Eli Lilly is pulling back toward support, while earnings season gets underway. The Daily Breakdown dives into the week ahead.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Weekly Outlook

We’re starting off another holiday-shortened trading week, this time in honor of Martin Luther King Jr. Day. Markets will operate under normal trading hours for the remainder of the week. Despite a four-day trading week, these next few days offer plenty for investors to keep an eye on.

Earnings

Big financial firms like JPMorgan and Goldman Sachs kicked off earnings last week and now we’re starting to diversify across some other sectors. Some of the biggest firms by market cap include: Netflix on Tuesday, Johnson & Johnson on Wednesday, and Procter & Gamble, General Electric, and Intel on Thursday.

Others worth noting include: United Airlines, Intuitive Surgical, Capital One Financial, Schlumberger, and Abbott Labs, among others.

Economic

While the record-long government shutdown from Q4 feels like old news, we’re still dealing with the repercussions of it. For instance, on Thursday we’ll get the much-delayed PCE inflation reports for October and November (while the December report will be released on February 20th). Remember, the PCE report is the Fed’s preferred inflation gauge. We’ll also get the final update on Q3 GDP on Thursday.

Want to receive these insights straight to your inbox?

The Setup — Eli Lilly

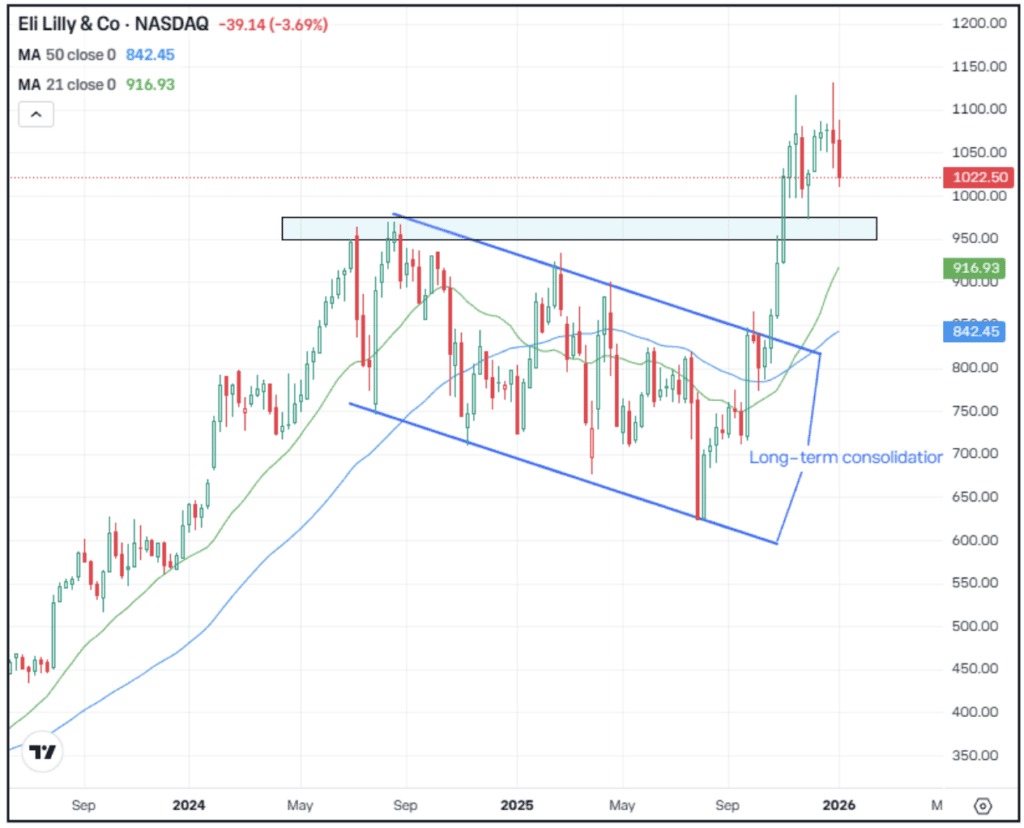

From the 2023 low to the 2024 high, Eli Lilly shares rallied more than 200%. However, the stock underwent a long-stage consolidation. After topping out near $975, shares embarked on a multi-quarter consolidation phase (annotated below), before breaking out to new record highs.

The $1,125 area is currently acting as resistance as LLY pulls back toward $1,000. Generally speaking, bulls want to see the $950 to $1,000 area hold as support, which can keep the current rally intact. Ultimately, a bearish trend shift could occur if Eli Lilly stock breaks below this current support area, and then loses the $900 area.

Options

One downside to LLY is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options. In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Small caps have been on a dominant run so far this year, with the Russell 2000 rising 8.3% vs. gains of 1.6% in the S&P 500 and 1.3% in the Nasdaq 100. Naturally, this has given a big boost to the IWM ETF, which hit new record highs last week. Check out the chart for IWM.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.