In the eye of the tariff storm, BYD has quietly overtaken Tesla as the new EV leader, with the Chinese EV manufacturer delivering more revenue and vehicles than its US counterpart in Q1. This comes at a time when Tesla’s shares have tumbled from their highs, analysts have slashed price targets, and sales across the globe have slowed. On the other hand, BYD’s sales and revenue are soaring, overtaking Volkswagen to become the top-selling car brand in China in 2024, a massive milestone. With new technology developments, alongside a new capital raise to fund overseas expansion, is BYD poised for further growth or will competition and price wars dampen its outlook? Let’s find out.

- BYD sold 1 million vehicles in Q1 and bettered Tesla’s revenue and net income, signalling a shift in the dominance of the EV market.

- Trading at a 19x forward P/E, BYD’s valuation offers attractive growth potential with strong financial performance and innovative tech continues to support its long-term growth.

- BYD has 37 buy ratings, 3 holds, and 1 sell, with an average price target of HKD$469.93, signalling a potential upside of 27% from its last closing price.

Explore BYD Co (01211.HK)

The Basics

BYD (which stands for “Build Your Dreams”) is a Chinese based manufacturer that began in 1995 as a battery maker founded by chemist Wang Chuanfu. It expanded into electric vehicles and has now become one of the world’s largest EV manufacturers.

The company offers a wide range of new energy vehicles from affordable compact models to buses and luxury SUVs, making it the world’s biggest manufacturer of battery-electric and plug-in hybrid cars. Popular BYD models like the Qin, Dolphin and Tang cater to mass-market buyers, while its premium brands (such as Denza and the high-end Yangwang line) target upscale segments. This lineup helped BYD capture about 34% of China’s EV market in 2024, and it’s got big plans for 2025. BYD is aiming to sell 5.5 million vehicles, 800,000 of which will be sold overseas, a clear signal of its intended global expansion.

Unlike rivals, BYD designs and makes many key components in-house, such as batteries, semiconductors, and motors, which can lower costs and reduce supply chain dependencies. It has gained notoriety with the Blade Battery, a space-saving lithium iron phosphate pack known for safety and cost efficiency. This technology is so advanced that even Toyota partnered with BYD to power its new bZ3 electric sedan with BYD’s Blade batteries.

This in-house integration was a factor in Warren Buffett’s Berkshire Hathaway buying a 10% stake in BYD back in 2008. Buffett’s partner, Charlie Munger, even called BYD one of Berkshire’s best investments. Berkshire has since trimmed its holdings to just below 5% after BYD’s share price skyrocketed by more than 2000% since 2008.Fun Fact: In 2021, BYD made a bold move by becoming the world’s largest producer of electric buses. The company’s buses are now in operation across over 300 cities globally, from the streets of Los Angeles to the roads of Sydney.

Competitor Diagnosis

BYD’s rise comes at a time when its most significant rival, Tesla, long the global EV leader, is seeing slowing growth. Tesla’s global deliveries fell to about 336,000 vehicles in Q1 2025 (down 13% year-on-year) , a rare setback attributed to softer demand and a “brand crisis” following CEO Elon Musk’s involvement with the United States Government. BYD sold approximately 416,000 battery EVs in the same quarter, outpacing Tesla. The expectation is that BYD will unseat Tesla as the world’s top EV seller this year, with BYD expected to claim about 15.7% of the global EV market vs. Tesla’s 15.3%.

For the full year 2024, BYD achieved revenue of over USD$100 billion for the first time, a massive milestone. That’s important because it means they delivered more revenue than Tesla for the first time ever, with Tesla achieving revenue of USD$97.7 billion in the same period. By comparison, in 2018, BYD’s revenue was about one-fifth of today’s level. That’s an incredible rise.

So, how do Tesla and BYD differentiate? Tesla focuses on premium models, whereas BYD offers many entry-level and mid-range models (including plug-in hybrids) that sell for a fraction of Tesla’s prices, capturing budget-conscious consumers, a clear competitive advantage. The transition to electric depends largely on price, charging infrastructure, and everyday suitability. Tesla’s cheapest model starts from around USD$40,000, but you can pick up a BYD vehicle from as little as USD$10,000. However, Tesla’s Model Y was the best-selling EV in 2024, with 1.2 million cars sold globally.

BYD and Tesla are technology-driven, but BYD has been making some big moves. It unveiled a “Super e-platform” that can charge cars in just five minutes for a range of 400 kilometres, aiming to virtually eliminate charging time concerns. BYD also announced it will include advanced driver-assistance (autonomous driving) features dubbed “God’s Eye” on most of its models at no extra cost. Essentially, BYD is looking to offer the ‘same’ premium options as Tesla at a fraction of the price, which undercuts Tesla’s strategy of charging hefty fees for its self-driving software upgrades.

In another sign of BYD’s recent dominance, it overtook Volkswagen to become the best-selling car brand in China in 2024, a big shift as Chinese buyers increasingly opt for BYD’s electric models over foreign petrol and diesel cars. Tesla, by contrast, has been cutting prices to stoke demand, squeezing its margins.

Chinese EV startups such as Nio, Xpeng, and Li Auto are still competitors, but they operate at a fraction of BYD’s volume and many are still unprofitable. BYD’s scale and profitability give it an advantage in weathering price wars that are pressuring the whole industry. Competition is extremely high, with global and local auto companies investing heavily in launching new EV models. From 2023-27, global auto majors are committing over USD$616b towards EVs.

Internationally, BYD is expanding into Europe, Asia-Pacific, and Latin America. The challenge will be translating its home-market dominance to overseas success, competing with Tesla’s strong brand and the home turf advantages of local carmakers abroad. Tariffs will remain the topic of conversation, especially for overseas expansion. Europe has imposed a 17% tariff on Chinese EV imports, which could make BYD’s cars less price-competitive in that region until it builds local factories. For now, BYD sells around 90% of its cars in China.

Financial Health Check

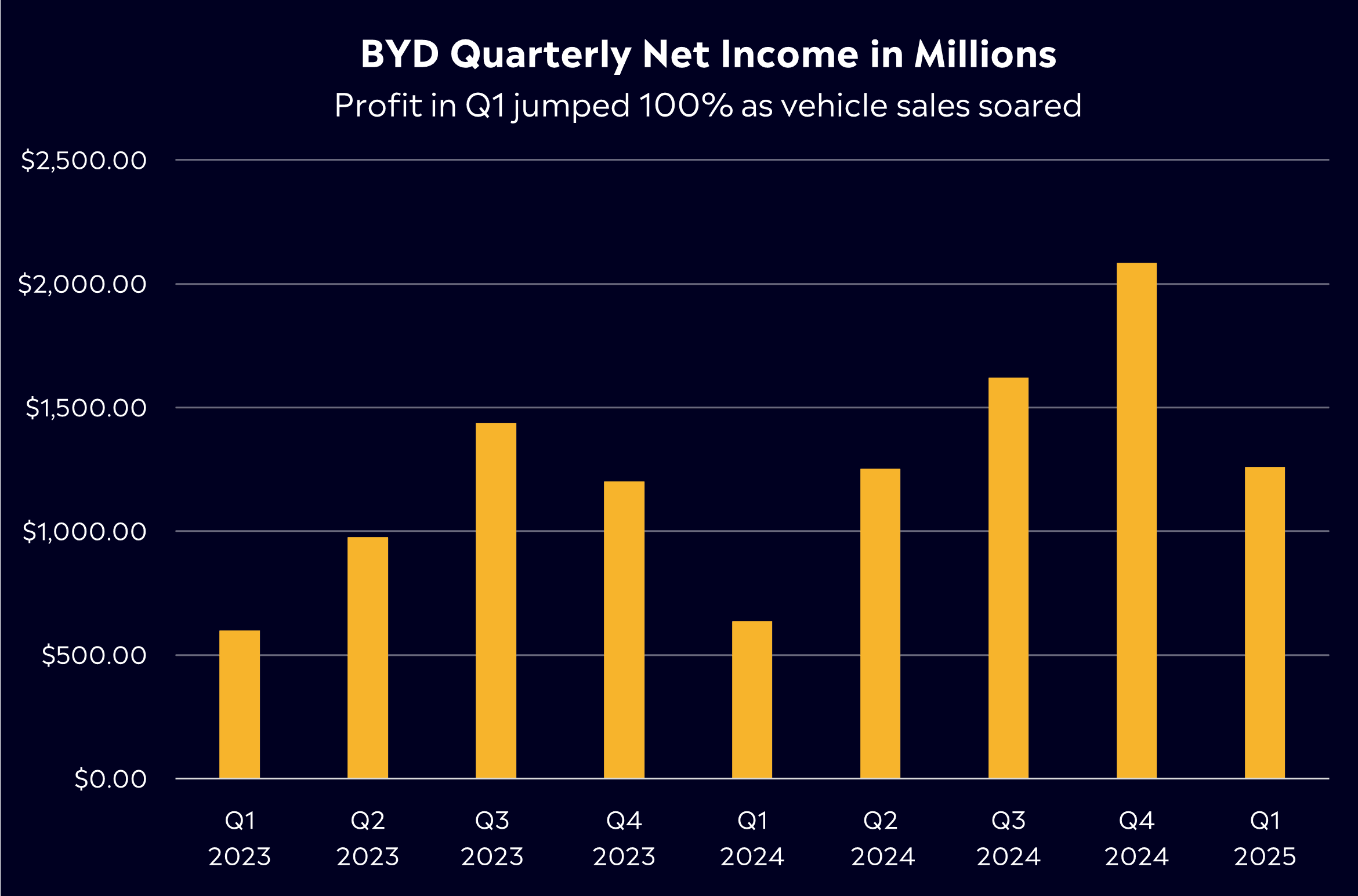

BYD handed down Q1 earnings in late April, with profit soaring during the quarter after they delivered just over one million units in the first quarter of 2025. Revenue rose 36% to USD$23 billion and BYD’s net income came in at USD$1.3 billion (+100% YoY), well ahead of Tesla’s USD$409 million (-71% YoY) for the same period. The first quarter is often a slower quarter for BYD, with the period containing the long Lunar New Year holiday, but these numbers put them on track for a big year ahead.

Gross margins came in at around 20%, a bit lower than a year earlier, indicating some pressure from recent price cuts. However, it was an improvement from Q4 margins, showing that BYD’s cost structure is stabilising even as it aggressively grows volume. Its economy of scale, producing over a million vehicles in the quarter alongside solid cost controls such as making their own batteries, is helping cushion margins despite lowering prices.

In another positive for growth, the automaker raised about USD $5.6 billion in fresh capital via a share sale in early 2025 to fund research and development and its overseas expansion. This boosts BYD’s cash reserves for building new factories (the company is launching plants in Asia and Europe) and developing next-gen technology, particularly around fast-charging and smart-driving capabilities.

Debt levels remain manageable and are backed by steady operating cash flow from car sales. One financial risk to watch is the intense competition driving a price war – if EV makers keep undercutting each other, profit margins could erode industry-wide. BYD has so far balanced growth and profitability well, but further large price cuts (either by Tesla globally or by local competitors in China) could test its margin resilience.

Buy, Hold or Sell?

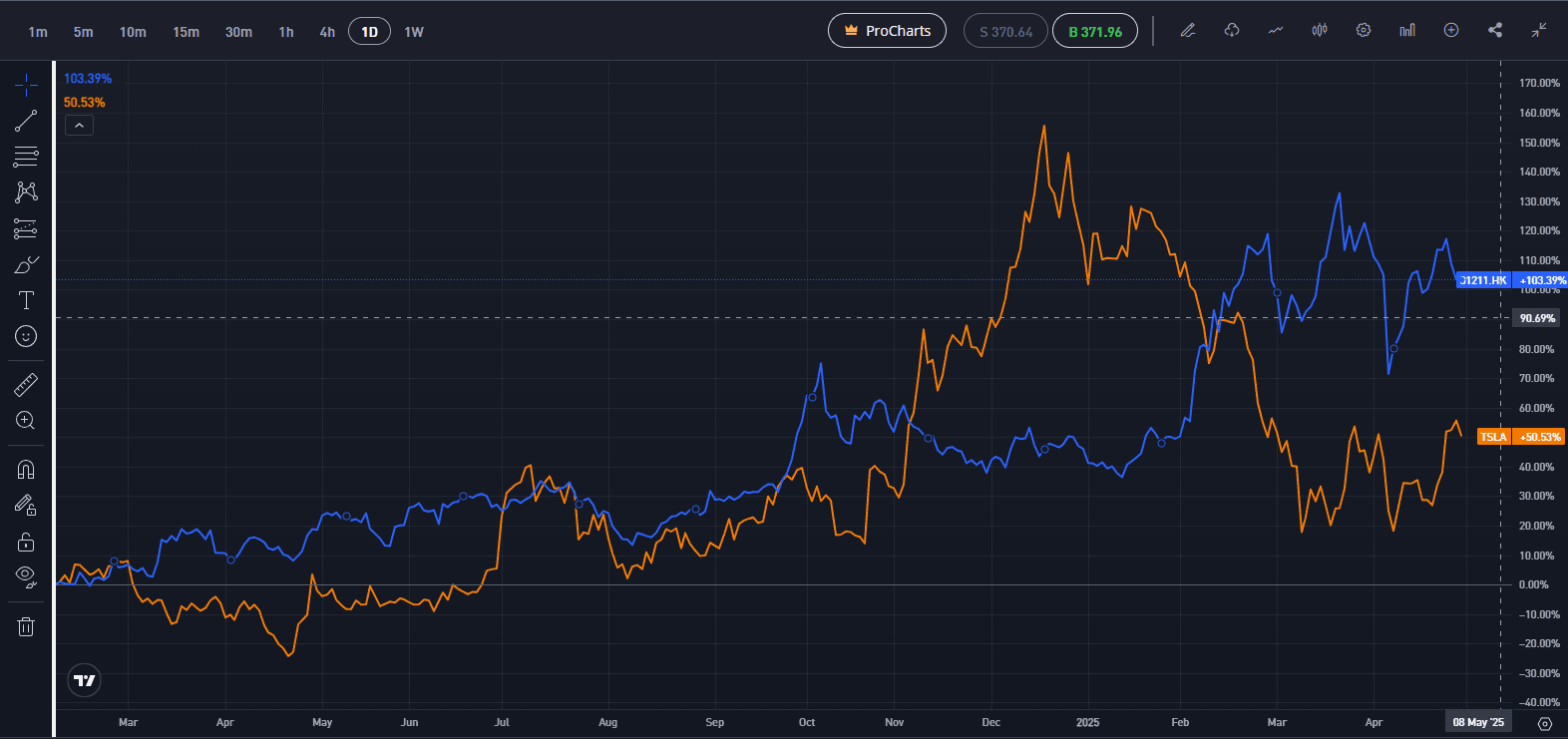

BYD shares have enjoyed a stellar run, underpinned by its rapid growth and market dominance in China. Recent global market volatility has seen shares come off about 13% from record highs reached back in early March at HKD$424.20, but in the last 12 months, BYD is up over 70% and more than 650% in the last 5 years.

Shares are trading at just 19x forward P/E. That valuation looks attractive, especially when compared to Tesla at 134x forward earnings. It still trades at a premium to legacy automotive manufacturers, such as Mercedes-Benz and GM, which are trading at single digits. But these stocks have not driven anywhere near the same growth in the last decade. BYD is the largest EV player in the world. It’s a quality business with a long growth runway, and the valuation is not expensive relative to the growth potential, with a focus on overseas expansion.

According to Bloomberg’s Analyst Recommendations, BYD has 37 buy ratings, 3 holds, and 1 sell, with an average price target of HKD$469.93, signalling a potential upside of 27% from its last closing price.

BYD has taken the crown of market leader in the EV transition, but as with any market leader, sustaining growth will be the key challenge. Competition remains rife, tariffs on Chinese vehicles from the US to Europe will remain a hurdle, and diminishing government subsidies could mark a potential slowdown in sales.

However, BYD offers a compelling growth story right now as it outpaces a slowing Tesla. If, as an investor, you can tolerate the bumps on the road, this business with its solid financial performance, aggressive expansion strategy, and leadership in battery technology, provides a robust foundation for long-term success.

Explore BYD Co (01211.HK)

*Data Accurate as of 01/05/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.