Insurance

Certain eToro entities provide eligible customers with free insurance purchased from Lloyd’s of London, one of the world’s leading providers of specialist insurance, giving coverage of up to 1 million EUR, AUD or USD (depending on the region).

The free insurance is only available for Platinum, Platinum + and Diamond Club members, customers of eToro (Europe) Ltd., eToro AUS Capital Ltd., eToro (ME) Ltd. and eToro (Seychelles) Ltd.

- The insurance covers claims of eligible clients suffering losses due to the unlikely event of eToro’s insolvency and in case of an Event of Misconduct (as defined in the applicable policy).

- The insurance covers: (i) up to 1 million EUR, AUD or USD (depending on the regulated entity); (ii) up to the aggregate limit purchased by eToro; and (iii) subject to an excess amount (as defined per applicable policy).

- Must exceed an initial amount of 20,000 EUR, AUD or USD.

- The insurance covers cash, all CFD positions, and securities. Note that REAL cryptocurrency positions are not covered by the insurance, as set in the applicable policy.

Three Layers of Protection

In the unlikely event of an eToro insolvency, eligible clients* of eToro (Europe) Ltd., eToro AUS Capital Ltd., eToro (ME) Ltd. and eToro (Seychelles) Ltd. have three layers of protection.

- In case of insolvency, the assigned liquidator will manage eToro’s assets and money distribution among its clients, if applicable.

- Regulatory protection: For clients of eToro (Europe) Ltd. (regulated by CySEC), certain regulatory schemes apply (ICF), which compensate clients in the event of insolvency and a shortfall of client funds of up to $20K.

- Private insurance: Provided by Lloyd’s of London, this investment insurance policy covers losses suffered due to insolvency, subject to an excess amount, and up to 1 million EUR/AUD/USD per client* as described above.

*The free insurance is only available for Platinum, Platinum + and Diamond Club members, customers of eToro (Europe) Ltd., eToro AUS Capital Ltd., eToro (ME) Ltd. and eToro (Seychelles) Ltd.

eToro offers additional services, such as:

Your Funds are Kept in a Segregated Account

eToro’s top priority is to keep its clients, and their funds, safe and secure. For this reason, every penny deposited by a client is held in a separate, segregated account. This means that even in the highly unlikely event of eToro’s insolvency, your funds will be safe.

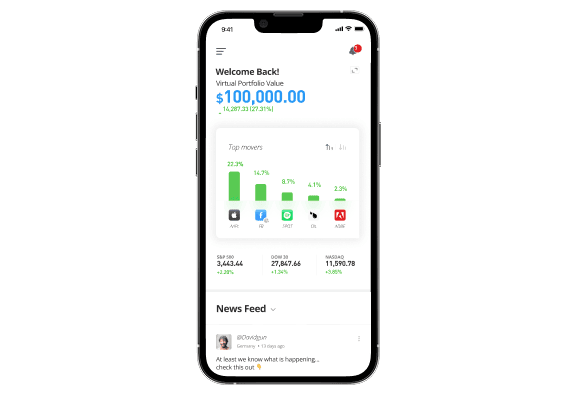

FREE $100K Demo Account

Explore the simplicity and ease-of-use of the eToro platform with a FREE $100,000 demo account. Open and close trades, build your virtual portfolio with stocks, crypto and other asset classes, and hone your trading and investment skills.

Terms and Conditions apply. For more information, please refer to the eToro insurance Terms and Conditions.

FAQ

- Which products are covered by the insurance policy?

-

The insurance covers cash, all CFD positions, and securities. Note that REAL cryptocurrency positions (non-CFD) are not covered by investment insurance.

- Who does the insurance cover?

-

The insurance is only available for Platinum, Platinum + and Diamond Club members, customers of eToro (Europe) Ltd., eToro AUS Capital Ltd., eToro (ME) Ltd. and eToro (Seychelles) Ltd.

- Does it have an expiry date?

-

No. However, the insurance may be withdrawn at eToro’s discretion at any point in the future. Prior notification is not required.

- When will the insurance be triggered?

-

The insurance may be triggered in the unlikely event of eToro’s insolvency.

- How does eToro hold my money?

-

To safeguard your funds, eToro holds them in a completely segregated account in a top-tier bank or qualifying money market fund.