Disney stock has gained in several years…technically speaking. However, it’s lagged the overall market. The Daily Breakdown dives into DIS.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Disney stock has now gained for three straight years, but over that span, it has climbed just 31%. While that may not seem too bad, it pales in comparison to the S&P 500’s gain of 78.3% or the Nasdaq 100’s rally of 130.8%.

The company has evolved from a focus on movies and theme parks into a broad entertainment juggernaut. Its TV networks include ABC, ESPN, FX, Fox, and National Geographic, while its streaming platforms are led by Disney+ and Hulu. Its hospitality arm extends beyond theme parks to include cruise ships and resorts, and Disney also controls Pixar, Marvel, Lucasfilm, and Twentieth Century Studios.

Despite this expansion in assets, the stock has not reacted in kind.

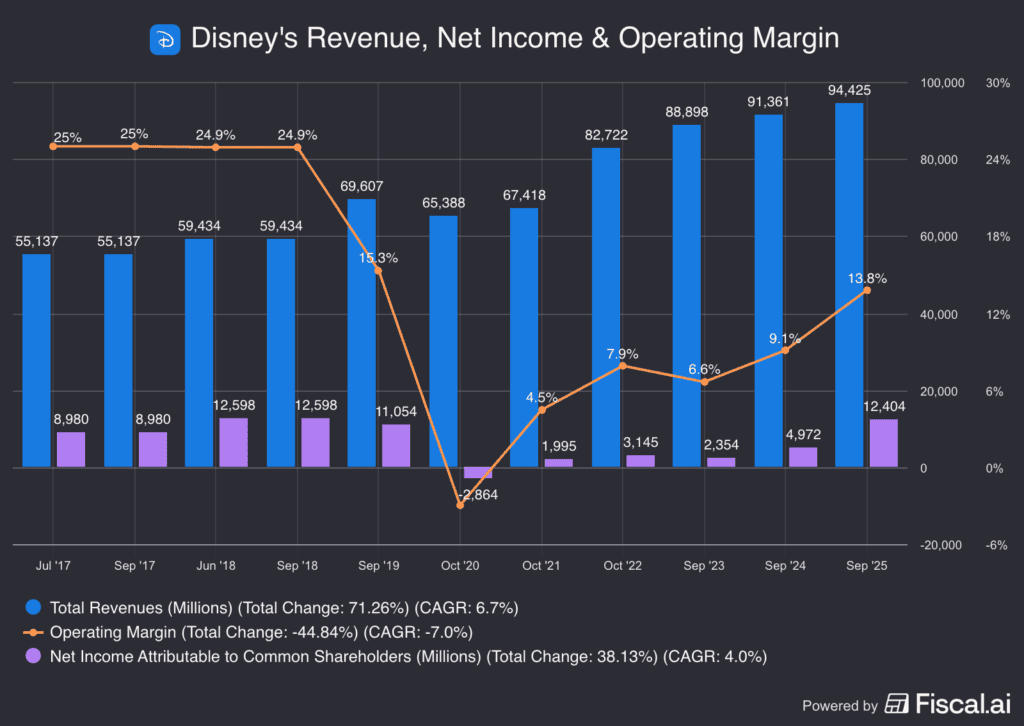

Looking at the business, profits took a major dip in 2020 even as revenue remained relatively resilient — a reality for an entertainment and hospitality company. However, while revenue has continued to grow, profits did not meaningfully recover until 2025, when net income jumped from nearly $5 billion to more than $12.4 billion. Operating margins are also trending higher.

Future Growth Projections

Disney’s fiscal year starts in October, so fiscal 2025 is already in the books. Despite revenue growth of just 3.4%, the company grew adjusted earnings by more than 19%. Looking ahead, earnings growth is expected to stabilize around 11% annually and continue to outpace revenue growth.

According to Bloomberg, analysts project the following:

- Earnings Growth: 11.4% in 2026, 11% in 2027, and 11.3% in 2028

- Revenue Growth: 6.8% in 2026, 4.3% in 2027, and 3.7% in 2028

Analysts currently have a consensus price target of ~$138 on DIS stock, implying about 20% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

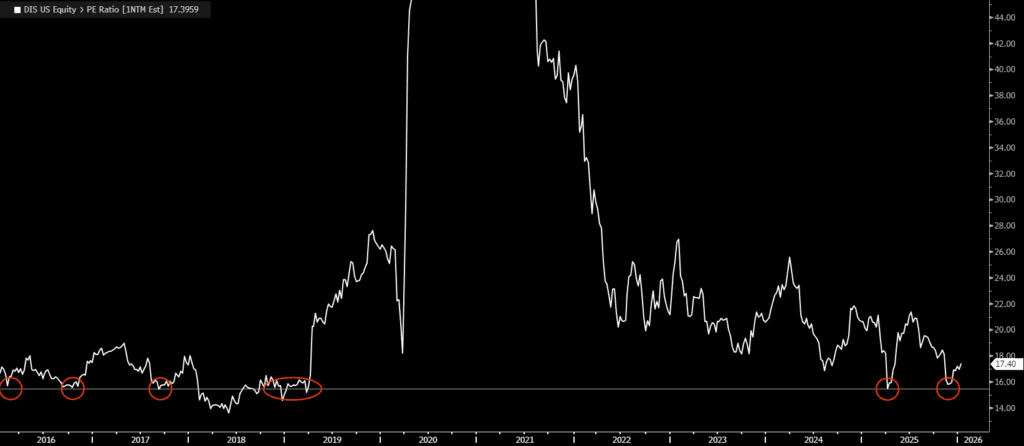

Because of the profit plunge in 2020, Disney’s valuation went off the charts — and in the case of the image below, we mean that literally!

Disney’s forward P/E ratio. Source: Bloomberg, 1/12/2026

Over the past decade, Disney stock has tended to find a trough when its forward P/E ratio falls into the 15x to 16x range. During an extended stretch in 2018, the valuation dipped closer to 14x. In more recent years, the stock has struggled to gain traction above roughly 22x earnings, though post-COVID spikes briefly pushed the multiple toward 26x. After falling to around 16x in late December, Disney shares have moved higher, lifting the valuation along with them.

Risks

Disney faces execution risk as it works to make streaming sustainably profitable amid intense competition and ongoing linear TV declines. The transition of ESPN to a direct-to-consumer model adds complexity around pricing, rights costs, and subscriber adoption. These challenges are compounded by balance sheet and capital allocation constraints, while advertising, travel, and consumer spending remain vulnerable to broader macroeconomic slowdowns.

The Bottom Line

Disney stock is no longer the compounding machine it once was. While bulls hope the company can reclaim its former momentum, both the market and the industry have evolved. Some investors may view Disney as an opportunity at a reasonable valuation, while others may choose to stay on the sidelines due to operational concerns and the risk of continued underperformance.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.