Ethereum/Euro Price ETHEUR

€1,653.7500-2.00(-0.12%)(1D)

Trending cryptos

Within the last 24h, these are the crypto assets with the highest trading volume in the market

Ethereum/Euro News

Cointelegraph • 11.02.26 • 21:59

Chainlink feeds go live for Ondo tokenized US stocks on Ethereum

Cointelegraph • 11.02.26 • 20:20

Price predictions 2/11: BTC, ETH, BNB, XRP, SOL, DOGE, BCH, HYPE, ADA, XMR

TipRanks • 11.02.26 • 16:35

Ethereum’s ETF Hype Is Staring at Some of the Ugliest Red Numbers in the Market. Here’s Why.How much is 1 ETHEUR?

ETHEUR/EUR€1,391.55

Euro

ETHEUR/GBP£1,212.27

Pound Sterling

ETHEUR/AUDA$2,314.13

Australian Dollar

ETHEUR/SGD$2,085.74

Singapore Dollar

ETHEUR/NZDNZ$2,727.88

NZ Dollar

ETHEUR/JPY¥252,530.93

Japanese Yen

ETHEUR Price Chart

-38.23

Past Month

1D

1W

1M

6M

1Y

3Y

MAX

Sign up for full charts powered by

*Past performance is not an indication of future results

The Ethereum/Euro price is rising this week.

i

A ‘rising’ price indicates that the weekly price has increased by more than 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

A price ‘on the decline’ indicates that the weekly price has decreased by more than 0.5%.

A ‘stable’ price indicates that the change in weekly price is between -0.5% and 0.5%.

The Ethereum/Euro price today is €1,653.7500, a -0.12% change in the last 24 hours and 5.49% in the past week. Ethereum/Euro price changed by -36.11% in the past year.

ETHEUR Key Metrics

Market Cap

i

The total value of a cryptoasset, found by multiplying the price by the total number of coins in circulation.

-

Day's Range

i

Shows the high and low prices of the day.

€1626 - €1665.18

52 Week Range

i

Shows the high and low prices of the last year.

€1242.0073 - €4227.08

Volume (1D)

i

A measure of how much of an asset was traded in the last day.

-

Market Rank

i

This crypto’s rank against other crypto by market cap.

-

All time high

i

The highest recorded price of an asset since its launch.

€4227.08

All time low

i

The lowest recorded price of an asset since its launch.

€71.0778

Price Change YTD

i

The amount the price of an asset has changed in the current calendar year.

€-35.99

How can I buy Ethereum/Euro?

To purchase Ethereum/Euro:

01

Create an eToro account:

Sign up for an eToro account and verify your identity.02

Deposit funds:

Deposit funds into your eToro account using your preferred payment method.03

Search and purchase:

Search the Ethereum/Euro (ETHEUR) page and place an order to buy Ethereum/Euro.Looking for more information? Check out our guides on Academy.

What Is Ethereum/Euro?

This pair measures the price of a single unit of Ether (Ethereum) in Euros. Ethereum is the second-largest cryptocurrency by market cap and a popular platform among blockchain developers. While its market cap is less than that of Bitcoin, the fact that Ethereum was used to create many other cryptocurrencies means its dominance in the market is quite overwhelming. This pair enables traders to open a long (BUY) position if they believe the ETH/EUR chart will go in favor of Ether, or a short (SELL) position if they think the ETH/EUR price will align in favor of the Euro (via CFD). Since the Euro is a fiat currency and Ethereum is a crypto, each can be affected by different factors. For example, the Euro can become volatile due to events relating to the European Union’s economy, while Ether could remain unaffected. In contrast, Ethereum could become volatile when regulations or legislation impact the crypto market, while the Euro might not be fazed by such events.

Top Guides

Our top picks for the most relevant guides from the eToro Academy

How to buy Bitcoin for the First Time

Read MoreLooking to buy Bitcoin for the first time? Learn more about the popular cryptocurrency from our simple beginner’s guide on how to buy bitcoin.

Beginner’s Guide to Investing in Crypto

Read MoreInterested in learning about cryptoassets and how to trade them? Walk through the basics of cryptoassets and learn how to trade crypto through eToro.

What Is Cryptocurrency and How Does It Work?

Read MoreLooking to understand crypto better? We explain what cryptocurrency is, look at crypto mining, and explore some of the top cryptocurrencies on the market.

Trade Ethereum/Euro

Today

Today

Create an eToro account to buy and sell Ethereum/Euro on a secure, user-friendly crypto trading platform.

FAQ

The current price of Ethereum/Euro (ETHEUR) is €1,653.7500

The market capitalisation of Ethereum/Euro is (The data is unavailable right now)

Ethereum/Euro's all-time high is €4,227.0800

Ethereum/Euro has a 24-hour trading volume of (The data is unavailable right now)

Select the "1D" or "1W" timeframe on the eToro chart and zoom out to see the historical price movements of Ethereum/Euro. The price of Ethereum/Euro has ranged between €1,242.0073 and €4,227.0800 over the last year.

To buy Ethereum/Euro, visit the "Ethereum/Euro (ETHEUR)" page. Once you have created an account and deposited funds, click the "Trade" button and decide how much Ethereum/Euro you want to purchase. You can also place an order that will buy Ethereum/Euro (ETHEUR) at a specific price in the future.

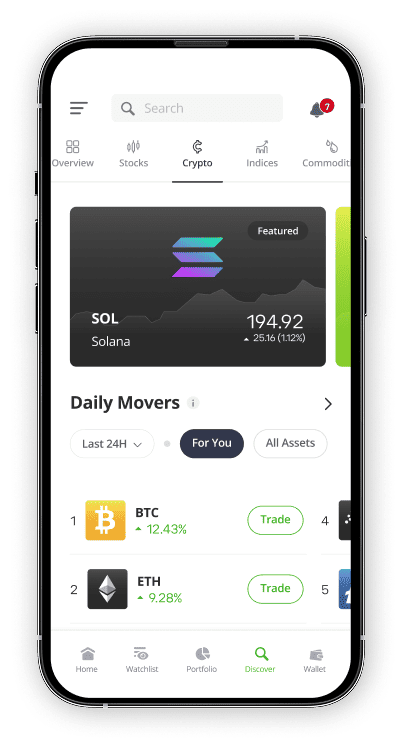

Daily Movers

Explore the biggest movers on the crypto market