Financial assets can be broken down into different categories, with popular asset classes including stocks, bonds, indices, funds, commodities, currencies and cryptoassets.

Spreading your

Discover the different asset classes, what they involve and why they might be a good option for helping to diversify your portfolio.

Choose the Right Asset Class for Investing Success

Tip: What are asset classes? An asset class is a grouping of investments that have similar characteristics. They typically react to market events in a similar way and will largely be subject to the same rules and regulations.

What asset classes should you invest in?

Picking your first investments and deciding where to invest your money in the future can be difficult, but understanding the different asset classes available to investors will help you to decide the right investment pathway for you.

Each asset class can have positive and negative attributes and will experience different kinds of price moves as market conditions fluctuate over time.

What types of Financial Asset Classes are there?

Stocks

Stocks typically make up a large part of a well-balanced

If a company performs well, or is expected to perform well, investors will buy shares in the company to gain a percentage of future profits. This should, in turn, then drive the price of the stock upwards. On the other hand, if a firm is considered to be underperforming, and investors sell their shares, their price will fall.

Trading in stocks is widely considered to be less complicated and more cost-effective than other asset classes, which is another reason behind their popularity. It is not uncommon for investors to allocate the majority of their capital to stocks.

Indices

Indices are stock

In the US, the Dow Jones Industrial Average is one of the most popular examples of an index. It tracks the price of 30 of the largest, publicly owned companies trading on the NASDAQ and the New York Stock Exchange. The NASDAQ 100 and the FTSE 100 are two other well-known indices, focusing on the 100 largest firms listed on the Nasdaq and London Stock Exchange respectively.

Indices offer a convenient way to gain exposure to the prospects of similar kinds of stocks, without needing to invest in them individually.

Developing a better understanding of the characteristics of the different asset classes will help you decide which blend of investment opportunities suits your risk tolerance.

ETFs

Exchange-traded funds (ETFs) are an asset class that is popular with beginner investors. Similar to indices, ETFs are fund-style in nature, with the underlying assets being grouped together by sector or asset type.

ETFs offer a way to invest in a range of assets, from emerging market stocks (EEM) to US Government bonds (TLT) and the health care sector (XLV). The functionality of exchange-traded funds makes them a user-friendly and cost-effective option for new investors.

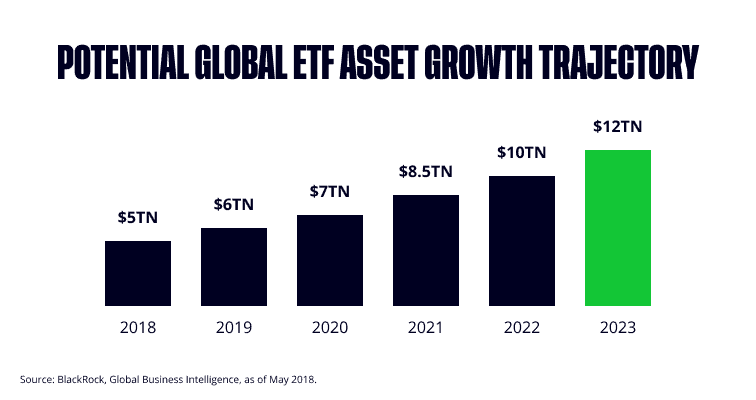

For illustration purposes only. Past performance is not an indication of future results.

Source: BlackRock

Tip: If you want to invest in an asset class, but can’t identify specific targets, a fund-style product will allow you to buy a basket of instruments within that group.

Commodities

Commodities are the raw materials purchased by manufacturers to drive global industrial output. Oil, wheat and copper are just some of the commodities traded on international exchanges, with the price fluctuating according to supply and demand.

If you believe that a particular geopolitical situation will result in the price increase of natural gas, for example, you could consider buying a

Currencies

The currencies of different countries are always changing in value. Some of these trends can be long-term in nature. For example, if a country is seen as a

Currency trading, forex trading and foreign exchange trading are all terms that explain the process of trading in a currency asset, in the belief that its value is due to change.

Cryptoassets

Cryptoassets, such as Bitcoin, are digital assets or currencies on a

Tip: An asset class that is generally considered to be low-risk, can contain instruments that are high-risk, and vice versa.

Cryptoassets are highly volatile and unregulated in the UK. No consumer protection. Tax on profits may apply.

Bonds

For investors, bonds do hold some risks, for example, if the bond issuer goes bust or can’t pay back the loan. This risk is usually reflected in the

Tip: Investments in more stable asset classes, such as bonds, can smooth out the overall returns of your portfolio. This can create room for a smaller percentage of capital to be invested in asset classes with a higher potential risk-return.

Final Thoughts

Developing a better understanding of the different asset classes and their specific characteristics will help you to decide which blend of investment opportunities suits your

Visit the eToro Academy to learn more about how different asset classes perform in various market conditions.

Quiz

FAQs

- How do I diversify my portfolio?

-

Portfolio diversification involves more than just buying a greater number of smaller positions. If all of the assets you own have similar characteristics, then, any price moves will most likely be reflected across your portfolio. Diversifying your portfolio involves investing in a range of assets that you believe will ultimately increase in value, but that may take different routes to achieving their individual targets.

- How long do I have to hold a position in different asset classes?

-

Different asset classes have different characteristics. If you are looking to invest for short-term gains, then instruments with lower volatility may be a better fit, as there is less chance of their value moving much lower or higher than you would like it to. The longer your

investment time horizon , the wider the choice of asset classes you can invest in while still maintaining a sensible approach. - Am I ready to start investing?

-

Successful investing requires an understanding of your aims, the assets and markets you are investing in, as well as the key terms associated with investing. In addition, investors should have a clear plan on how to achieve these goals. There are many other aspects of the financial markets you can study to strengthen your position, but if you have satisfied those core principles, you should be ready to start investing.

- What factors should I consider when selecting an asset class?

-

Start by considering if you want to target income returns or capital growth. Then find assets with levels of price volatility which match your overall investment aims, investment time-horizon and risk tolerance.

- Can I invest in multiple asset classes at once?

-

Yes, multi-asset brokers offer markets in a large number of asset types and allow you to hold a diverse range of investments in one account. Spreading your capital across different asset classes is generally recommended and ties in with the principles of diversification which can reduce overall risk.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research.

Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. The availability of all the above-mentioned products and services may vary by jurisdiction and country.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.