Meta Platforms Inc META

691.70$-14.71(-2.08%)(1D)

• Preise verzögert um NASDAQ • in USD

Investieren Sie jetzt in Meta Platforms Inc

Erstellen Sie ein eToro-Konto, um META-Aktien auf einer sicheren, benutzerfreundlichen Multi-Asset-Tradingplattform zu kaufen.

Meta Platforms Inc META

Trend Aktien

Sehen Sie sich die Aktien mit den größten täglichen Volumenspitzen im Vergleich zu ihrem 3-Monats-Durchschnitt an.

Meta Platforms Inc-Nachrichten

Finanz Nachrichten • 02.02.26 • 19:50

Meta und Alphabet müssen sich vor Gericht verantworten, Snap kauft sich frei und Apple plagen Vorwürfe über Technologiediebstahl

Wallstreet:Online • 02.02.26 • 05:56

SAP, Meta & Co.: Abstürze und Überflieger

Wallstreet:Online • 01.02.26 • 07:39

Meta Platforms nach der Zahlenrallye: Das sind die nächsten Kursziele für die AktieMETA Aktienkurs

6.15

Letzter Monat

1D

1W

1M

6M

1Y

3Y

MAX

Anmelden für vollständige Charts, unterstützt von

* Vergangene Wertentwicklung ist kein Indikator für zukünftige Ergebnisse.

Die Meta Platforms Inc Aktie ist in dieser Woche gestiegen.

i

Ein ’steigender’ Preis weist darauf hin, dass der Wochenpreis um mehr als 0,5% gestiegen ist.

Ein ’fallender’ Preis weist darauf hin, dass der Wochenpreis um mehr als 0,5% gefallen ist.

Ein ’stabiler’ Preis weist darauf hin, dass die wöchentliche Preisänderung zwischen -0,5% und 0,5% liegt.

Ein ’fallender’ Preis weist darauf hin, dass der Wochenpreis um mehr als 0,5% gefallen ist.

Ein ’stabiler’ Preis weist darauf hin, dass die wöchentliche Preisänderung zwischen -0,5% und 0,5% liegt.

Der Aktienkurs von Meta Platforms Inc beträgt heute 691.70$ und weist eine Veränderung von -2.08% in den vergangenen 24 Stunden sowie 2.40% in der letzten Woche auf. Die Marktkapitalisierung von META liegt derzeit bei 1.79T$, bei einem durchschnittlichen Handelsvolumen von 18.24M in den letzten drei Monaten. Die Aktie hat ein Kurs-Gewinn-Verhältnis (KGV) von 30.07 und eine Dividendenrendite von 0%. Das Beta der Aktie beträgt 1.53.

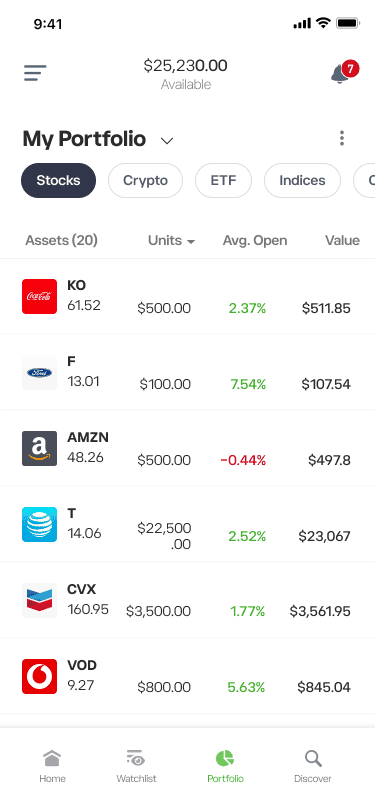

Wichtige Kennzahlen zu META

Marktkapitalisierung

i

Der Gesamtwert aller Aktien eines Unternehmens, berechnet durch Multiplikation des Aktienkurses mit der Gesamtzahl der ausgegebenen Aktien.

1.79T$

Tages-Spanne

i

Zeigt die höchsten und niedrigsten Kurse des Tages.

685.39$ - 713.54$

52W-Spanne

i

Zeigt die höchsten und niedrigsten Kurse des letzten Jahres.

451.63$ - 794.83$

Durchschnittliches Volumen (3M)

i

Die durchschnittliche Anzahl der Aktien, die in den letzten drei Monaten pro Tag gehandelt wurden.

18.24M

Kurs-Gewinn-Verhältnis

i

Das Ergebnis des Aktienkurses dieses Vermögenswerts geteilt durch seinen Ertrag pro Aktie.

30.07

Umsatz

i

Die Gesamteinnahmen, die im vergangenen Jahr mit den Waren und Dienstleistungen dieses Unternehmens erzielt wurden.

200.97B$

Dividende (Ertrag)

i

Wie viel Dividende ein Unternehmen jedes Jahr im Verhältnis zu seinem Aktienkurs ausschüttet.

2.1$ (0%)

Vorheriger Schlusskurs

i

Der Endpreis dieses Vermögenswerts am Ende des letzten Handelstages.

691.7$

Gewinn je Aktie

i

Der Gesamtgewinn eines Unternehmens geteilt durch die Anzahl der ausgegebenen Aktien.

23.49$

Beta

i

Eine Kennzahl, die die Kursbewegungen einer Aktie mit dem Gesamtmarkt vergleicht

1.53

Wie kann ich Meta Platforms Inc-Aktien kaufen?

So kaufen Sie Meta Platforms Inc:

01

Erstellen Sie ein eToro Konto:

Eröffnen Sie ein eToro Konto und verifizieren Sie Ihre Identität.02

Zahlen Sie Geld ein:

Zahlen Sie mit Ihrer bevorzugten Zahlungsmethode Geld auf Ihr eToro Konto ein.03

Suchen und kaufen:

Durchsuchen Sie die Seite Meta Platforms Inc (META) und erteilen Sie einen Auftrag zum Kauf von Meta Platforms Inc.Suchen Sie nach weiteren Informationen? Sehen Sie sich unseren Leitfaden auf der Akademie an.

Was ist Meta Platforms Inc?

Facebook Inc. wurde 2004 gegründet und hat seinen Hauptsitz in Menlo Park, Kalifornien. Das Unternehmen hatte am 30. Juni 2018 30.275 Mitarbeiter und betreibt ein großes soziales Netzwerk mit – nach dem Stand vom Juni 2018 - täglich durchschnittlich 1,47 Milliarden aktiven Nutzern. Zu Facebook gehören mehrere Unternehmen, auch Instagram. Die Ergebnisse des zweiten Quartals des Unternehmens für das Geschäftsjahr 2018 enthielten eine Umsatzsteigerung um 42% auf 13.231 Mio. USD. Verfolgen und traden Sie FB, um weitere Nachrichten und Updates zu erhalten.

CEO

Mark Elliot Zuckerberg, MD

Mitarbeiter

78.9K

Gegründet

2004

HQ

Menlo Park, California, US

Top Guides

Unsere Top-Auswahl der relevantesten Leitfäden der eToro-Akademie

Wie man am Aktienmarkt investiert

Mehr erfahrenEntdecken Sie mit unserem Einsteigerleitfaden, wie Sie in den Aktienmarkt investieren. Erfahren Sie, wie die Märkte und das Trading funktionieren.

KI-Aktien mit Wachstumspotenzial 2026

Mehr erfahrenBereiten Sie sich auf 2026 vor: Entdecken Sie KI-Aktien wie Nvidia, SAP, Alphabet, ASML, Amazon und Mikron – mit Experten-Analysen von eToro.

Zukunftspotenzial von KI-Aktien 2025

Mehr erfahrenErfahren Sie mehr über die Top-KI-Aktien 2025 und entdecken Sie fundierte Einblicke in zukunftsweisende Technologien und deren Potenzial für Ihr Portfolio.

Investieren Sie jetzt in Meta Platforms Inc

Erstellen Sie ein eToro-Konto, um META-Aktien auf einer sicheren, benutzerfreundlichen Multi-Asset-Tradingplattform zu kaufen.

FAQ

Aktueller META Aktienkurs liegt bei 691.70$.

Das durchschnittliche Kursziel für Meta Platforms Inc liegt bei 691.70$. Registrieren Sie sich bei eToro, um detaillierte Analystenprognosen und Kursziele zu erhalten.

Analysten erstellen Prognosen für Meta Platforms Inc basierend auf Markttrends, Finanzberichten und erwartetem Wachstum. Hier finden Sie die aktuellen Prognosen für die weitere Kursentwicklung.

Die Marktkapitalisierung von Meta Platforms Inc beträgt 1.79T$ USD

Tops und Flops

Die größten Gewinner und Verlierer von heute