Learn to invest

Enhance your financial skills with eToro Academy’s free courses, podcasts, and webinars for all levels.

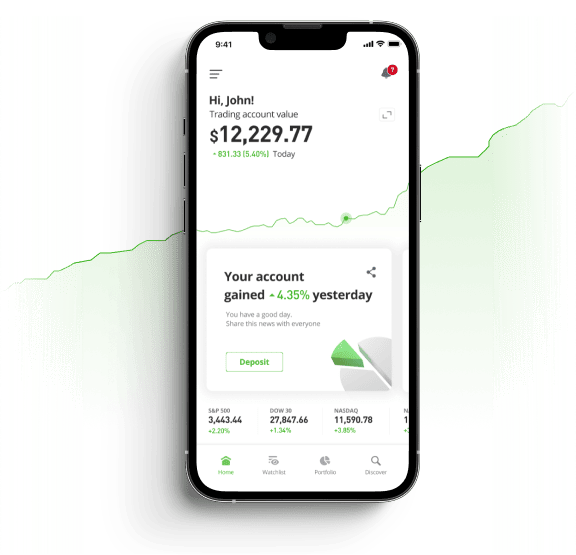

NEW TOINVESTING?

If you’re ready to get started in the financial markets but not sure how, this course is for you

From beginnerto investor

Learn live online from the experts & be on your way to better investing. Not just another investing course!

BUILDING YOURPORTFOLIO

Complete this course to learn how to build a diversified investment portfolio.

Improve Your Trading

Take this course to enhance your trading with additional advanced trading strategies.

The knowledge to invest, all in one place

The eToro Academy is your one-stop resource to empower yourself with the knowledge you need to master the markets. Start your journey to better investing by exploring the topics below:

Essentials

Show All >Why should you consider investing?

Investment Terms You Need to Know

What Is CFD Trading and How Does It Work?

How To Set Up Stop-Loss & Take-Profit Orders

How to Build Your Portfolio

Most Popular

Show All >What Is CFD Trading and How Does It Work?

Top Dividend Stocks for 2026

How to buy Bitcoin for the First Time

New Top Cryptoassets to Watch in 2026

What Is Leverage and Margin?

Keep growing as an investor

Join our global community of investors to view other traders’ portfolios, discuss strategies and access their collective expertise. Then practise what you learn with a free $100,000 virtual portfolio.