Aussie Broadband (ASX: ABB) is an emerging leader in the Australian telecommunications sector, known for its strong customer service and rapid growth. With a diversified range of services, including NBN, mobile, and business solutions, the company has been expanding its market share and challenging the dominance of the country’s telecom giants. As it moves into new areas, including AI-driven mobile services, Aussie Broadband’s growth trajectory remains impressive. But will it continue to thrive amid increasing competition? Let’s find out.

- Aussie Broadband is taking on the big telco names in Australia, and it’s doing it well. Revenue surging 32% year-over-year from its H1 2025 results.

- With the Buddy Telco mobile brand and strategic investments, Aussie Broadband is positioning itself as more than just an NBN provider, tapping into new markets like cloud communications.

- Aussie Broadband has 9 buy ratings, 3 holds, and 0 sells, with an average price target of AUD$4.49, signalling a potential upside of 6% from its last closing price.

Explore Aussie Broadband (ASX:ABB)

The Basics

Aussie Broadband is an Australian telecommunications provider offering internet, phone, and mobile services to residential, business, and wholesale customers. Founded in 2008 by a group of internet service professionals, Aussie Broadband started small and has since grown into one of the country’s top telcos, now serving over one million services across the nation. Known for its excellent customer service, Aussie Broadband has earned a strong reputation and has become the 5th largest NBN provider in Australia.

The brand built its reputation on local customer support and reliable, fast internet plans, which helped it stand out in a market long dominated by a few big players. In recent years, Aussie has significantly diversified its services. In addition to its NBN services, Aussie Broadband has expanded into mobile and business offerings. In 2023, it launched Buddy Telco, a subsidiary brand designed for cost-conscious consumers seeking simple, no-fuss mobile plans. A key highlight of Buddy Telco is its use of artificial intelligence to enhance customer experience and service.

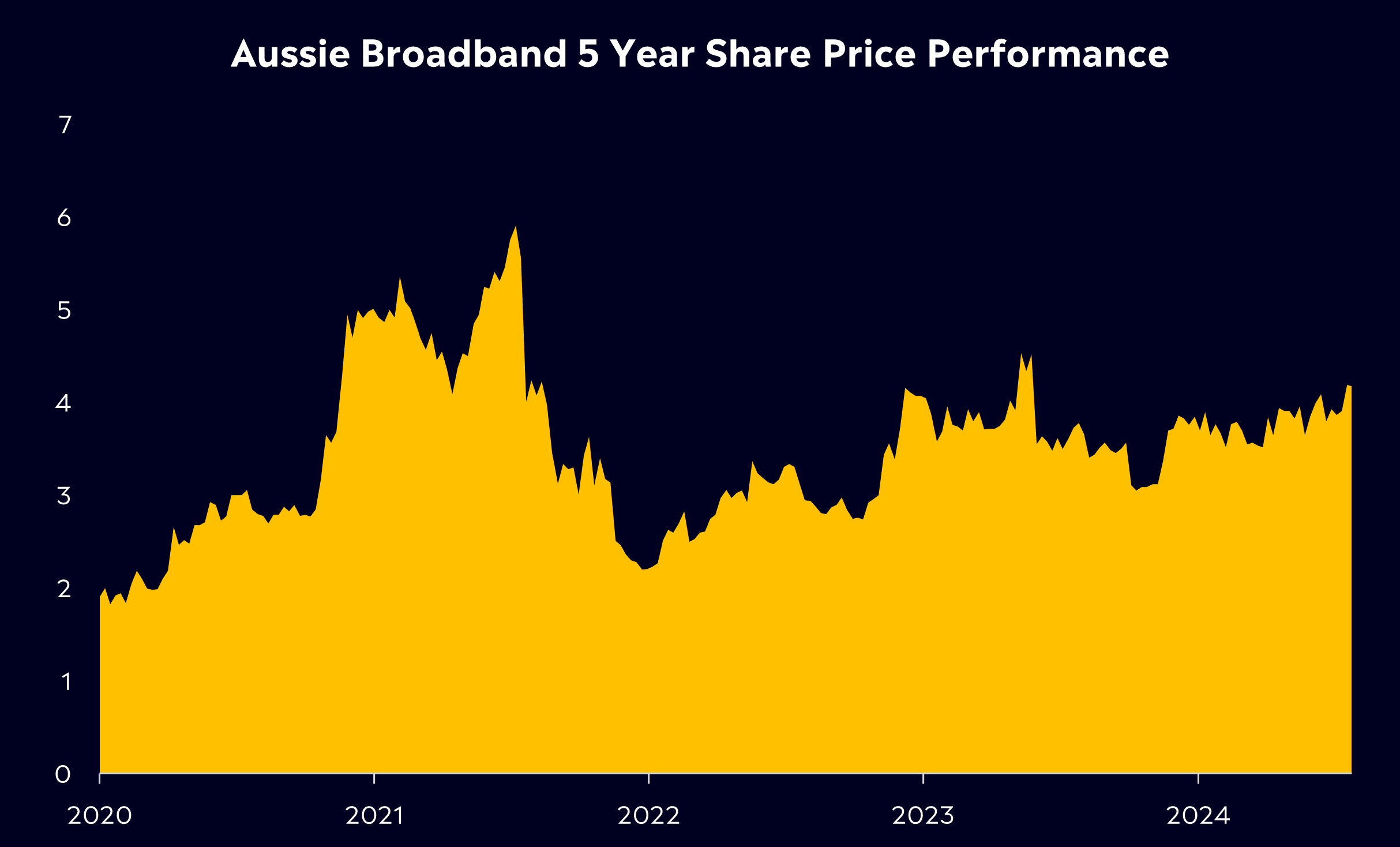

Since listing on the ASX in 2020, Aussie Broadband has moved from strength to strength. Shares have climbed over 100% in that time, and thanks to investing in its own fibre network and its product range, customer growth has continued. They have also made strategic acquisitions, such as the purchase of Over The Wire in 2022 for $344 million and Symbio Holdings in 2024. These acquisitions enable Aussie to broaden its services and capabilities, including cloud communications and business-grade services. Then, in early 2024, Aussie completed the takeover of Symbio Holdings, helping to boost the Group’s total customer count above the one-million mark.

Aussie Broadband isn’t just a small challenger internet provider, but a full-service telecom company looking to challenge the big names in Australia.

Competitor Diagnosis

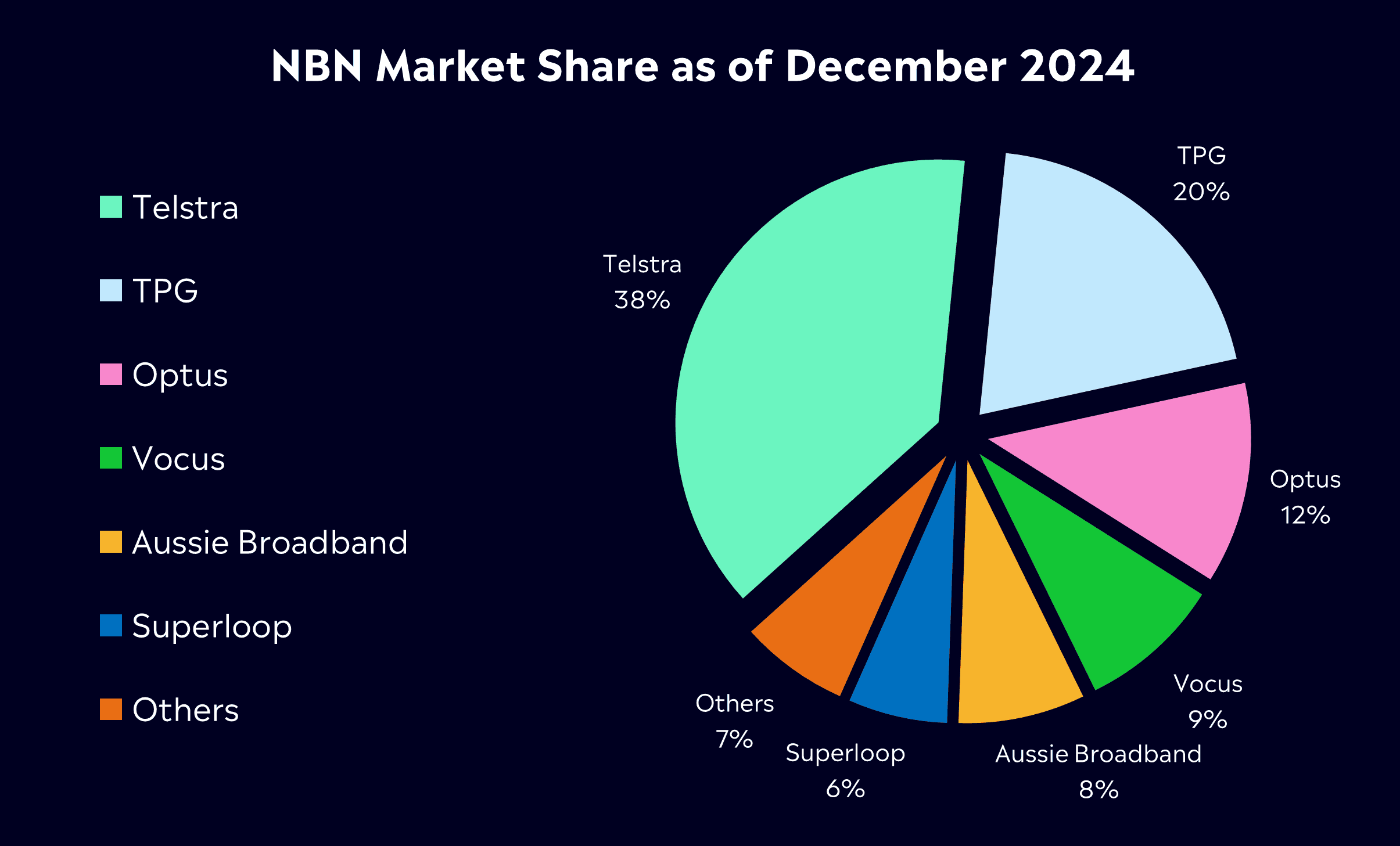

Aussie Broadband is up against some major competitors in Australia’s telecommunications space, primarily Telstra, TPG Telecom, and Optus. These large players collectively control most of the country’s broadband and mobile market. Telstra, for example, holds around 38% of the NBN broadband market, with TPG and Optus at 20% and 12% respectively. By comparison, Aussie Broadband’s market share in the NBN segment is still under 8%, but it has been growing at a strong pace and is gaining ground, thanks to its customer satisfaction and service quality.

Major players like Telstra and TPG hold significant advantages, including extensive infrastructure, strong brand recognition, and the ability to offer bundled services such as mobile, broadband, and entertainment. Their financial strength also allows them to invest heavily in marketing, securing a dominant presence in both retail and consumer markets. The big differentiator has been customer experience and service quality. Aussie Broadband consistently tops consumer satisfaction surveys, it boasts an NBN customer satisfaction rating of 84%, significantly higher than Telstra’s 73% (and the highest in the industry). Aussie consistently ranks as one of the top providers for customer satisfaction in Australia, with a Net Promoter Score (NPS) higher than both Telstra and Optus, which resonates with customers who value good service and fast responses.

The company has cultivated a loyal fan base thanks to perks like Aussie-based support staff, transparent communication (no surprise fees or hard sell tactics), and reliably fast speeds. Essentially, Aussie has built a brand as the “friendly” telco, in contrast to the bureaucratic image of larger competitors. Aussie leads the “challenger” segment of telcos, among the smaller providers outside the big three, Aussie holds roughly a 40% share of that up-and-coming market.

Nonetheless, going up against these formidable competitors is no easy feat, but Aussie’s formula of competitive pricing, top-notch service, and strategic network investments is allowing it to punch above its weight against far larger rivals.

Financial Health Check

Aussie Broadband’s growth is reflected in solid financial performance, with the company positioning itself well for continued expansion. In the most recent half-year results for FY25 (the six months ending December 31, 2024), Aussie Broadband reported revenue of AUD$588.5 million, which marked a 32% increase year-on-year. This solid revenue growth was driven by the expansion of its broadband customer base, as well as its growing mobile and business services segments, including the integration of the Symbio acquisition.

It’s not just revenue that’s growing, it’s also improving its profitability. EBITDA (earnings before interest, tax, depreciation and amortisation) came in at AUD$65.8 million for the half, which is a 42% jump year-on-year. This reflects better operating leverage and cost control as the business scales up. At the bottom line, net profit after tax was AUD$12.2 million, a rise of 23.8%. Aussie has only recently broken into consistent profitability, so seeing positive earnings grow double-digits is a good sign of maturation. But, a net margin of just over 2% demonstrates the challenges of the industry, where much of the revenue is passed onto infrastructure providers, such as NBN Co, for wholesale access.

These results also saw the company declare its first-ever dividends, a 1.6 cent interim and a 2.4 cent special dividend, as a way to return some cash to shareholders after a profitable half.

On the balance sheet, Aussie Broadband has managed its debt load effectively, reducing net borrowings to approximately $101 million by the end of FY25’s first half, after using proceeds from the sale of Superloop shares (worth around $100 million) to pay down debt. This is a relatively modest debt level for a company with around $1.2 billion in annualised revenue, and it shows the company is maintaining a solid financial footing as it scales up its operations.

Aussie Broadband’s operating cash flow was positive at $16.3 million, indicating that its core business is generating cash to fund its expansion and other capital needs. They also recently announced a share buyback program aimed at repurchasing up to $20 million worth of shares, showing confidence in the business amid strong free cash flow.

Thanks to its strong satisfaction ratings, the company has shown it can raise prices or upsell higher-speed plans without alienating customers. It’s also now proven that it can generate real profits and cash, and even return some to investors, which differentiates it from many growth-stage tech companies.

Aussie Broadband’s finances are solid, with robust revenue growth, improving margins, and manageable debt, but investors should keep an eye on how efficiently the company can turn its growing sales into larger, sustainable profits going forward.

Buy, Hold or Sell?

Shares have had a decent start to 2025, rising 20% amidst ongoing trade tensions and market uncertainty, but still sit around 30% off the record high of AUD$5.91 reached back in 2022. Aussie has made impressive strides in the local telco market, increasing its market share, expanding its service offerings, and integrating strategic acquisitions like Symbio Holdings. It is now not only a leading NBN provider but also making moves into mobile services and cloud communications, diversifying its revenue streams.

From the perspective of what’s ahead, Aussie Broadband’s revenue growth has been strong, up 32% year-on-year in the latest half-year results, and its expansion into new areas like mobile and business services provides a long-term growth story. The company is proving it can scale, with a solid customer base and high customer satisfaction, while its AI-driven mobile brand, Buddy Telco, enhances its market appeal.

However, growth won’t come without challenges. The Australian telco market is highly competitive, and the big players like Telstra and TPG will not easily give up market share. Aussie’s profit margins remain thin, and while growth is promising, the company’s ability to convert this into significant profit is still a work in progress. Additionally, expanding into mobile services brings new competition from other low-cost mobile providers and network operators, which could put pressure on margins.

Analysts are bullish on the stock though. According to Bloomberg’s Analyst Recommendations, Aussie Broadband has 9 buy ratings, 3 holds, and 0 sells, with an average price target of AUD$4.49, signalling a potential upside of 6% from its last closing price.

With its share buyback program showing confidence in its future and ability to generate cash, Aussie Broadband’s long-term prospects remain positive, especially if it can continue gaining market share from larger incumbents like Telstra.

Explore Aussie Broadband (ASX:ABB)

*Data Accurate as of 08/05/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.