Two critical, interconnected features of the financial markets that can significantly impact your trading outcomes are liquidity and slippage. Understanding what they are, and how to manage them, can help you to make better-informed trading decisions.

Active traders of Spot-Quoted futures (SQFs) and other instruments understand that execution is everything. This article breaks down the relationship between liquidity and slippage and provides actionable trading techniques to help you navigate the SQF market with greater control and precision.

What Is Liquidity in SQF Markets?

Liquidity in SQF markets refers to how easily contracts can be traded without significantly impacting price. High liquidity is often associated with higher trading volumes and should result in smoother execution; low liquidity, on the other hand, increases trading risks and costs.

Spot-Quoted futures, or SQFs, are an innovative new product with many attractive functionality features, but SQF traders still face the challenge of establishing a market’s ability to absorb buy and sell orders efficiently. The starting point is to appreciate that the liquidity landscape in SQF markets varies significantly across different contracts and trading sessions.

Define high vs. low liquidity

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant change in its price. In SQF markets, liquidity determines how efficiently your orders execute and at what cost.

How to measure liquidity

Measuring liquidity on the eToro platform requires examining several key metrics that provide insights into market conditions. The primary indicators include trading volume, open interest, and the

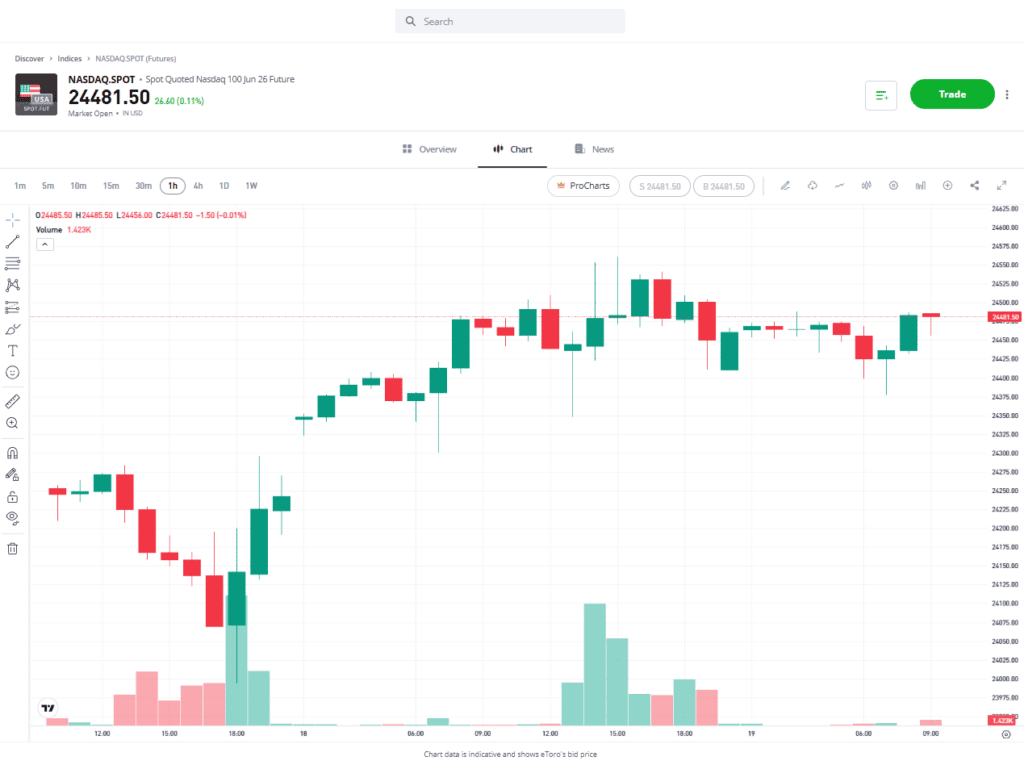

If you want to trade SQFS on the Nasdaq 100 Index, you can access this instrument’s metrics from the Spot-Quoted NASDAQ futures contract details page. Trading volume, showing the number of contracts traded over various timeframes, appears when you select “Volume” from the drop-down menu of indicators in the chart section. Open interest, representing the total number of outstanding contracts, indicates the market’s overall depth and participant engagement.

| NASDAQ.SPOT Price Chart With Volume Indicator |

Source: eToro

For illustration purposes only. Past performance is not an indication of future results.

The bid-ask spread is visible in real time on the order ticket, displaying the best available prices for immediate execution. Wider spreads typically signal lower liquidity, while tight spreads suggest active market participation. In addition, examining the order book depth – when available – reveals how much size is available at different price levels beyond the best bid and offer.

The Link Between Liquidity and Slippage

Liquidity can determine

As liquidity decreases, the potential for slippage tends to increase, sometimes sharply. This connection becomes particularly pronounced during volatile market conditions or when trading outside primary market hours.

Understanding this relationship helps traders to anticipate execution challenges and to adjust their trading strategies accordingly. Recognising liquidity patterns and their impact on order execution is part of effective

Defining slippage

Slippage is the difference between the expected price of a trade and the price at which the trade is actually executed. This phenomenon occurs when market conditions change between order placement and execution, or when available liquidity at the desired price level is insufficient to fill the entire order.

In SQF markets, slippage can work both positively and negatively. Negative slippage occurs when you buy at a higher price or sell at a lower price than expected, while positive slippage delivers better execution than anticipated. However, in low-liquidity environments, negative slippage tends to dominate, particularly for larger orders that exceed available size at the best prices.

A hypothetical scenario

Let’s walk through a practical example that demonstrates how liquidity constraints create slippage in real trading situations.

- Setup: A trader places a market order to buy 50 contracts of a low-liquidity SQF, with the best ask price at $100.

- Execution: Due to the limited available volume, only 10 contracts are filled at $100. The next 20 are filled at $100.05, and the final 20 at $100.10.

- Breakdown: The total cost calculation outlines what amount of the order was filled at what price, revealing the impact:

Here’s a breakdown based on different amounts of contracts:

- 10 contracts × $100 = $1,000

- 20 contracts × $100.05 = $2,001

- 20 contracts × $100.10 = $2,002

- Total cost: $5,003

- Average execution price: $100.06

- Slippage: $0.06 per contract (0.06%)

- Total slippage cost: $3

This scenario illustrates how even modest-sized orders can experience slippage in thin markets. The $3 additional cost may seem small, but it represents a 0.06% degradation in execution quality – a figure that compounds significantly for active traders executing multiple trades daily.

This scenario is for illustration only. Slippage may be positive or negative depending on market conditions, order size, and liquidity. It should be considered as part of overall execution risk when trading futures.

Tip: Before placing large market orders, check the order book depth to estimate potential slippage.

Plans To Minimise Slippage

Plans to minimise slippage incorporate order types, timing strategies, and position management techniques which all go to maintain execution quality. These approaches can help to reduce the impact of slippage and make it more manageable.

Implementing these strategies requires trading discipline and a thorough understanding of market microstructure. By combining multiple techniques, traders can create robust execution frameworks that adapt to varying liquidity conditions.

Use limit and stop-limit orders

Limit orders provide price control, and may limit exposure to negative slippage by ensuring the trade only executes at a specified price or better. Unlike market orders that prioritise immediate execution, limit orders prioritise price certainty – an important consideration for managing execution risk in volatile or illiquid markets.

Tip: Limit orders may not be filled if the open-market price does not reach the determined price level.

The trade-off between execution certainty and price certainty becomes apparent when markets move rapidly. Market orders provide quick entry or exit points but expose traders to unlimited slippage risk, while limit orders help to avoid slippage, but may not execute if prices do not reach the limit. Stop-limit orders are triggered at a specific level, but maintain price protection through the limit component.

For SQF traders, the choice between order types depends on current market conditions and trading objectives. Some traders may prefer to use limit orders during periods of high volatility or when trading less-liquid contracts. In those situations, the price control of limit orders can be beneficial, although this comes with the trade-off of possible execution uncertainty, particularly for non-urgent position entries.

Trade during peak hours

Timing your trades strategically can influence slippage costs. In SQF markets, liquidity cycles can align with major financial centres’ operating hours and key economic releases.

Peak liquidity periods tend to increase during the overlap of London and New York sessions (14:00–17:00 GMT), when institutional participation often reaches a higher level. During these windows, bid-ask spreads may narrow, order book depth may improve, and large orders can be absorbed. Conversely, trading during Asian hours or around market closes often encounters wider spreads and thinner books.

Consider which market you trade

SQF liquidity is driven by the liquidity levels in the market of the underlying instrument. Major stock indices are widely followed and can offer deep liquidity pools, while niche or newly launched SQF contracts may present challenges for traders seeking to execute larger positions.

Break down large orders

Splitting large orders into smaller ones may help split available liquidity at single price points. This technique, known as “order slicing” or “iceberg ordering,” conceals your full trading intention while accessing liquidity as it naturally replenishes.

Illustrative Example: Consider an order book showing:

- Bid: $99.95 (20 contracts)

- Ask: $100.00 (15 contracts)

- Next Ask: $100.05 (25 contracts)

- Following Ask: $100.10 (30 contracts)

Scenario 1 – Single Large Order: Buying 70 contracts with a market order can consume liquidity across several price levels, increasing slippage.:

- 15 contracts at $100.00

- 25 contracts at $100.05

- 30 contracts at $100.10

- Average price: $100.064

Scenario 2 – Gradual Execution: Breaking the same 70 contracts into seven orders of 10 contracts each, executed over 30 minutes:

- Natural order flow replenishes the $100.00 level between executions

- Most fills occur at or near $100.00

- Average price: $100.01

Staggering execution allows orders to interact with the market gradually rather than all at once. By doing so, traders may benefit from the natural replenishment of bids and offers in the order book. Instead of consuming all visible liquidity at a single moment, smaller tranches can be absorbed as counterparties continue to place new orders, often at or near prevailing prices. .

The scenarios above are hypothetical illustrations for educational purposes only. They do not account for real-time market conditions, transaction costs, fees, or slippage beyond the assumptions shown. Actual execution outcomes will vary depending on market liquidity, volatility, order type, and timing. This content should not be construed as investment advice or a recommendation to adopt any particular trading strategy.

Tip: Consider setting up price alerts for your target entry levels during off-peak hours.

Final Thoughts

Understanding liquidity dynamics and slippage control are important aspects of SQF trading. While slippage is a natural part of trading and cannot be avoided, a thorough understanding of market liquidity allows for its management.

Slippage management techniques become more relevant as position sizes grow and trading frequency increases. Even small differences in execution quality can accumulate over time, which is why many traders monitor liquidity closely when planning their activities.

Visit the eToro Academy to learn about other advanced trading techniques.

FAQs

- Is slippage always a bad thing?

-

Not necessarily. Slippage may work in your favour. Positive slippage occurs when trades are executed at better levels than expected – buying lower or selling higher than your intended price. This typically happens during rapid market movements in your trade direction or when hidden liquidity improves available prices. However, in low-liquidity markets, negative slippage tends to be more common than positive slippage.

- Will a limit order always protect me from slippage?

-

Limit orders set a maximum (or minimum) price at which you’re willing to trade, but they don’t guarantee execution itself. In fast-moving markets, prices may gap past your limit level without filling your order. This creates a different risk – missing potentially profitable trades entirely.

- What’s the typical slippage range for liquid vs illiquid SQFs?

-

Slippage tends to be lower in highly liquid assets and higher in less-traded ones. For example, widely followed assets generally experience smaller slippage for standard order sizes compared with niche or thinly traded contracts, where price impact can be more pronounced – especially during periods of high volatility or major news events. It’s important to factor potential slippage into risk management when planning trades.

These figures can multiply for larger orders or during news events. It’s important to factor potential slippage into your risk calculations before entering positions and monitor an Economic Calendar to anticipate changes in trading volumes.

- How do professional traders minimise slippage on large SQF positions?

-

Professional traders often use sophisticated execution algorithms that combine multiple techniques: dynamic order slicing based on real-time liquidity, participation in hidden liquidity pools, and tactical use of different order types. They may also employ pre-trade analysis to estimate market impact and adjust their approach accordingly. While retail traders lack access to some institutional tools, applying scaled-down versions of these strategies may help to reduce the effects of slippage.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

Spot-Quoted Futures involve significant risk and are not suitable for all investors.

You may lose more than your initial investment due to the underlying assets’ price volatility.

Please ensure you understand the risks involved.