Bonds have distinct characteristics which make them popular with a lot of investors. Typically considered to be at the lower-risk end of the investment spectrum, they offer not only a degree of security, but also other benefits such as diversification.

Bonds are a key component of financial markets and may represent an opportunity to develop an income-generating or relatively defensive investment strategy. This comprehensive guide explores the fundamentals of bond investing, from basic concepts to practical strategies for getting started.

What Are Bonds and How Do They Work?

Bonds are essentially IOUs issued by governments, corporations, or other entities to raise capital. When you purchase a bond, you’re lending money to the issuer for a predetermined period.

In return, the issuer promises to pay you regular interest payments, known as

The mechanics of bond investing revolve around several key components and understanding the core terms is an ideal starting point for navigating the bond market:

- Issuer – an entity such as a bond or corporation that borrows money by selling bonds to investors

- Face value (or par value) – the amount you’ll receive when the bond matures

- Coupon rate – annual interest payments as a percentage of the face value

- Yield – the return on a bond. Calculated by dividing a bond’s face value by the amount of interest it pays

- Redemption – the process taken by the bond issuer to return capital to investors

- Maturity date – the date on which bonds redeem and you receive your principal back

- Short-term bond – bonds with a maturity date under 3 years

- Long-term bonds – bonds with a maturity date of over 10 years

Understanding these fundamentals can help investors to evaluate whether or not bonds align with their investment objectives and risk tolerance.

Types of Bonds

The bond market offers diverse options to suit different investment strategies and risk profiles. Each category presents distinct characteristics that investors should understand before allocating capital.

Government Bonds

Government bonds represent the safest tier of fixed-income investments, backed by national treasuries. These securities carry a lower

In the UK, these are called gilts, while the US issues Treasury bonds often referred to as T-bonds, and Treasury bills called T-bills.

Government bonds serve as the foundation for many conservative portfolios. They typically provide regular interest payments and may offer a more defensive position during times of market uncertainty. Investors can choose from various maturities, from short-term T-bills maturing in weeks to 30-year bonds providing decades of income.

Corporate Bonds

Corporate bonds are debt securities issued by companies to fund operations, expansion, or refinancing. These bonds typically offer higher

Investment-grade corporate bonds from established blue-chip companies like Unilever or Johnson & Johnson typically provide moderate risk with reasonable returns, while high-yield bonds, also called junk bonds, offer higher yields, but carry significant default risk.

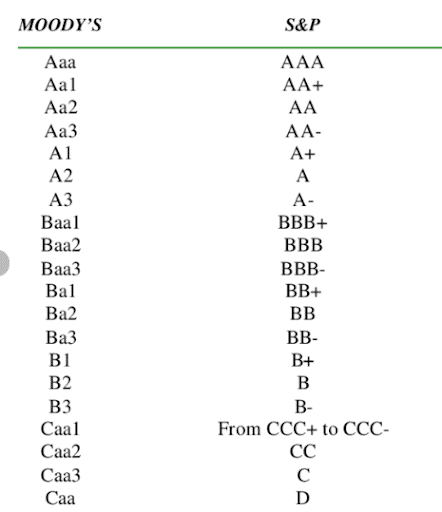

One way to establish the risk-return presented by a bond is to access reports from market research firms such as Moody’s and S&P. These two agencies assess the creditworthiness of issuers and use alphanumeric codes to express the creditworthiness of bonds. In the case of S&P ratings, AAA represents the highest quality and anything below BBB – is considered speculative grade.

| The Alphanumeric Bond Ratings used by Moody’s and S&P |

Municipal Bonds

Municipal bonds, while more common in the US market, represent debt issued by local authorities and public entities. These bonds fund infrastructure projects, schools, and public services. In the UK context, similar instruments include local authority bonds and social housing bonds.

Tip: Municipal bonds often provide tax advantages to domestic investors.

Understanding these bond categories may help investors to construct portfolios that are aligned with their risk tolerance and income requirements. Generally, government bonds can provide stability, corporate bonds offer higher yields, and municipal bonds support local communities while generating returns.

Understanding Treasury Bonds and Government Securities

Treasury bonds and government securities form the bedrock of global fixed-income markets. These instruments, whether UK gilts or US Treasuries, serve as benchmarks for pricing other bonds and measuring economic expectations.

Tip: The global bond market is valued at over $128 trillion with government bonds making up 68% of that total.

The

Investors can access government bonds through individual purchases or perhaps more conveniently through bond Exchange-Traded Funds (ETFs) which may be able to offer instant diversification and daily liquidity.

Tip: Investing in bonds from multiple issuers with different maturities can reduce individual bond risk while maintaining fixed-income exposure.

The relationship between government bond yields and economic conditions provides valuable market insights. Rising yields often signal economic growth expectations or inflation concerns, while falling yields may indicate economic uncertainty or flight to safety. Understanding bond market dynamics can help investors adjust portfolio allocations accordingly.

Benefits and Risks of Bond Investing

Bond investing may offer several compelling advantages for portfolio construction. However, bond investing carries distinct risks requiring careful consideration. These are some of the pros and cons of investing in bonds.

- Regular income: Coupon payments provide predictable cash flows which is particularly valuable for retirees or income-focused investors.

- Lower volatility: Bond market volatility is typically lower than stock market volatility meaning bonds offer portfolio stability during market downturns.

- Diversification: Spreading investments across different asset classes, sectors, or securities can reduce overall portfolio risk and bond prices often move inversely to equity markets.

- Interest rate risk: Bond prices fall when interest rates rise.

- Inflation risk: Inflation erodes the real value of fixed payments which is particularly problematic for bond investors during inflationary periods.

- Credit risk: If the bond issuer can’t repay the loan and defaults on the bond, you stand to lose all of your investment.

Managing these risks involves strategic diversification across bond types, maturities, and credit qualities. Laddering strategies, where investors purchase bonds maturing at different intervals, may help to mitigate interest rate risk while maintaining steady income.

Tip: Monitoring the yield curve can provide insights into economic expectations and potential factors influencing bond investment decisions.

How To Start Investing in Bonds

Beginning a bond investing journey requires understanding the available options and selecting appropriate vehicles.

Bond ETFs

Exchange-traded funds represent the most accessible entry point for most investors, offering instant diversification, daily liquidity, and lower minimum investments compared to individual bonds.

Popular options include iShares $ Treasury Bond 0-1yr ETF for short-term government bond exposure or the Pimco Active Bond ETF which offers diverse exposure to different elements of the bond market including government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Individual Bonds

Those who prefer individual bonds may consider starting with government securities before exploring corporate options. Evaluate key metrics including

Practical Steps for Bond Investing

Bond investing requires setting clear objectives. While these will vary according to personal circumstances and market conditions, here are some factors to consider:

- Establish aims. Is the priority income generation, capital preservation, or diversification?

- Determine appropriate allocation levels. If part of a diversified portfolio including stocks, many investors would opt for 20–40% of capital to be committed to bonds.

- Select suitable vehicles. Whether that is choosing individual bonds or ETFs, focus on costs, liquidity needs, and tax implications.

Final thoughts

The reasons for following the bond market extend beyond holding them in your portfolio. Analysts and investors who specialise in fixed-income products may often adopt a long-term view and carry out extensive research on the prospects of the global economy and the financial markets.

Price moves in the bond markets may, therefore, be seen as potential leading indicators of a change in overall investor sentiment, and have ramifications for the prices of other types of markets, such as stocks, forex, and commodities.

Visit the eToro Academy to discover ways to fine-tune your portfolio construction.

FAQs

- What is the minimum investment required for bonds?

-

Individual bonds typically require $1,000 minimum per bond, but bond ETFs allow investments from as little as the price of one share, often under $100.

- How do rising interest rates affect existing bonds?

-

When interest rates rise, existing bond prices fall because newer bonds offer higher yields to attract investors who could alternatively hold cash in a bank savings account. However, if you hold bonds to maturity, you’ll still receive the full face value.

- Are government bonds completely risk-free?

-

While government bonds from stable countries like the UK carry minimal default risk, they still face interest rate risk and inflation risk that can affect returns.

- Can I sell bonds before maturity?

-

Yes, bonds can be sold in the secondary market before maturity, although the price received depends on prevailing macroeconomic factors such as interest rates and market conditions.

- What are SSA bonds?

-

The term SSA refers to Sovereigns, Supranationals, and Agencies and includes issuers who are governments, but also government-related entities, such as the World Bank, and other government-affiliated agencies. The term SSA bonds is often used interchangeably with the term government bonds.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research.

Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. The availability of all the above-mentioned products and services may vary by jurisdiction and country.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.