The Daily Breakdown takes a closer look at Bitcoin’s chart, then dives into what’s behind Pudgy Penguins and Optimism.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 110+ cryptoassets offered by eToro. Today we’ll discuss Pudgy Penguins and Optimism.

Pudgy Penguins (PENGU): Currently trading with a market cap of roughly $825 million

Pudgy Penguins is a leading NFT-born brand that launched in 2021 with 8,888 penguin avatars on Ethereum and has since evolved into a broader IP and consumer brand. After being acquired by entrepreneur Luca Netz, the project expanded beyond NFTs into retail merchandise, digital experiences, and licensed storytelling. While ownership does not confer revenue rights or profit-sharing, NFT holders gain access to brand participation and IP use. Pudgy Penguins’ value is driven by cultural relevance, community engagement, and mainstream brand adoption rather than financial promises.

Optimism (OP): Currently trading with a market cap of roughly $700 million

Optimism is an Ethereum Layer-2 scaling network that uses Optimistic Rollups to deliver faster, lower-cost transactions while inheriting Ethereum’s security. Developed by the Optimism Foundation, the protocol emphasizes open-source infrastructure through the OP Stack, which powers networks like Coinbase’s Base. The OP token is used for governance within the Optimism Collective, a decentralized model focused on funding public goods and ecosystem development. Optimism’s approach prioritizes coordination, scalability, and long-term Ethereum alignment rather than profit-driven token utility.

Want to receive these insights straight to your inbox?

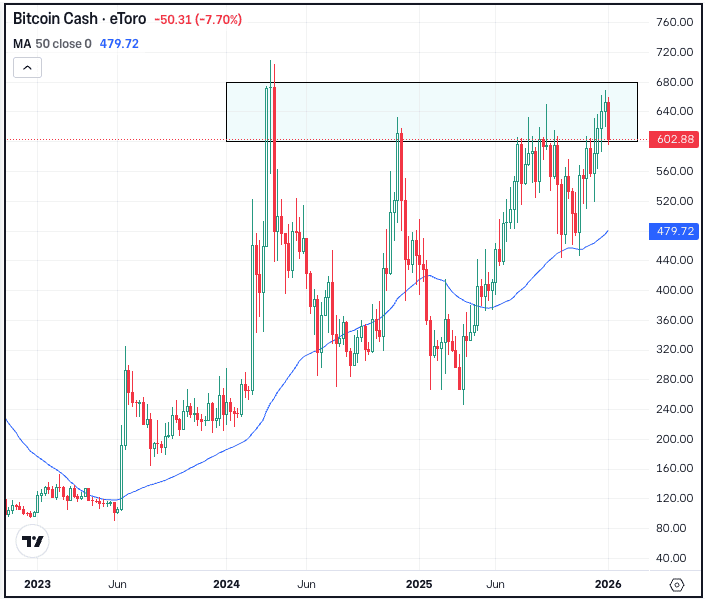

The Setup — Bitcoin Cash

Bitcoin Cash has been quietly flying under the radar, as it hits new 52-week highs earlier this month. While crypto is starting to regain some momentum — with Bitcoin, Ethereum, Solana and others enjoying a recent rally in mid-January — BCH has been quietly cruising higher, up about 20% over the past six months (from mid-July to mid-January).

Like many other cryptocurrencies, BCH declined in Q1 and bottomed in early April. However, unlike many others that broke down to new 2025 lows in October, Bitcoin Cash found support near $450 — well above its April low near $250. Now though, BCH is running into a wide range of resistance, which for the last two years has been between $600 and $680.

If this area remains resistance, bulls will have to see where support will materialize. Last quarter, that was around the 50-week moving average — although there’s no guarantee BCH will fall that far, or if it does, that this moving average will be support once again. Conversely, if it’s able to break out over resistance, it could open the door to higher prices and bullish momentum could accelerate.

What Wall Street’s Watching

Bitcoin fell more than 23% in the fourth quarter, ending the year on a three-month skid and wiping out all of its year-to-date gains. Now though, BTC is trying to recover, up about 9% so far in 2026. We’ve seen a similar rebound in the IBIT ETF, the largest Bitcoin ETF by AUM. Inflows have been solid so far this month, standing at roughly $1.3 billion as of January 19th. Check out the chart of BTC — and remember, options trading is supported on IBIT. For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.