Retailers looks to have had a record online Black Friday holiday. Will that give investors some comfort? The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Crypto was buried yesterday as Bitcoin and Ethereum led the way lower, while stocks were slugged on the open. The S&P 500 closed within a point of where it opened and fell about 0.6% on the day, although the Nasdaq’s decline of “just” 0.4% felt like a minor victory for the bulls as the index was down more than 1% at one point.

Now though, Bitcoin is up more than 4% from yesterday’s low, while stocks are trying to muster a bounce this morning.

Shoppers Show Up

There’s plenty of concern right now for the state of the US consumer. While this group has buoyed the economy over the last few years, persistent inflation, falling confidence, and a cooling labor market has investors anxious that consumers can continue to shoulder such a heavy load.

But at least for the Black Friday weekend, they showed up in force.

According to Reuters, “U.S. online spending on Black Friday hit a record $11.8 billion, according to Adobe Analytics, which tracks 1 trillion visits that shoppers make to online retail websites.” Those estimates showed sales of $23.6 billion from Friday to Sunday, while Adobe’s forecasts call for online Cyber Monday sales between $13.9 billion and $14.2 billion, which would be up about 6% vs. last year’s figures.

Want to receive these insights straight to your inbox?

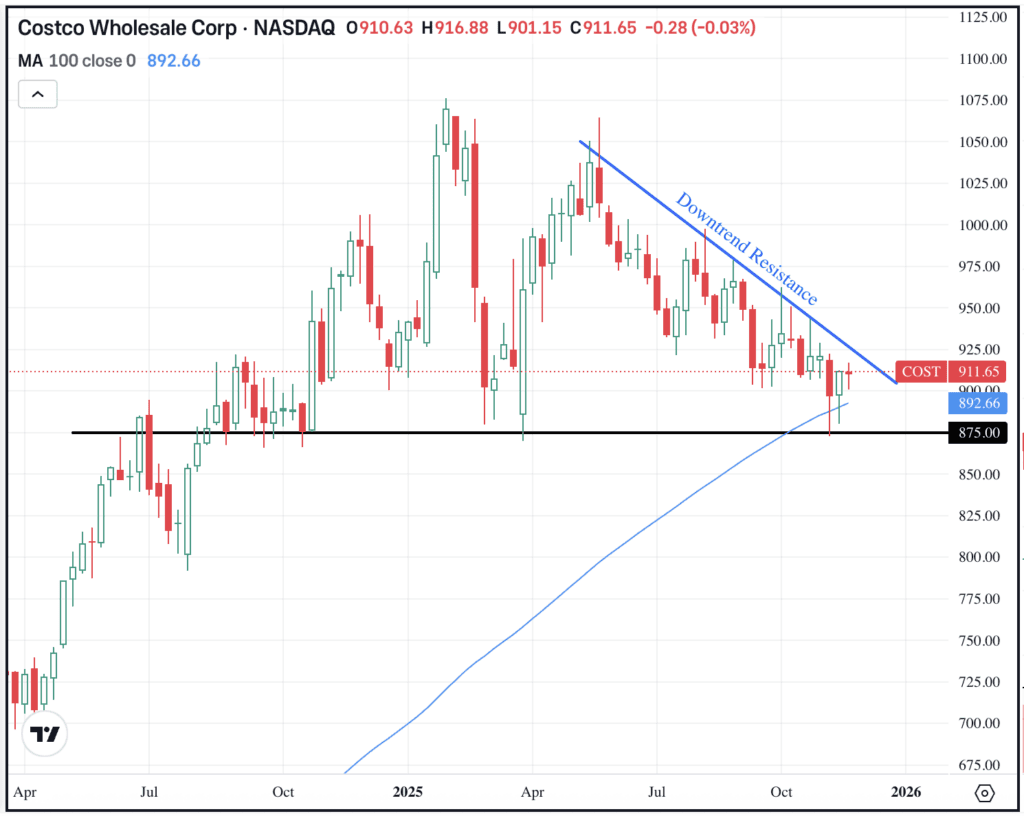

The Setup — Costco

On Main Street, Costco’s known as consumers’ favorite wholesale shopping experience. On Wall Street, COST is known as a high-quality retail stock that commands a premium valuation. While its lofty valuation could keep the stock price in check through the holidays, some bulls might be taking a closer look at the charts.

Shares recently pulled back to $875, which has been a key support area over the past year. At those levels, Costco stock is down almost 20% from its record highs. Further, the stock is testing — and for now holding — its 100-week moving average. A weekly close below $875 could usher in more selling pressure, while holding this level could have bulls looking for an eventual move higher. With enough bullish momentum, $1,000 or higher could eventually be in play provided support holds.

What Wall Street’s Watching

Shares of MongoDB are soaring this morning, up more than 20% in pre-market trading after the firm delivered better-than-expected quarterly results. Revenue of $628 million grew 19% year over year and beat estimates of $592 million, while earnings of $1.32 a share beat analysts’ expectations of 80 cents a share. Shares were up ~41% on the year coming into today’s session.

Cybersecurity firm CrowdStrike reports earnings after the close. Wall Street will watch closely for signs that enterprise spending on digital defense is holding up amid tighter IT budgets — particularly after management previously provided a better-than-expected long-term outlook. Analysts expect earnings of $3.62 per share on revenue of $4.3 billion. Check out the charts.

Synopsys stock jumped almost 5% yesterday and is up again this morning as investors cheer reports that Nvidia took a $2 billion stake in the firm. Nvidia paid $414.79 per share for the stake — a price that’s about 36% below the record high the stock hit in July. The investment is part of a larger partnership aimed at accelerating chip design and AI innovation between the two tech firms. Dig into the fundamentals for SNPS.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.