eToro Trust Accounts

Grow and manage wealth with a trust structure

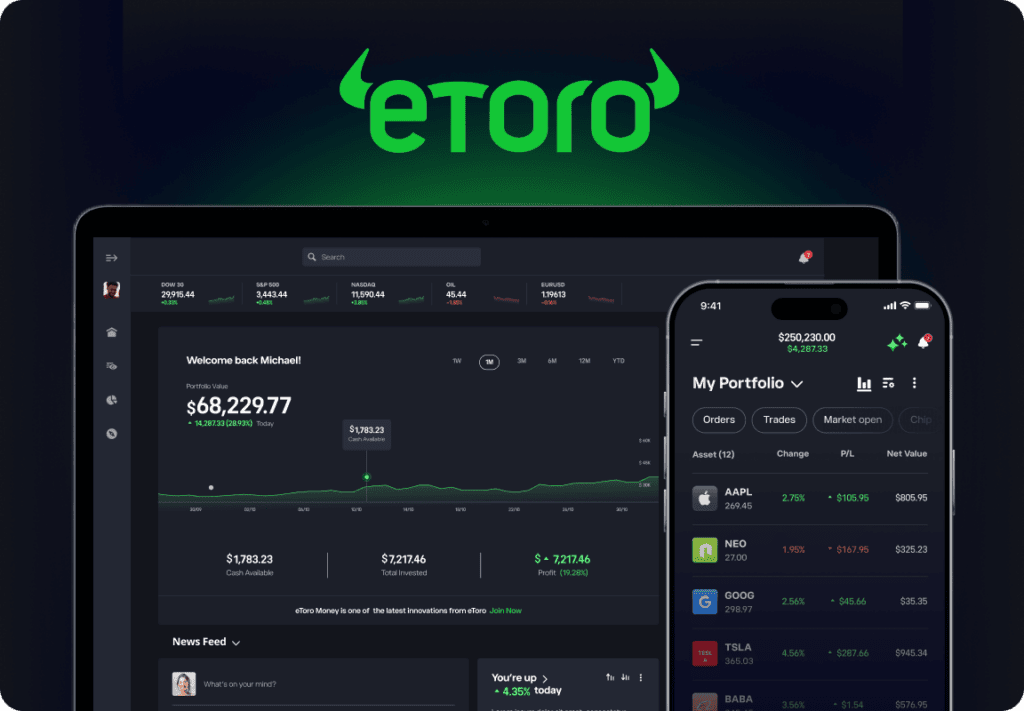

A trust account on eToro is a powerful way to manage family wealth and invest across global markets. Set up in minutes, it gives you access to award-winning tools, thousands of assets, and support from a local specialist.

A minimum of $10,000 USD is required to open an eToro Trust account.

Why choose a trust account with eToro?

A trust account gives you room to grow and a way to protect what matters most, your family, your future, and everything you’ve worked hard for. With eToro, you can invest with confidence and flexibility across:

Supporting your investment goals

If you already have a trust structure set up, you can start investing with eToro. The eToro app gives you the ability to:

- Full online access

- Easy portfolio tracking

- Control without losing flexibility

- Succession planning and asset protection features

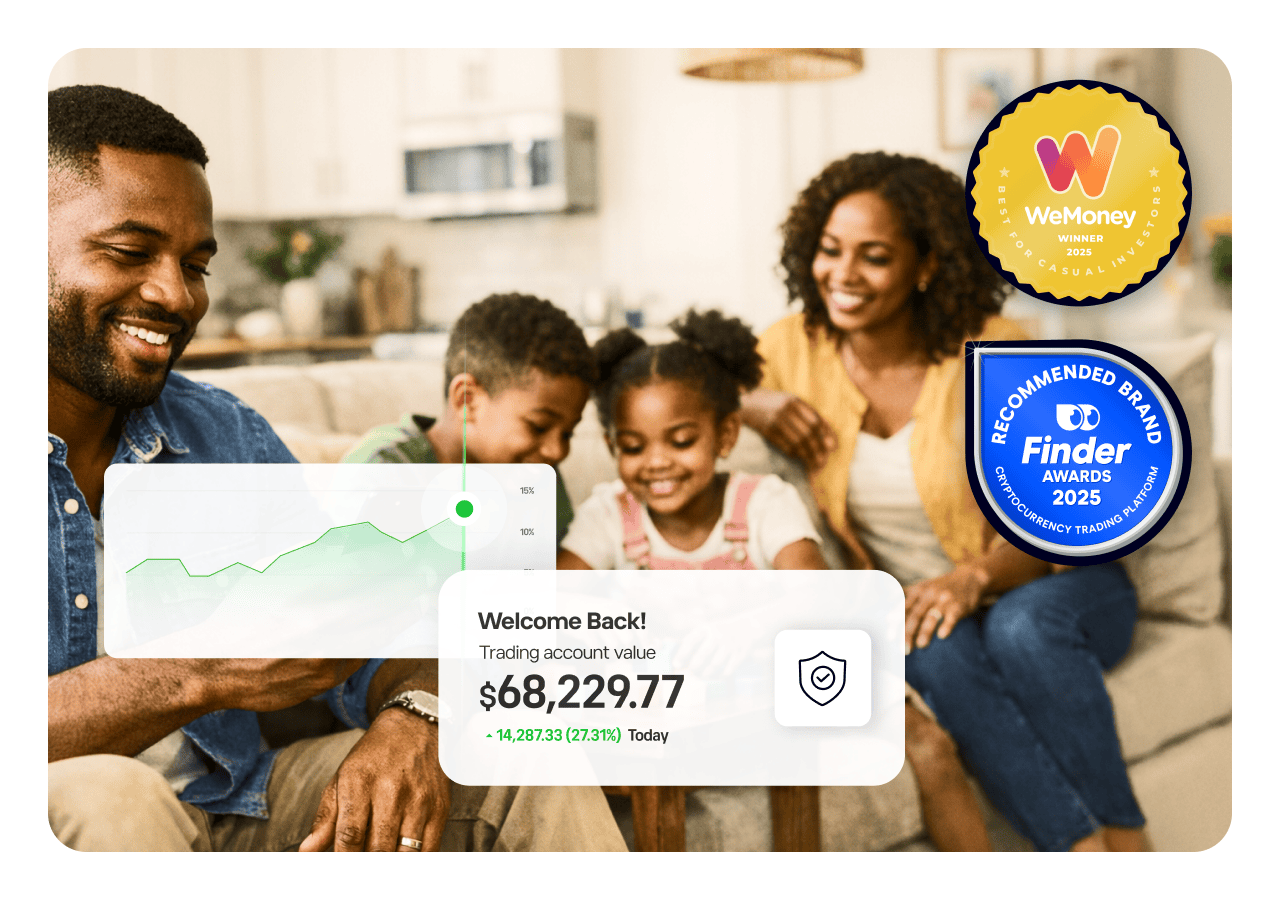

Trusted by Australians

eToro has been recognised for service, value, and innovation by leading comparison platforms including Finder and WeMoney. These independent awards provide added confidence for investors managing meaningful wealth through a trust.

Speak with a specialist

Have questions about eligibility or how it works? Speak to our Australian-based team, with zero obligation.

How it works

Use the trust account form to begin.

Upload your trust deed and trustee details.

We will guide you through ID checks and compliance.

Once approved, your trust gains access to eToro’s full investment platform.

Why trusts matter?

Australians use trusts to manage and grow assets because they offer:

An eToro trust account brings these benefits together with access to global markets and modern investing tools.

About eToro

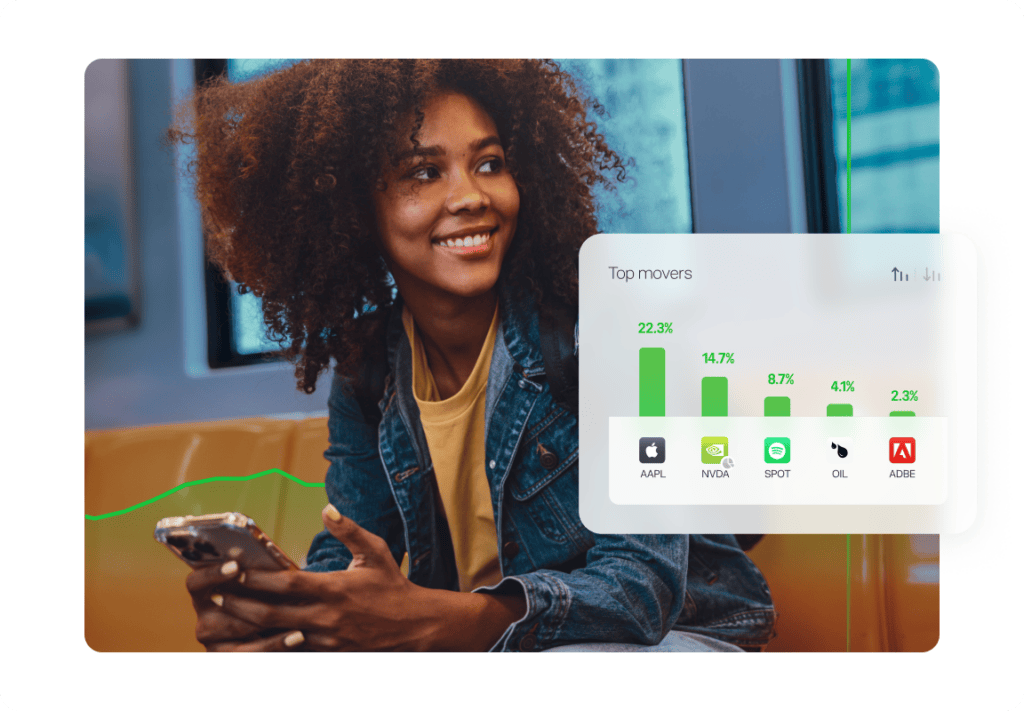

eToro is a global investing platform trusted by over 38 million users across 75 countries. We make investing simple, transparent, and accessible across a wide range of traditional and emerging markets.

- Multi-asset platform

- Global market access

- 110+ Smart Portfolios

- 3,200+ Popular Investors to follow or copy

- Education through eToro Academy

- Local support teams

Ready to open your trust account?

Start the process today or speak with a specialist to explore your options.

Your funds are held in top-tier institutions

The eToro Group works with globally renowned banking partners, including:

These banks are partnered with the eToro group and do not serve all entities within the group.