Investing in shares on the Australian Securities Exchange (ASX) can be a rewarding venture. Develop a greater understanding of Australian shares to expand or diversify your portfolio.

The ASX in Australia is similar to the New York Stock Exchange (NYSE) in the United States or the London Stock Exchange in England. While it features thousands of listed companies, it is perhaps best-known for the ASX 200 Index.

Getting to know the ASX

The Australian Securities Exchange, commonly known as the ASX, is one of the largest stock exchanges in the Asia-Pacific region. It provides a platform for investors to buy and sell shares in 2,000-plus publicly listed companies.

The ASX is known for its robust technological infrastructure, which facilitates efficient and seamless trading experiences for investors both locally and internationally. It also operates under a well-regulated framework that aims to protect investors and maintain market integrity.

The ASX is not just a marketplace for trading shares; it also offers a range of other financial products, including exchange-traded funds (ETFs) and

Tip: Understanding the ASX’s role and how it works is crucial to making informed investment decisions.

Key Features and Operations of the ASX

The ASX operates on a fully electronic trading system, which enhances the speed and efficiency of transactions. Trading hours are from 10:00am to 4:00pm, Sydney time, Monday to Friday, excluding public holidays.

A key feature of the ASX is its commitment to providing investors with timely and accurate information. Through its website, the ASX offers access to a wealth of data, including market announcements, share prices and historical performance. This market information is invaluable for investors looking to make informed decisions.

Tip: The ASX hosts a range of educational resources and webinars to help investors enhance their understanding of the market.

Types of Shares on the ASX

There are a variety of different ways to gain exposure to the more than 2,000 companies listed on the ASX. These include buying stocks in individual companies, trading CFDs of stocks and indices, and investing in ETFs. ch helps sort the businesses within each sector even further. These classifications allow investors to easily search and sort companies to see how they are not only performing compared to each other, but also how entire sectors are performing.

The 200 largest shares by

Tip: The ASX 200 is regularly updated, with companies entering/leaving it depending on the realtive size of their market capitalisation.

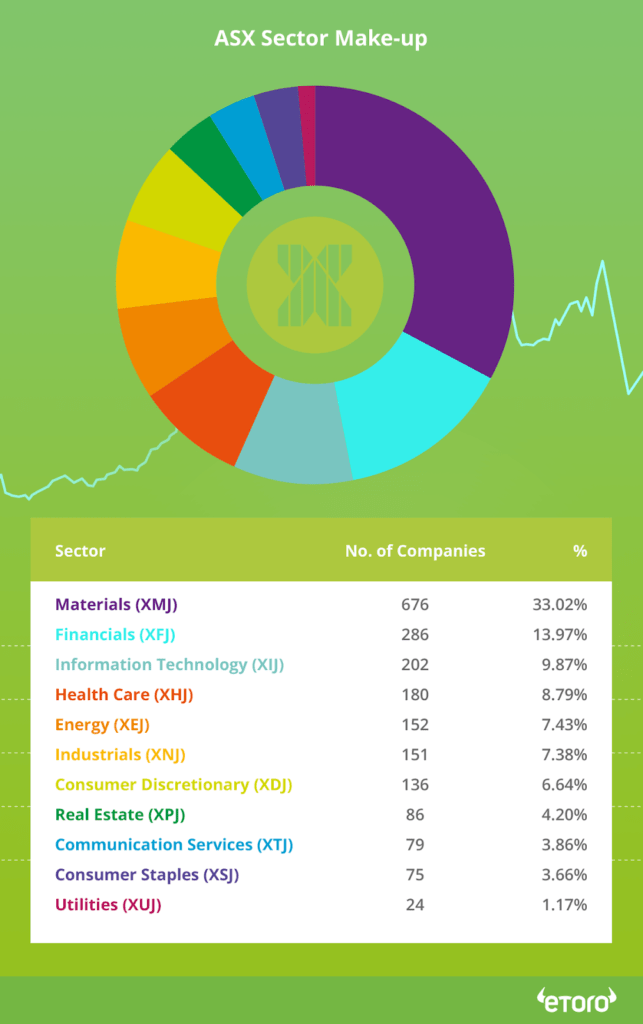

What Is the Sector Makeup of the ASX?

Companies that are traded on exchanges such as the ASX are grouped into sectors, often determined by the Global Industry Classification Standard (GICS). Some of these sectors are then broken down into industry groups, which helps sort the businesses within each sector even further.

These classifications allow investors to easily search and sort companies to see how they are performing compared to direct competitors, and also how entire sectors are performing in relation to each other.

The ASX features the top 2,000 companies from 11 different sectors and 24 industry groups.

| Sector | Industry Group |

|---|---|

| Materials | Companies that engage in the discovery, development or processing of raw materials, such as BHP Group (BHP.ASX). |

| Financials | Including insurance companies and banks such as Westpac (WBC.ASX). |

| Information Technology | Businesses involved in providing software and hardware services and equipment, including NEXTDC (NXT.ASX). |

| Health Care | Health care, pharmaceuticals, biotech and life sciences firms such as Neuren Pharmaceuticals (NEU.ASX). |

| Energy | Companies involved in the production and distribution of energy, including extraction and refining, such as Santos (STO.ASX). |

Steps to Invest in ASX shares

Once you’ve decided on what ASX shares to buy, the next step is setting up an account with a trusted broker. This account acts as an intermediary between you and the stock market, allowing you to buy and sell shares.

Setting up a brokerage account

When choosing a broker, consider factors such as fees, customer service and the range of investment options available. Many brokers, including eToro, offer online platforms that make it easy to manage your investments from the comfort of your home.

- Once you’ve selected a broker, you’ll need to complete an application process, which typically involves providing personal information and verifying your identity.

- After your account is set up, you can deposit funds and begin exploring the investment opportunities available on the ASX.

Tip: Price changes in the ASX 200 Index provide a high-level view of the health of the Australian stock market.

Final thoughts

The ASX forms an attractive proposition for all types of investors. The ASX 200 Index products offer a way for beginners to gain broad exposure to the prospects of the Australian economy, while individual stocks provide a chance for more experienced investors to invest in the niche sectors.

Regardless of your personal circumstances, there is still a need to bear in mind the five golden rules of investing, which can help you plan how to achieve your investment goals.

Learn more about Australian stocks by joining the eToro Academy.

FAQs

- How can I keep track of when the ASX is open and closed?

-

The eToro market hours page contains information on the trading hours of the ASX and any upcoming public holidays that will result in the exchange being closed. This page is regularly updated and is a good base for keeping track of upcoming news events.

- When was the Australian Stock Exchange first formed?

-

In 1987, Parliament passed legislation that combined the independent stock exchanges of six states to become the Australian Stock Exchange. However, the ASX as we know it was completed in 2006, when the Australian Stock Exchange and the Sydney Futures Exchange came together to form what we now know as the Australian Securities Exchange, which is located in Sydney.

- What criteria does a stock have to meet to be included in the ASX 200?

-

There are three main factors that go into being part of the ASX 200. The company has to be publicly traded on the Australia Stock Exchange. It has to meet liquidity requirements, which means that it has to have a certain number of shares available for trade by a wide number of potential investors. And finally, it must have a market capitalisation that ranks in the top 200 of the ASX.

- How frequent are the reviews that determine which stocks are members of the ASX 200 Index?

-

Audits that evaluate and reorganise the ASX 200 Index take place every three months. Decisions on which stocks will move in and out of the index are published on the ASX Online notice board.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.