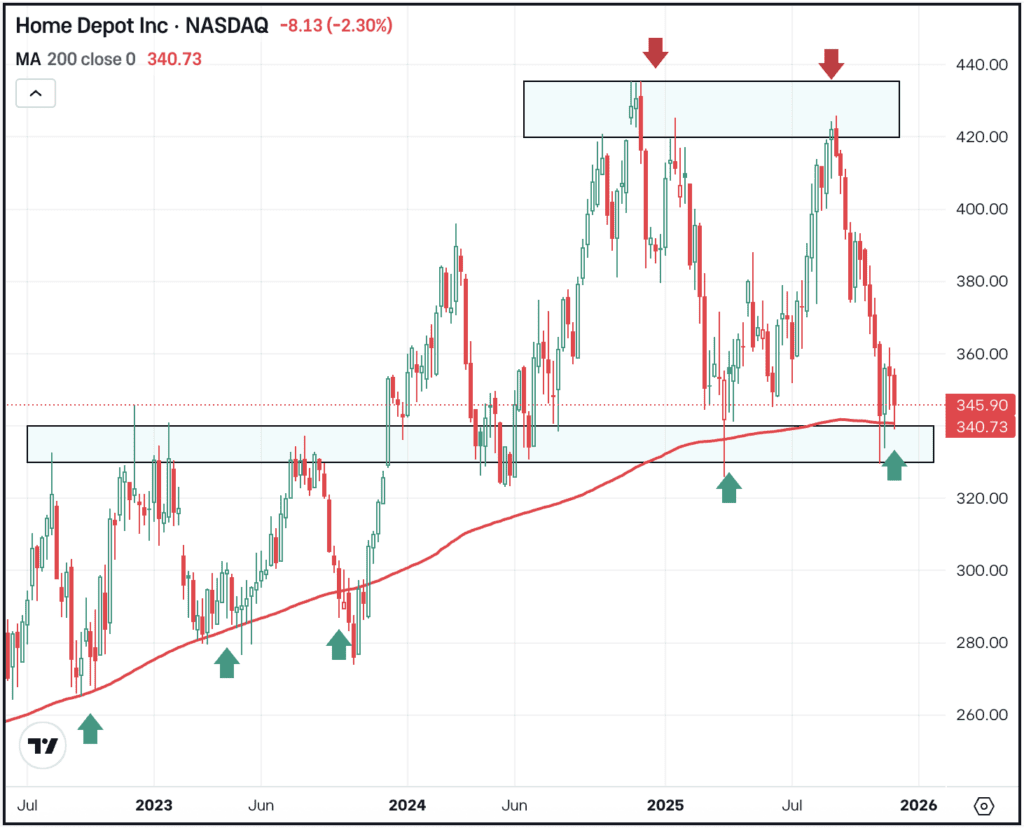

Home Depot has been waxing and waning over the last two years, with rallies stalling above $420 and declines finding support in the $330 to $340 zone — near where the stock is now. HD has also been looked at as an interest-rate story too, with management from Home Depot and Lowe’s noting that consumers have put off large home projects until rates move lower.

Bulls are keeping a close eye on this $330 to $340 zone, as well as the 200-week moving average, which has been supportive over the past few years. If this area continues to hold as support, bulls may look for a bounce in the coming weeks and months. However, if this support area breaks, more selling pressure could ensue.

Options

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of JPMorgan tumbled on Tuesday, falling almost 5% on the day after management said credit card competition and AI investments would drive costs higher in 2026. Shares ended the day near $300, while the October and November lows came into play in the low- to mid-$290s. Check out the chart for JPM.

GameStop has enjoyed a couple of strong weeks, rising about 20% from its recent low to this week’s high. Shares are down about 5% this morning after a mixed report, as revenue fell 4.6% to $821 million and badly missed analysts’ expectations, although adjusted earnings of 24 cents per share beat estimates of 20 cents per share. Here’s where analysts think GME stock can go.

Shares of GE Vernova are jumping this morning, up around 10% in pre-market trading after the company doubled its quarterly dividend from 25 cents to 50 cents a share and raised its buyback plan from $6 billion up to $10 billion. Management also raised its profit outlook, saying that AI is helping boost demand. Dig into the fundamentals for GEV.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.