What do electric vehicles, wind turbines, smartphones and defence systems all have in common? They rely on a small group of minerals known as rare earths. And right now, one Aussie company is helping the world’s biggest economies secure them. Lynas Rare Earths shares are up 40% in the past year, thanks to rising trade tensions and its rare position as a non-China supplier. But with expansion risks, trade talks and price volatility in play, is there still upside ahead for this miner? Let’s find out.

- Lynas is the world’s ONLY rare earth producer with full processing capability outside of China, giving it a key advantage.

- With new plants in Malaysia and Texas, Lynas is pushing to become a truly global critical minerals supplier, despite rare earth prices falling 60% from their highs.

- According to Bloomberg’s Analyst Recommendations, Lynas Rare Earths has 9 buy ratings, 4 holds, and 3 sells.

Explore Lynas Rare Earths

The Basics

As this section is headlined “The Basics,” let’s start by explaining rare earths. Despite their name, they are not particularly rare; they’re relatively abundant in the Earth’s crust, but they are absolutely essential. Rare earth elements are a group of 17 minerals, and Lynas Rare Earths, listed on the ASX, is one of the world’s largest producers of these materials outside China. What’s rare is the expertise, investment and environmental clearance required to process them at scale. That’s what gives Lynas its edge.

The company mines and processes rare earths, which are used in the permanent magnets found in electric vehicles, wind turbines, smartphones, and defence systems. They are also critical to the clean energy transition.

Its core operations centre on the Mt Weld mine in Western Australia, one of the highest-grade rare earths deposits in the world. From there, Lynas processes concentrate at its facility in Malaysia, where it refines the elements into separated oxides ready for export.

So, why is Lynas grabbing the headlines and why does it matter? Well, China controls around 85 to 90% of the world’s rare earth processing, and they’ve recently slapped export restrictions on these rare earths. That triggered alarm bells for automakers and tech firms. Lynas recently commissioned a new processing facility in Western Australia and upgraded its Malaysian plant, enabling it to separate valuable heavy rare earths like dysprosium and terbium. This made Lynas the only fully integrated producer of rare earths outside of China, meaning it plays a key role in providing Western countries with secure supply chains.

China’s move to restrict exports may end up backfiring. Instead of consolidating control, it’s prompting countries like the US, Japan and those in Europe to accelerate local rare earth processing. Lynas, already operating and expanding with government support, is well placed to benefit from this global realignment.

Fun Fact: Rare earth magnetic motors convert the electricity that is stored in a battery into motion. This could be the motion to make the four wheels of an electric vehicle turn. Rare earths are also used to turn motion into electricity, such as in a wind turbine.

Competitor Diagnosis

China’s dominance in rare earths is backed by large state-owned enterprises like China Northern Rare Earth Group. They control the bulk of mining, processing and downstream magnet production. Their scale and government support make them tough to match on cost.

Lynas’s biggest Western competitor is MP Materials, which operates the Mountain Pass mine in California. MP is growing fast and has US government support, but still sends some product to China for final processing. That makes Lynas unique in its ability to supply fully separated rare earth oxides outside China.

Other emerging players include Iluka Resources in Australia are building capacity, but none currently match Lynas in output or integration.

The company is also building a new processing facility in Kalgoorlie and a US-based separation plant in Texas, supported by the US Department of Defense. These developments will reduce reliance on Malaysia, expand Lynas’s processing capabilities and deepen strategic ties with key governments.

So, essentially, one of Lynas’ biggest advantages is friendships. Yes, Western nations, especially the US and its allies, are now funding and prioritising partnerships with non-Chinese suppliers. As nations shift away from fossil fuels and toward cleaner technologies, demand for rare earths is expected to rise sharply, and therefore, governments are providing incentives and funding to build rare earth processing outside China. Lynas’s established supply chain and operational experience put them right at the front of the queue to benefit from this structural shift.

Financial Health Check

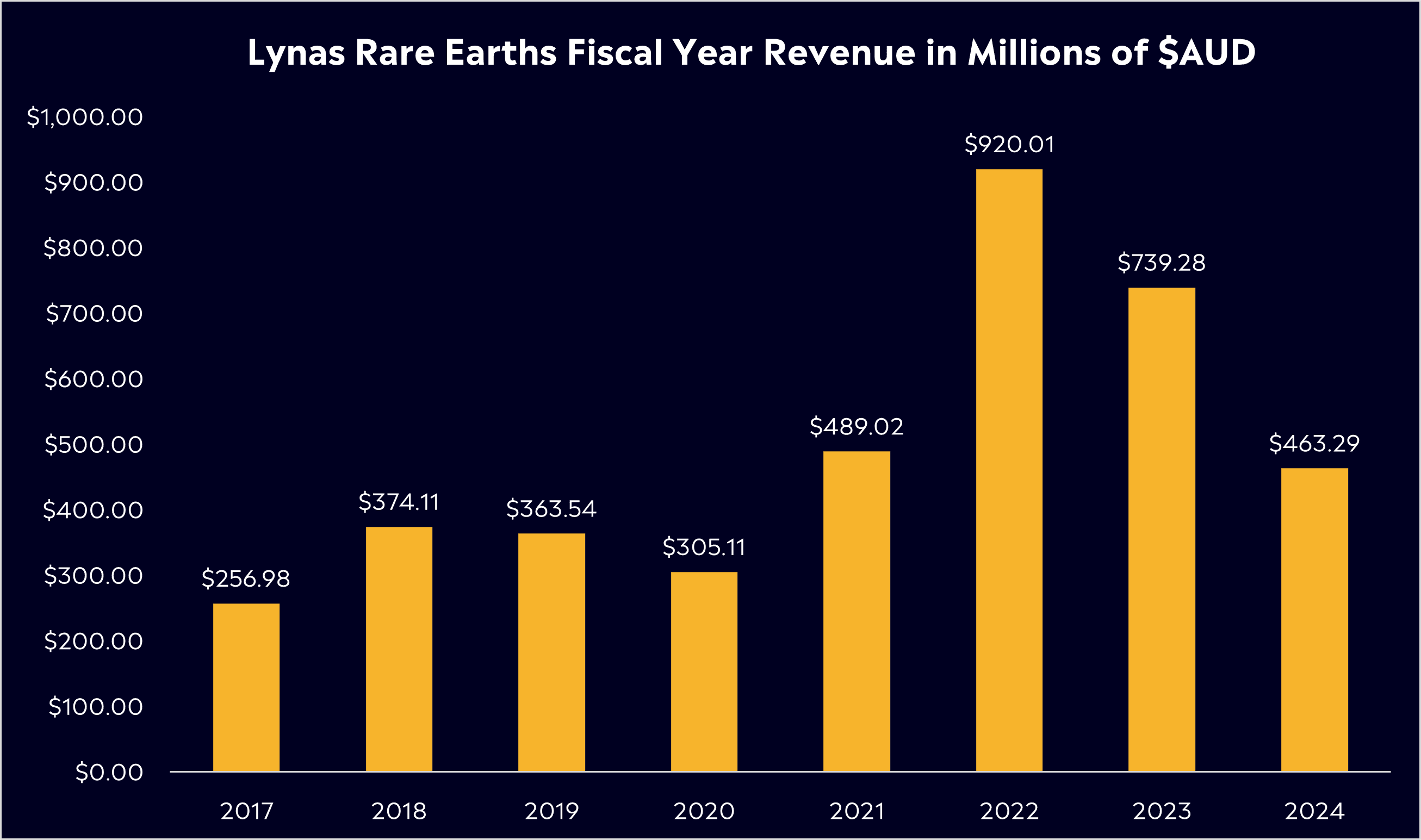

Although Lynas looks set to benefit from the move away from relying on China for rare earths, it is still vulnerable to commodity price fluctuations. Rare earth prices have tumbled since their highs back in 2022, down around 60%. This was in part due to weaker demand from China’s magnet supply chain (EVs and Renewable Energy) and elevated inventory levels.

In its most recent half-year update at the end of February, Lynas reported revenue of AUD$254.3 million, up 8% year-over-year, thanks to a 22% increase in production volume. However, net profit fell to AUD$5.9 million, a sharp decrease from AUD$39.5 million in the same period a year ago, with its cost of sales increasing 29%.

Capital expenditures increased as it continued to invest heavily in its operations in Kalgoorlie, Texas, and Malaysia. The Kalgoorlie facility will allow Lynas to process concentrate domestically, reducing dependence on Malaysia and improving supply chain control. Meanwhile, the Texas plant gives it a foothold in the US, one of the largest and most strategically important markets.

The company has said it expects demand from the energy transition and global defence sectors to support rare earth prices over the medium term. Global commodity analysts also believe there’s no large-scale alternative to these materials, particularly for EVs and clean energy. That puts Lynas in a strong long-term position, even if short-term pricing remains volatile.

Buy, Hold or Sell?

Lynas shares are up around 40% in the past 12 months, thanks to its unique position outside of China’s supply chain and investors looking to gain exposure.

Lynas has a compelling long-term growth story. Demand for rare earths is tied to structural global trends; electric vehicles, wind power, semiconductors and defence systems and with Western governments prioritising supply chain security, they may stand to benefit.

But the company’s 1H FY25 results remind us this isn’t a smooth ride, rare earth prices remain volatile and lower pricing hit revenue and profits hard. The company also faces execution risk on its expansion projects. Regulatory challenges in Malaysia, cost blowouts and delays in Kalgoorlie or Texas could affect margins and investor confidence. We’re also seeing trade negotiations progress between the US and China, with rare earths set to be a big part of that deal. If the US and China can come to a key agreement that includes rare earths, the initial attraction for investors to Lynas may be limited in the short term.

Given it’s 40% rally, some of the upside may be priced in, if rare earth prices firm up further, or if the US strengthens support for domestic processing, even despite a trade deal, Lynas could see another leg higher.

According to Bloomberg’s Analyst Recommendations, Lynas Rare Earths has 9 buy ratings, 4 holds, and 3 sells. The average analyst price target is AUD$9.18, signalling a -6% downside from current levels.

The investor takeaway?

Lynas still has plenty going for it. It remains the only large-scale, non-China producer of rare earths with full processing capability. Its cash position is strong, and it’s backed by long-term policy tailwinds, particularly from the US and its allies, who are investing in rare earth supply security.

Explore Lynas Rare Earths

*Data Accurate as of 13/06/2025

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.