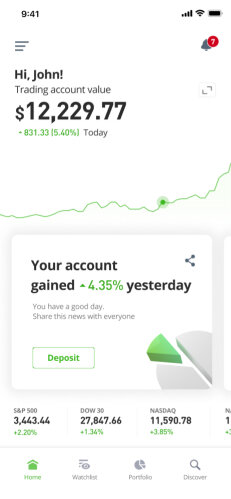

Park Hotels & Resorts Inc PK

$10.930.03(0.28%)(1D)

• Delayed prices by NASDAQ • in USD

Analyst Forecast

i

This 12-month forecast is based on a composite of analyst projections. Based on analysts with a rating of 4+ stars. This is not a prediction made by eToro nor is it investment advice.

Consensus

Moderate Buy

Price Target

12.33

Based on analysts who covered PK

Sign up for more analyst insights

Invest in Park Hotels & Resorts Inc

Today

Today

Create an eToro account to buy PK stock on a secure, user-friendly, multi-asset trading platform.

Park Hotels & Resorts Inc PK

Trending stocks

See stocks with the biggest daily volume spikes vs. their 3-month average.

Park Hotels & Resorts Inc News

GuruFocus • 17.01.26 • 00:05

Insider Buying: Christie Kelly Acquires Shares in Park Hotels & Resorts Inc (PK)PK Stock Price Chart

0.55

Past Month

1D

1W

1M

6M

1Y

3Y

MAX

Sign up for full charts powered by

*Past performance is not an indication of future results

The Park Hotels & Resorts Inc share price is on the decline this week.

i

A ‘rising’ price indicates that the weekly price has increased by more than 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

The Park Hotels & Resorts Inc share price today is $10.93, reflecting a 0.28% change over the last 24 hours and -2.06% over the past week.

The current market capitalization of PK is $2.18B with an average volume in the last three months of 3.8M.

The stock has a P/E ratio of -145.54 and a dividend yield of 0.09%. With the stock’s beta sitting at 1.34

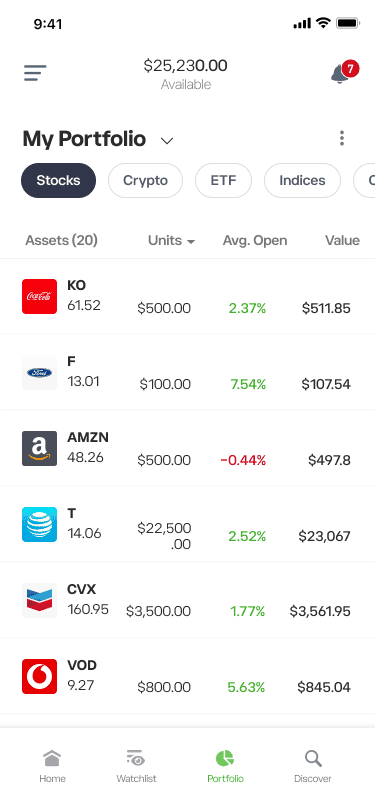

PK Key Metrics

Market Cap

i

Total value of all asset shares, calculated by multiplying the price by the total number of outstanding shares.

$2.18B

Day’s Range

i

Shows the high and low prices of the day.

$10.64 - $10.99

52W Range

i

Shows the high and low prices of the last year.

$8.6 - $16.2

Average Volume (3M)

i

The average number of shares traded per day over the last three months.

3.8M

Price-Earnings Ratio

i

The result of this asset’s share price divided by its earnings per share.

-145.54

Revenue

i

The total income generated by this company’s goods and services last year.

$2.54B

Dividend (Yield)

i

How much a company pays out in dividends each year relative to its stock price.

$1 (0.09%)

Prev Close

i

The final price of this asset at the end of the last trading day.

$10.93

EPS

i

A company’s total earnings divided by the number of shares it has issued.

$-0.08

Beta

i

A measure of whether any asset does, or doesn’t, experience price moves in line with the broader market.

1.34

How can I buy Park Hotels & Resorts Inc stocks?

To purchase Park Hotels & Resorts Inc:

01

Create an eToro account:

Sign up for an eToro account and verify your identity.02

Deposit funds:

Deposit funds into your eToro account using your preferred payment method.03

Search and purchase:

Search the Park Hotels & Resorts Inc (PK) page and place an order to buy Park Hotels & Resorts Inc.Looking for more information? Check out our guide on Academy.

What Is Park Hotels & Resorts Inc?

Park Hotels and Resorts (PK) is a real estate investment trust (REIT) established in 2017 as a sister company of the Hilton Worldwide hotel chain. Park Hotels is the second-largest publicly traded REIT in the hotel sector, with 67 properties on its books that are managed from the company’s Tysons, Virginia, headquarters. The portfolio includes Hilton hotels and those franchised from Marriott and Hyatt in the US. The REIT also completed the acquisition of the Chesapeake Lodging Trust for $1bn in 2019.

The effects of the coronavirus pandemic hit the PK share price hard. The stock had traded in the $26–$32 range consistently between January 2017 and the first quarter of 2020. However, COVID-19 saw the PK price chart tumble by 74.9% in the lows of March 2020. The adjusted EBITDA for the second quarter was $(122)m, and the net loss stood at $261m.

Park Hotels and Resorts has attempted to consolidate its position by selling several properties. That move increased earnings by some $688m in 2019–20. As of August 2020, the firm still operates some Hilton Worldwide, DoubleTree and Embassy Suites properties, including New York Hilton Midtown, Hilton Hawaiian Village and Hilton Orlando Lake Buena Vista.

Invest in this property trust and be sure to stay in the loop of all the latest Park Hotels and Resorts developments with the PK ticker.

The effects of the coronavirus pandemic hit the PK share price hard. The stock had traded in the $26–$32 range consistently between January 2017 and the first quarter of 2020. However, COVID-19 saw the PK price chart tumble by 74.9% in the lows of March 2020. The adjusted EBITDA for the second quarter was $(122)m, and the net loss stood at $261m.

Park Hotels and Resorts has attempted to consolidate its position by selling several properties. That move increased earnings by some $688m in 2019–20. As of August 2020, the firm still operates some Hilton Worldwide, DoubleTree and Embassy Suites properties, including New York Hilton Midtown, Hilton Hawaiian Village and Hilton Orlando Lake Buena Vista.

Invest in this property trust and be sure to stay in the loop of all the latest Park Hotels and Resorts developments with the PK ticker.

CEO

Thomas J. Baltimore, Jr., MBA

Employees

91

Founded

1919

HQ

Tysons, Virginia, US

Top Guides

Our top picks for the most relevant guides from the eToro Academy

Top Dividend Stocks for 2026

Read MoreGear up for 2026 with top dividend stocks. Explore the potential of J&J, Chevron, Coca Cola, Verizon, Caterpillar, McDonald’s with eToro’s expert analysts.

Stock Trading And Investing For Beginners

Read MoreLearn stock trading basics with our beginner's guide. Discover how to choose stocks, manage risks, and build your first investment portfolio.

AI Stocks Poised for Growth in 2026

Read MoreGear up for 2026 with AI stocks. Dive into the potential of Nvidia, Broadcom, CrowdStrike, Arista Networks, and Amphenol, through eToro’s expert analysis.

Invest in Park Hotels & Resorts Inc

Today

Today

Create an eToro account to buy PK stock on a secure, user-friendly, multi-asset trading platform.

FAQ

The current price of PK is $10.93.

The average price target for Park Hotels & Resorts Inc is $12.33. Sign up to eToro for detailed analyst forecasts and price targets.

Analysts offer forecasts for Park Hotels & Resorts Inc based on market trends, financial reports and projected growth. Check the latest forecast for future price movements.

The market capitalisation of Park Hotels & Resorts Inc is $2.18B

Based on 3 analysts offering recommendations for PK in the last 3 months, the overall consensus is Moderate Buy.

Daily Movers

Explore the biggest stocks movers on the market.