After a dream run through the pandemic recovery, shares in LVMH have been brought back to earth, falling more than 50% from their peak. With ten straight quarters of flat revenue and slowing demand from key markets like China and the US, investors are questioning whether the world’s largest luxury group has lost its shine. But with a far more attractive valuation and a brand portfolio most rivals can only dream of, could this be a rare chance to buy quality for less? Let’s find out.

- After a 50% drop following flat growth and weak sales, the world’s biggest luxury group looks like it’s on sale. However, long-term investors may see value beneath the surface.

- In fashion, nothing stays on top forever, even LVMH. The luxury giant has faced a reality check with Gen Z favouring trendier labels, putting sales under pressure.

- According to Bloomberg’s Analyst Recommendations, LVMH has 19 buy ratings, 15 holds, and 1 sell. The average analyst price target is EUR€581.50, signalling a 30% upside from current levels.

Explore LVMH

The Basics

LVMH or Louis Vuitton Moët Hennessy, is the world’s largest luxury group, and arguably the gold standard in global brand building. Under the leadership of Bernard Arnault, now the world’s 9th richest man, since 1989, the business has grown into a powerhouse of 75 brands across fashion, jewellery, cosmetics, watches, and spirits. These aren’t just labels, they’re some of the most iconic names in the world, think Louis Vuitton, Christian Dior, Moët & Chandon, Tag Heuer, Tiffany & Co., Fendi, Bulgari, and more.

But even empires stumble. After surging to an all-time high of over €900 in 2023, LVMH’s share price has halved, now trading near €450. Much of that is due to macroeconomic headwinds, slower global growth, increased competition and a cooling of the post-COVID luxury boom. After two years of double-digit growth post-COVID, sales have flattened out, and we’ve seen softness continue into 2025, driven by contracting Chinese demand and growing global tariff risks that could weigh on luxury’s recovery.

In the last year, shares have fallen 38% and 50% from their peak, but over the long run, LVMH has rewarded patient investors handsomely. In the last 10 years, shares have rallied more than 250%, including dividends, but this is arguably one of the biggest tests for LVMH in recent history. Interestingly, the Arnault family has been buying heavily on the dip, buying over €1 billion worth of stock this year, reinforcing their confidence in the long-term story.

Fun Fact: LVMH is the only company that makes champagne, handbags, watches and yachts. From Dom Pérignon to Dior, Bulgari to billionaires’ boats, it’s luxury at every level.

Competitor Diagnosis

Luxury is a competitive space, but few brands can match the scale and diversification of LVMH. But amid a sharp slowdown across the €364 billion personal luxury goods industry, rivals like Hermès, maker of the iconic Birkin bag, have shown greater resilience. Its relative strength has brought LVMH’s weaknesses into sharper focus. Richemont, the owner of Cartier and Van Cleef & Arpels, has also weathered the storm better. This is supported by strong demand for high-end jewellery, a segment that’s held up relatively well even as spending in fashion and accessories weakens

What makes LVMH unique is the sheer breadth of its portfolio, spanning fashion, cosmetics, jewellery, wines and spirits, retail, and even hospitality. In theory, this diversification should provide resilience by spreading risk across categories. But in this environment, it may be a double-edged sword. With softness hitting almost every corner of the market, from fashion and Cognac to skincare and champagne, the group’s size is now exposing it to a broader set of challenges. Demand in China has weakened, growth in the US has stalled, and even European shoppers are spending more cautiously.

Ultimately, with luxury fashion or anything luxury, it comes down to what is hot and what is not, which is a key consideration for investors. According to the latest Lyst Fashion Index for Q1 2025, Prada and its sister brand Miu Miu continue to dominate the rankings, taking the top two spots. Miu Miu’s continued appeal, particularly among Gen Z and fashion-forward consumers, has helped keep the Prada Group in the spotlight.

Coach, under the Tapestry umbrella, also remains in the top 10, reflecting the brand’s ability to tap into accessible luxury and social media relevance. Meanwhile, none of LVMH’s flagship brands like Louis Vuitton and Dior appear in the top 20, a sign that younger consumers may be shifting attention elsewhere, at least for now. Competitors such as Loewe, Miu Miu, and Saint Laurent are capturing more attention in the current fashion landscape. That’s not to say LVMH is out of fashion, but it does highlight how competitive and trend-sensitive the market has become. Consumer preferences are fickle, particularly when it comes to fashion, so staying dominant is not easy.

Financial Health Check

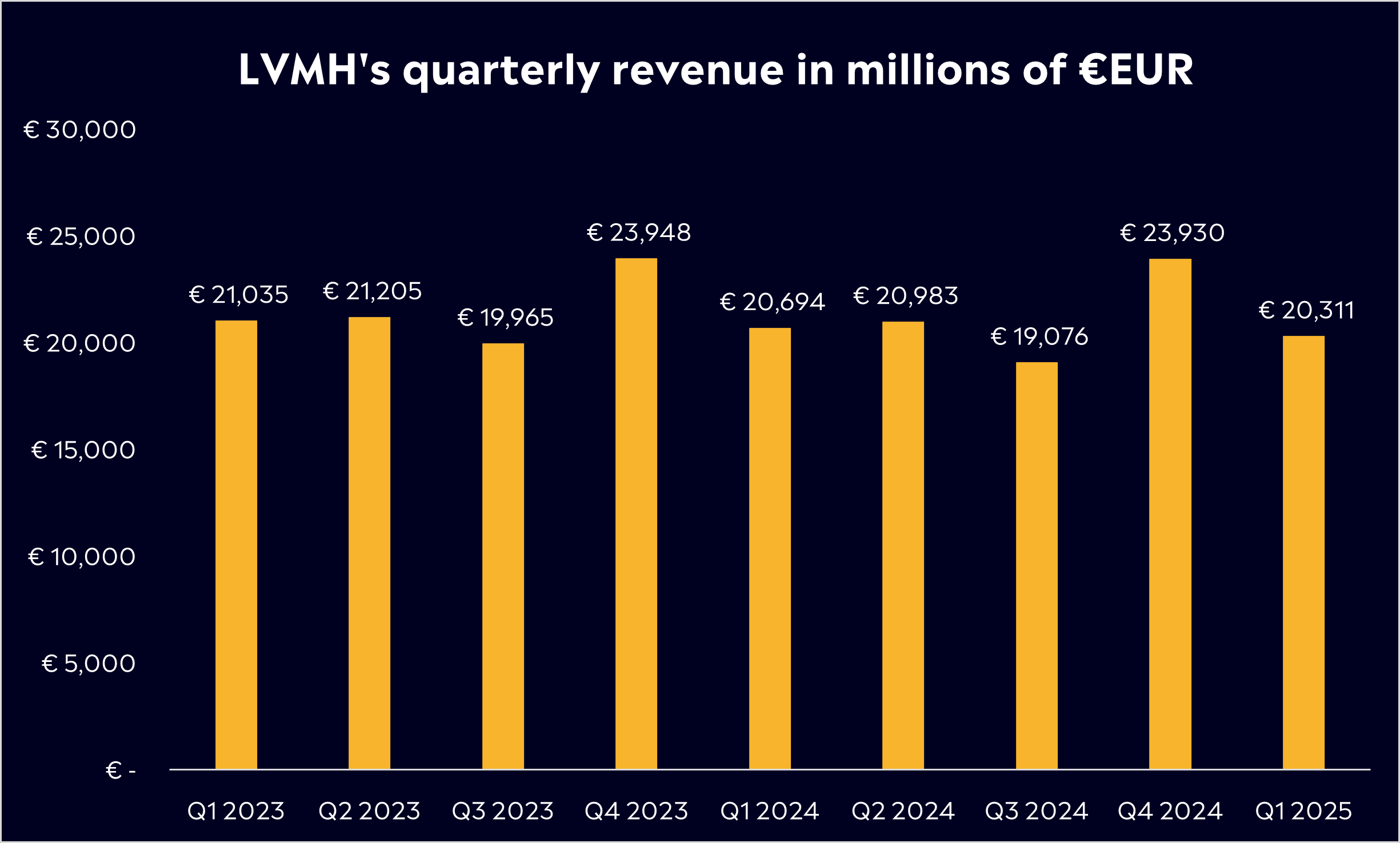

After an exceptional run during the pandemic recovery, LVMH’s financial performance has cooled. Since early 2023, revenue has remained virtually flat at around €21 billion for ten consecutive quarters, with little sign of acceleration. That’s spooked some investors, especially with second-quarter results approaching, that is expected to show a revenue decline across every single revenue segment of the business.

As mentioned above, the causes of this are broad and largely cyclical: fading post-COVID demand, weak consumer sentiment in key markets, and the effects of inflation. But, at the brand level, Dior and Moët Hennessy are two key brands dragging on group performance. Together, they account for around 17% of EBIT (Dior 14%, Hennessy 3%). Dior lost momentum due to overpricing and brand missteps, and Moët Hennessy is struggling with falling Cognac sales, job cuts, and tariff threats.

But beneath the surface, LVMH remains in strong shape. Its balance sheet is healthy, free cash flow is robust, and its brands are still the most valuable in the industry. Its strong financial position gives it the flexibility to continue investing, pursue strategic acquisitions, or return capital via buybacks. LVMH currently pays a dividend yield of close to 3%.

Valuation-wise, the reset has been dramatic. At its 2021 peak, LVMH traded at 40 times forward earnings, a level that was hard to justify even for the world’s most luxurious portfolio. Today, that multiple is closer to 19 times, below its long-term average and the broader luxury sector. That’s a fundamentally attractive valuation that will stand out to most investors, especially for a business so broad and successful as LVMH.

Buy, Hold or Sell?

There’s no doubt LVMH is facing short-term challenges; it’s a business grappling with a tough macro backdrop and brands that are arguably falling short among consumers right now. If you believe that global demand for luxury will rebound, especially from the Chinese consumer, then this could be a compelling entry point, especially from a technical perspective that my colleague Sam North pointed to here.

Although the business is under pressure, don’t expect a dramatic shift away from its tried-and-tested strategy. LVMH is likely to focus on streamlining operations, protecting profit margins, and maintaining market leadership. In the short term, positive trade agreements between the United States and Europe or China could also provide some relief for LVMH. Long-term, LVMH’s strength lies in its resilience and optionality. Whether it’s through a rebound in consumer demand, asset sales, or strategic repositioning, CEO Bernard Arnault has a track record of adapting and winning. Succession uncertainty is another factor weighing on sentiment. While Bernard Arnault extended the CEO age cap to 85, the lack of a clear successor has raised questions about long-term leadership, particularly as LVMH navigates one of its toughest periods in decades.

According to Bloomberg’s Analyst Recommendations, LVMH has 19 buy ratings, 15 holds, and 1 sell. The average analyst price target is EUR€581.50, signalling a 30% upside from current levels.

The investor takeaway?

In a market that’s quick to fall out of love, LVMH might just be the luxury comeback story worth watching. Some investors may prefer to wait for clearer catalysts before jumping in. But for those with a long-term horizon, this may be a rare chance to own a best-in-class business at a much more reasonable price.

Explore LVMH

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.