Inflation was about in-line with economists’ expectations, yet silver and gold hit new highs. The Daily Breakdown looks at Alibaba’s breakout.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Market volatility is picking up as sectors seesaw and asset prices swing. US stocks staged a late-day rally on Tuesday that helped pare earlier losses, but it wasn’t enough to prevent the Volatility Index — the VIX — from rising about 10% so far this week. Meanwhile, silver and gold hit new record highs, while Bitcoin gained 4.6% and Ethereum climbed 7.5%.

Inflation Update

Yesterday’s inflation report was roughly in line with expectations: headline CPI rose 2.7% year over year, while core CPI — which excludes more volatile items such as food and energy — increased 2.6%. Inflation is easing, but not quickly. Still, continued progress would be welcome news for the Fed and investors, as inflation has been a key constraint on interest-rate cuts.

Banks Sink

JPMorgan reported fourth-quarter results yesterday, beating earnings and revenue expectations. However, shares fell 4.2% after the bank guided to higher expenses this year and cited a decline in investment-banking fees. The drop weighed on the broader sector, with financials falling 1.9% — the worst-performing S&P 500 sector on the day.

Next up: Bank of America, Citigroup, and Wells Fargo.

Want to receive these insights straight to your inbox?

The Setup — Alibaba

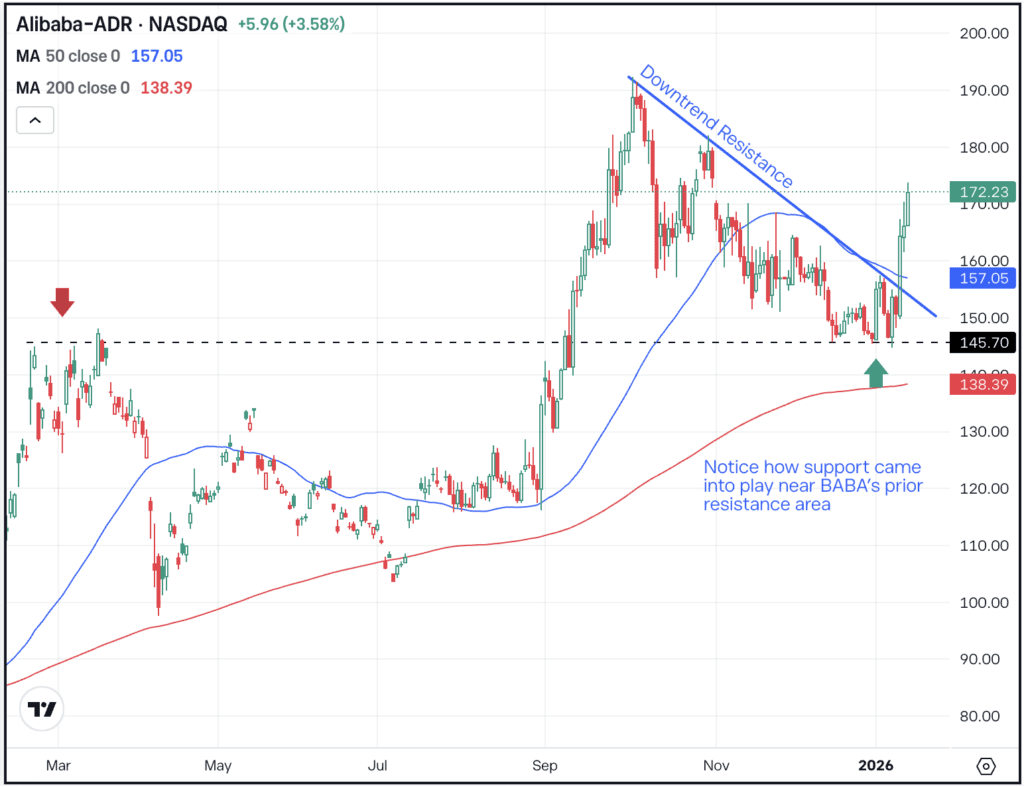

Alibaba had an impressive 2025, climbing more than 70%. However, it ended the year on a bit of a skid, falling almost 24% from its high in October. Now though, shares are trying to wake up.

Shares have been pulling back for several months now, but found support around $145 — roughly where BABA hit resistance in Q1. With Alibaba’s rally this week, it’s been enough to launch the stock back over the 50-day moving average and downtrend resistance. Bulls want to see shares stay above these measures, potentially putting more upside in play. Bears want to see this rally fade, potentially opening the door back down to recent $145 support and the 200-day moving average.

Options

For some investors, options could be one alternative to speculate on BABA. Remember, the risk for options buyers is tied to the premium paid for the option — and losing the premium is the full risk.

Bulls can utilize calls or call spreads to speculate on further upside, while bears can use puts or put spreads to speculate on the gains fizzling out and BABA rolling over.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Salesforce came under pressure yesterday, falling more than 7% on the day. However, it wasn’t the only stock under pressure. Snowflake, Adobe, ServiceNow and others also fell notably on the day on renewed worries that AI could disrupt these businesses, even as many firms continue to deliver results above analysts’ expectations. Dig into the fundamentals for CRM.

SLV

Silver continues to surge this week, with the SLV ETF hitting new record highs on Monday and Tuesday. Now, shares are up more than 5% in pre-market. That’s as spot silver is now trading above $90 an ounce — up from less than $30 an ounce one year ago. For its part, the GLD ETF is up about 1% in morning trade.

Shares of Moderna surged on Tuesday, climbing 17% and hitting its highest level since late January 2025 — the stock’s 52-week high is currently at $45.40. The rally came after CEO Stéphane Bancel said the company expects 2025 sales of about $1.9 billion, slightly above the midpoint of its initial guidance range. While the stock had fallen out of favor, it has now rallied in four of the last five months and is up more than 66% in that span. Check out the chart for MRNA.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.