For active traders looking to expand their toolkit, Spot-Quoted futures (SQFs) offer a new and unique way to access the futures markets. While you may already be familiar with the concept of futures trading, this guide provides a practical, step-by-step walkthrough of how to trade using SQFs.

Spot-Quoted futures (SQFs) have unique features which offer a new way to gain exposure to the

We will cover everything from analysing a contract to closing your position, supported by a video tutorial and an interactive simulator to help you to build confidence and develop your understanding.

Tip: Practise trading SQFs using a demo account which uses virtual funds.

A Quick Refresher on Spot-Quoted Futures (SQFs)

Spot-Quoted futures are

SQFs are instruments with many similarities to traditional futures, but also some differences. These are some of the distinguishing characteristics of SQFs:

- Margin – SQFs, like futures, involve the use of

margin allowing you to control a larger position with a smaller initial outlay. - Market structure – Both SQFs and futures are traded on regulated exchanges and both have a defined

expiry date .

Tip: SQF expiry dates tend to be longer dated reducing the need to manage the rollover of contracts.

- Cost structure – When trading SQFs, financing fees, carry costs, and other charges are recorded as one single adjustment fee called an ADJ. This innovative approach to the accounting process makes P&L readings more transparent.

- Pricing – the ADJ is recorded daily which allows SQFs to track the spot price of a market rather than the forward price as with traditional futures.

- Cash settlement – SQFs only settle in cash, removing the risk of trading physical delivery futures by mistake.

- Standardised – Each SQF contract represents a specific quantity of the underlying asset, creating uniformity and transparency.

- Contract size – SQFs have a smaller minimum contract size which means traders can trade with less market exposure than when using traditional futures.

Key Considerations When Trading SQFs

Before diving into trading SQFs, it’s essential to understand the inherent risks and develop a sound trading strategy. This includes understanding how margin works, selecting appropriate underlying assets, and establishing a robust trading plan.

Understanding Margin

Margin trading allows you to amplify potential returns, but also magnifies potential losses. The

If your account balance falls below the maintenance margin, you may receive a

Choosing the Right Underlying Asset

Choosing the right underlying asset is crucial for successful SQF trading. Consider factors like an instrument’s

Tip: Stock indices and cryptoassets, which can both be traded using SQFs, have very different risk-profiles.

Develop a Trading Plan

A well-defined trading plan is essential for managing risk and making disciplined trading decisions. Your plan should include pre-defined entry points, exit points (both profit targets and stop-loss levels), and risk management rules, such as the 1% rule, which limits the risk on any single trade to 1% of your trading capital.

A Step-by-Step Guide to Trading Spot-Quoted Futures on eToro

Trading SQFs on eToro mirrors the process for trading other types of instruments. It involves finding the right contract, executing your trade, ongoing management and the closing out of your position. The following steps will guide you through the entire procedure.

Step 1: Find Spot-Quoted Futures (SQFs) on the Platform:

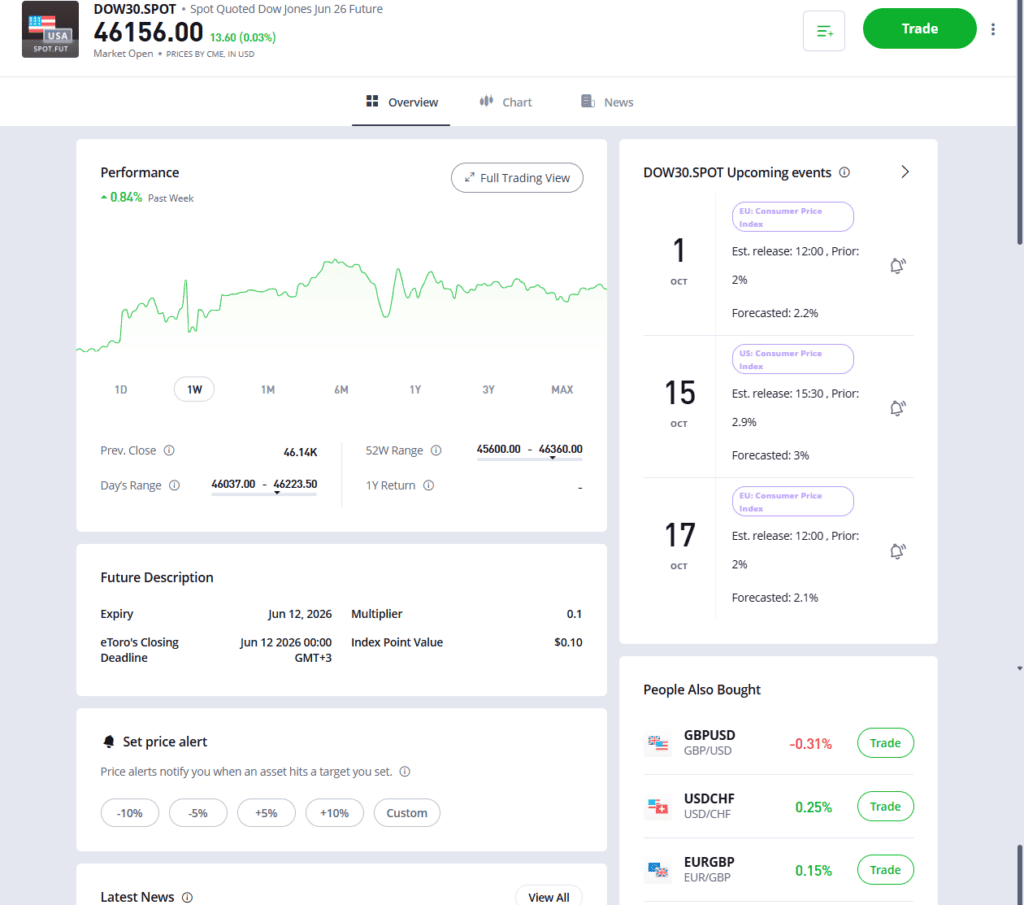

Navigate to the SQF page of the instrument you want to trade. The instruments are identifiable by the suffix “.spot” such as DOW30.SPOT.

Step 2: Analyse the Contract Specifications:

Review the Features Description section to confirm you are trading the right instrument and check the important details of the SQF, such as multiplier, expiry date, and index point value.

Source: Etoro

Step 3: Place a Buy (Long) or Sell (Short) Order:

Click on the “Trade” button to bring up the trading interface which will present the option to “short” or “buy” the market. Enter the amount you want to trade and finalise your order by clicking “Short” or “Buy” depending on the direction of your trade.

A market order executes at the current market price, while a limit order allows you to specify the price at which you want to buy or sell.

Step 4: Monitoring and Managing Your Position

Any SQF positions you have will be shown in the “Portfolio” section of your account. From there, you will be able to monitor P&L, set stop-loss and take-profit orders, and check the margin requirement on your position.

You can set calendar reminders to check your position. This is especially important in the run-up to the expiry date when you will have to decide if you want to roll over or close your position.

Step 5: Closing Your Position:

You can trade out of an SQF position any time that the market is open. You don’t need to wait for the expiry date for cash settlement to take place. If you do trade out of your position early, the net outcome of your trade will factor in the prices at which you opened and closed your trade and associated costs.

Common Mistakes To Avoid When Trading Spot-Quoted Futures (SQFs)

While SQFs can be a valuable trading tool, it’s important to be aware of common pitfalls and how to avoid them. Understanding these mistakes can help you to navigate the complexities of SQF trading more effectively.

- Position management: Using excessive margin and scaling up on your exposure to a market can lead to significant losses if the market moves against you

- Ignoring Expiry Dates: Failing to monitor expiry dates can result in unexpected outcomes, especially if you’re not actively managing your positions.

- Trading Without a Clear Plan: Trading without a defined strategy can lead to impulsive decisions and inconsistent results.

- Not being prepared: Trading without a full understanding of a market, or in sizes which are outside of your natural comfort zone can result in your decision-making becoming influenced by psychological biases which can distort your decision-making.

Final Thoughts

Trading Spot-Quoted futures involves a series of steps, from analysing the contract to closing your position. While SQFs offer potentially high rewards, they also carry significant risk and are best suited for experienced traders.

Develop a full understanding of the way the instrument works and the markets they operate in and then use a demo account to familiarise yourself with the mechanics before trading with real capital.

Visit the eToro Academy to learn more about futures trading.

FAQ

- What happens if I hold a Spot-Quoted futures contract until its expiry date?

-

On expiry date, a Spot-Quoted Future contract will settle in cash based on the spot price of the underlying asset at expiry. If you hold a long position in the Spot-Quoted S&P 500 Index future, that position will be closed out and you will receive cash based on the number of contracts you hold and the price of the SPX500 Index.

- What are the margin requirements for trading SQFs on eToro?

-

Margin requirements vary by underlying asset and market conditions. Always check the specific contract details on the SQF section of theToro platform before trading, as these requirements can affect your capital allocation and risk management strategy.

- How do SQFs differ from options contracts?

-

While both options and SQFs are derivatives, SQFs obligate traders to buy or sell at expiry, whereas options give the holder the right, but not the obligation to do so. SQFs also have linear payoffs compared to the non-linear payoff structure of options.

- Can beginners trade Spot-Quoted futures effectively?

-

Beginners should approach SQF trading with caution due to margin being involved and the complexity of futures markets. It’s advisable to thoroughly understand the mechanics, practise with a demo account, and start with small positions while developing experience.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.