iShares National Muni Bond ETF MUB

$107.75-0.01(>-0.01%)(1D)

Invest in iShares National Muni Bond ETF

Today

Today

Create an eToro account to buy and sell iShares National Muni Bond ETF on a secure, user-friendly trading platform.

iShares National Muni Bond ETF MUB

Trending ETFs

See the top-trending assets with the highest trading volumes and price movements.

MUB Price Chart

0.27

Past Month

1D

1W

1M

6M

1Y

3Y

MAX

Sign up for full charts powered by

*Past performance is not an indication of future results

The iShares National Muni Bond ETF price is stable this week.

i

A ‘rising’ price indicates that the weekly price has increased by more than 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

The iShares National Muni Bond ETF price today is $107.75, a -0.01% change in the last 24 hours and 0% in the past week. iShares National Muni Bond ETF price changed by 0% in the past year.

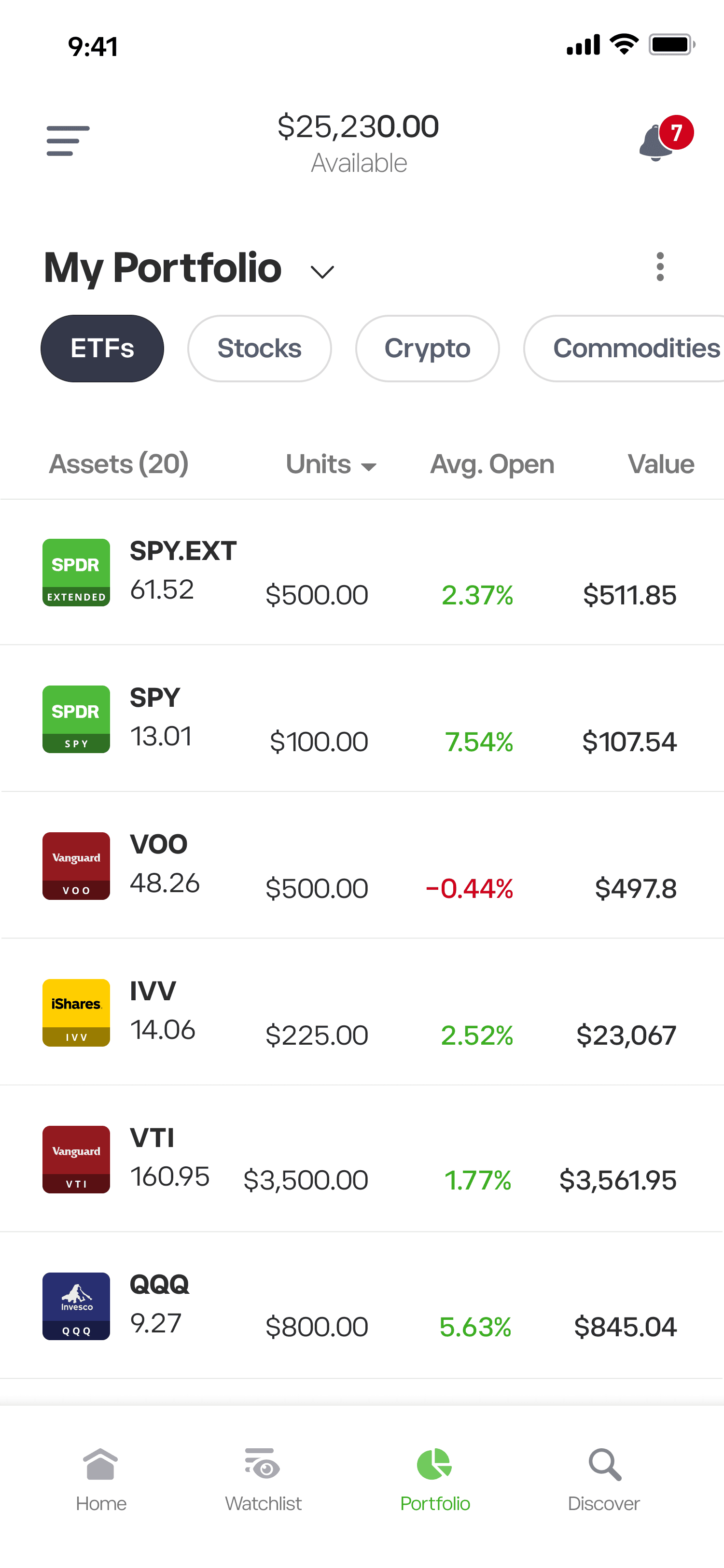

MUB Key Metrics

Prev Close

i

The final price of this asset at the end of the last trading day.

$107.75

Day's Range

i

Shows the high and low prices of the day.

$107.61 - $107.91

52 Week Range

i

Shows the high and low prices of the last year.

$100.63 - $108.98

1Y Return

i

A measure of this asset's return on investment over the last year.

0.86%

Price Change YTD

i

The amount the price of an asset has changed in the current calendar year.

0.74%

All time high

i

The highest recorded price of an asset since its launch.

$117.92

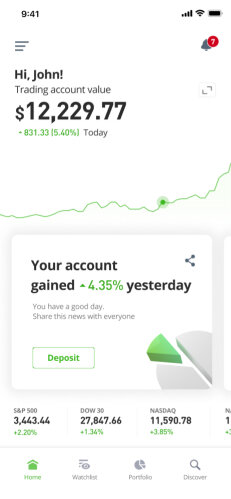

How can I buy iShares National Muni Bond ETF?

To purchase iShares National Muni Bond ETF:

01

Create an eToro account:

Sign up for an eToro account and verify your identity.02

Deposit funds:

Deposit funds into your eToro account using your preferred payment method.03

Search and purchase:

Search the iShares National Muni Bond ETF (MUB) page and place an order to buy iShares National Muni Bond ETF.Looking for more information? Check out our guides on Academy.

What Is iShares National Muni Bond ETF?

Established in 2007, the iShares National Muni Bond ETF tracks the S&P National AMT-Free Municipal Bond Index. It is managed by San Francisco-based BlackRock. Using US dollars as its base currency, the fund mainly invests in US-based, tax-exempt municipal bonds and trades under the ticker MUB on the NYSE. Follow this fund on eToro to receive updates on the MUB share price.

Top Guides

Our top picks for the most relevant guides from the eToro Academy

What is an ETF?

Read MoreDiscover what ETFs are and how they work with this beginner's guide. Learn about the benefits, risks, and why you may want to consider investing in them.

Discover the Benefits of ETF Investing

Read MoreETFs can help when diversifying a portfolio. Learn more about ETF investing, passive investment, and how to create consistent trading strategies.D

Invest in iShares National Muni Bond ETF

Today

Today

Create an eToro account to buy and sell iShares National Muni Bond ETF on a secure, user-friendly trading platform.

FAQ

The current price of iShares National Muni Bond ETF (MUB) is $107.75

iShares National Muni Bond ETF's all-time high is $117.92

Select the "1D" or "1W" timeframe on the eToro chart and zoom out to see the historical price movements of iShares National Muni Bond ETF. The price of iShares National Muni Bond ETF has ranged between $100.63 and $108.98 over the last year.

To buy iShares National Muni Bond ETF, visit the "iShares National Muni Bond ETF (MUB)" page. Once you have created an account and deposited funds, click the "Trade" button and decide how much iShares National Muni Bond ETF you want to purchase. You can also place an order that will buy iShares National Muni Bond ETF (MUB) at a specific price in the future.