There are some key factors that help to distinguish a beginner investor from someone with more experience. Learning the basics behind trading and investing is crucial, but there are plenty of additional features available, including “leverage” and “margin,” that could change the way you trade.

These terms might seem complicated at first, but once you understand what they are and how they work, it might have a positive impact on your investing. Discover what leverage trading is and how margin is used, and look at some real examples of using leverage.

Leverage and margin trading could be good options for those looking to increase the risk-return ratio of their investments. Both processes refer to the ability to open a large trading position with less up-front capital than otherwise required. If you make the right decisions, profits will be a multiple of what they would have been if you had bought something outright. However, if you make the wrong call, losses are also magnified.

Tip: Leverage trading can take you out of your comfort zone. Studies into the psychology of trading show that due to cognitive bias, people approach profits and losses from trading differently, which distorts their decision-making.

What is leverage?

Generally speaking, leverage involves using something to its maximum potential. In the financial world, the meaning is not dissimilar, with investors taking funds and using leverage to optimise their earning potential. To put it simply, leverage enables you to take a small amount of money and increase its value on the investment markets.This means that your capital extends further, but so does the risk of losing it.

Tip: Maximum leverage rates vary across different asset groups. The higher the price volatility of a market, the lower the leverage that will be offered. Financial regulators, such as the FCA, ASIC and CySEC, also set limits on what leverage rates can be offered in the markets they oversee.

What is margin?

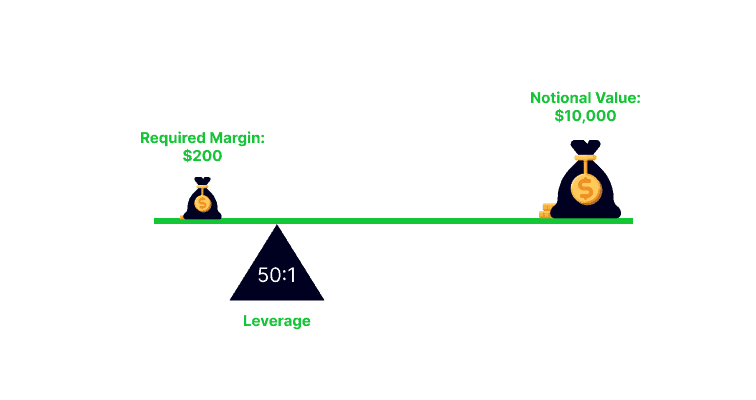

Margin is the amount of money you will need to open your position, while leverage is a multiple of this deposit. The terms are often used interchangeably to describe the process of taking on exposure greater than your capital might otherwise allow, but they are different. Think of margin as the cash wired to a new brokerage account. The deposit you place with the broker is what gives them the confidence to let you trade using leverage — it can be used to cover trading losses in your account.

Calculating margin gets more complicated when you also hold assets such as stocks, bonds and forex, and when you have profits or losses on open positions. Your broker might consider those positions as forms of collateral and incorporate them into the formulae they use to determine your overall margin level. Whatever the exact T&Cs, margin is the value a broker attributes to the assets you hold in your account with them.

How does leveraged trading work?

Leveraged trading works by allowing you to increase the amount of cash you commit to a trade, by effectively borrowing from your broker. The amount of leverage on a trade will be determined at the time you execute it. You can set your account up to trade at default leverage levels or use a broker that allows you to adjust the amount of leverage on a trade-by-trade basis.

If profitable, the life cycle of a trade will be similar whether you are using leverage or not. Profits will be posted to your cash balance when you close the position.

However, if your trade is loss-making, a range of new factors need to be considered. Brokers don’t want you to hold a position that might end up making a loss greater than the deposit you made with them — your margin.

If you want to continue to hold a loss-making position, your broker may ask you to boost your margin by depositing more funds. This is referred to as a margin call . If you don’t deposit additional funds, your broker is entitled to cut your position size to reduce the risk exposure on the position. This is called a stop-out.

Tip: Investors holding long-term positions may find it more cost-effective to buy outright, rather than using leverage and incurring daily financing fees.

Examples of leverage in trading

To fully understand the concept of leverage trading, it is worth looking at some examples. Imagine you are confident that Google’s share price will rise. You have $100 to trade but you want to increase your potential return.

If your broker offers leverage of 1:5, with their backing, you could manage a position of up to $500, with a margin of $100. If Google’s share price doubled in value over the course of your trade, your position would be worth $1,000, rather than $200. However, if the price fell 10%, the total value lost from the trade would be $50, rather than $10.

If the maximum leverage offered was 1:10, then a cash deposit of $100 could allow you to take on exposure of $1,000.

As another example, if you had $1,000 available and were interested in trading Apple stock using leverage, the following table demonstrates the potential size of your position, depending on the leverage rate used.

| Available Funds | Leverage | Position Size | Price Change | New Position Size | Funds After Price Change |

|---|---|---|---|---|---|

| $1,000 | 1:2 | $2,000 | 10% -10% | $2,200 $1,800 | $1,200 $800 |

| $1,000 | 1:5 | $5,000 | 10% -10% | $5,500 $4,500 | $1,500 $500 |

| $1,000 | 1:10 | $10,000 | 10% -10% | $11,000 $9,000 | $2,000 $0 |

Since you are effectively borrowing from the broker to put on a larger position, there are overnight financing fees to consider. These are interest charges applied to your account on a daily basis. The greater the position, the larger the fee.

Margin is the amount of money you’ll need to open your position, while leverage is the multiple of exposure.

Trading with leverage on eToro is done via CFDs. The costs associated with it are spreads and overnight fees. You can find more detailed information on these here.

Final Thoughts

Trading with leverage does not improve your decision-making, and so, if you continue to trade in the same way that you did when you were not using leverage, your win-loss ratio will remain the same. The key difference, however, is that both profits and losses will be magnified, although it is impossible to lose more than you invest. Leverage trading requires careful planning and has a high risk-reward potential that will not suit all trading styles.

Learn more about leverage and other aspects of trading by heading to the eToro Academy.

FAQ

- What is Negative Balance Protection?

-

Negative Balance Protection is a client protection protocol offered by brokers. It ensures that traders can’t lose more than the cash they put into their brokerage account. It also explains why brokers use margin calls and stop-outs to minimise the risk of losses on leveraged trades.

- How can you avoid a margin call?

-

If you don’t trade CFDs, you will never have a margin call. If you do trade CFDs, bear in mind that even trades without leverage can still trigger a margin call. To reduce the likelihood of receiving one, however, you could design a low-risk investment strategy. Alternatively, you can prepare for market volatility by funding your account with additional cash that can act as a protection buffer against a sudden price drop.

- How do you know if your account is in a margin call?

-

You can monitor your margin levels by accessing your brokerage account. Your broker will likely message you if your account is approaching a situation in which a margin call might occur. It is important that you don’t ignore these messages.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.