The Daily Breakdown takes a closer look at the best — and the worst — performers of 2025, including crypto, stocks, sectors, and more!

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

2025 Wrapped

With inspiration from Spotify’s Wrapped campaign — where I was hit with a listening age of 72, my top podcast was Joe’s Happy Hour, and Creedence Clearwater Revival was my most-listened-to band — we want to do our own, albeit miniature, 2025 Wrapped for markets.

Volatility

While the CBOE Volatility Index — known as the VIX, or Wall Street’s “fear gauge” — went out with a whimper, it burst higher in 2025. The VIX had a closing high of 52.33 on April 8, while its average closing price over the course of the year was 18.92. However, the average VIX reading during Q3 and Q4 was just 16.85.

All that to say, the beginning of the year was volatile. The end? Not so much.

Sectors

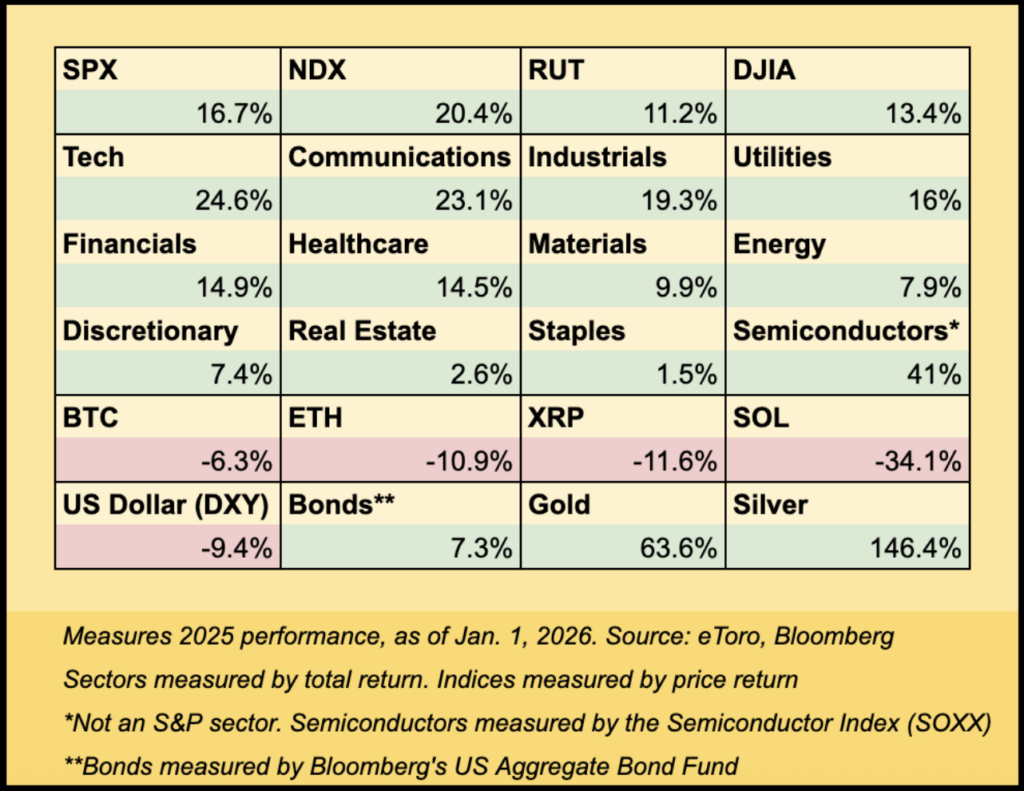

On a total-return basis, all 11 S&P 500 sectors finished higher on the year. Technology (+24.6%), Communication Services (dominated by Alphabet and Meta, +23.1%), and Industrials (+19.3%) were the three best-performing S&P sectors in 2025.

The three worst-performing sectors were Energy (+7.9%), Real Estate (+2.6%), and Consumer Staples (+1.5%). On a price-return basis only (that is, excluding dividends), Real Estate and Consumer Staples were down slightly on the year.

Earnings fun fact: Technology, Communication Services, and Health Care are expected to generate the strongest earnings growth for 2025 once Q4 results are reported over the next few months. Looking ahead to 2026, analysts expect Technology, Materials, and Industrials to lead next year’s earnings growth.

Individual Stocks

The AI and data center catalysts were a major driver for the three best-performing stocks in the S&P 500, which all came from one area of the market: semiconductors and computer hardware/storage. Western Digital climbed 282%, Micron jumped 239%, and Seagate Technology rallied 219%.

On the losing side, The Trade Desk and Fiserv each lost roughly two-thirds of their value this year, while Deckers tumbled nearly 50% in 2025 — womp-womp.

Crypto

At one point, Bitcoin was up more than 35% on the year, with those highs coming in early October. Since then, it’s been a rough run, with BTC down about 56 for the year and roughly 30% from those highs. Ethereum has also been all over the map. At its August highs, ETH was up nearly 50% for the year. But after a roughly 40% tumble, it now sits down about 11% for the year. The big question: will 2026 reward patient holders?

Want to receive these insights straight to your inbox?

The Setup — A Year In Review

Here’s a look at some of the top assets for the year. Included below are the eligible ETFs as measured by the largest assets under management (AUM).

Index

The S&P 500 (VOO highest by AUM) or (SPY highest by volume). The Nasdaq 100 (QQQ). Russell 2000 (IWM), Dow Jones (DIA).

Sector

Tech (XLK), Communications (XLC), Industrials (XLI), Utilities (XLU), Financials (XLF), Healthcare (XLV), Materials (XLB), Consumer Discretionary (XLY), Energy (XLE), Real Estate (XLRE), Staples (XLP).

Crypto & Bonds

Bitcoin or (IBIT), Ethereum or (ETHA), XRP, and Solana.

Ultra-short duration bonds (BIL), short duration bonds (BSV), medium duration (IEF), and long duration (TLT). Gold (GLD) and silver (SLV).

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.