January is usually when you promise yourself you’ll be better with money than you were last year. This week, instead of making big resolutions or bold predictions, I want to help you put a few practical, actionable steps in place for your investing in 2026. Nothing complicated, just simple habits you can actually stick with, boring, repeatable habits that work in rising markets, falling markets and everything in between.

One of the biggest reasons people put off investing is simple, they feel like they’ve missed the boat or should have started earlier. Here’s the thing, markets spend a lot of time near all-time highs because, over the long run, they tend to rise. So yes, in hindsight, starting earlier would have helped. But the next best time is today. That feeling usually shows up when looking at some of the world’s biggest companies. Stocks like Microsoft, Apple and Google have spent much of the last decade making new highs. Over the past five years alone, they’ve continued to deliver strong returns, with all three seeing shares rise by more than 100% during that time, despite rate hikes, inflation scares, and plenty of volatility along the way.

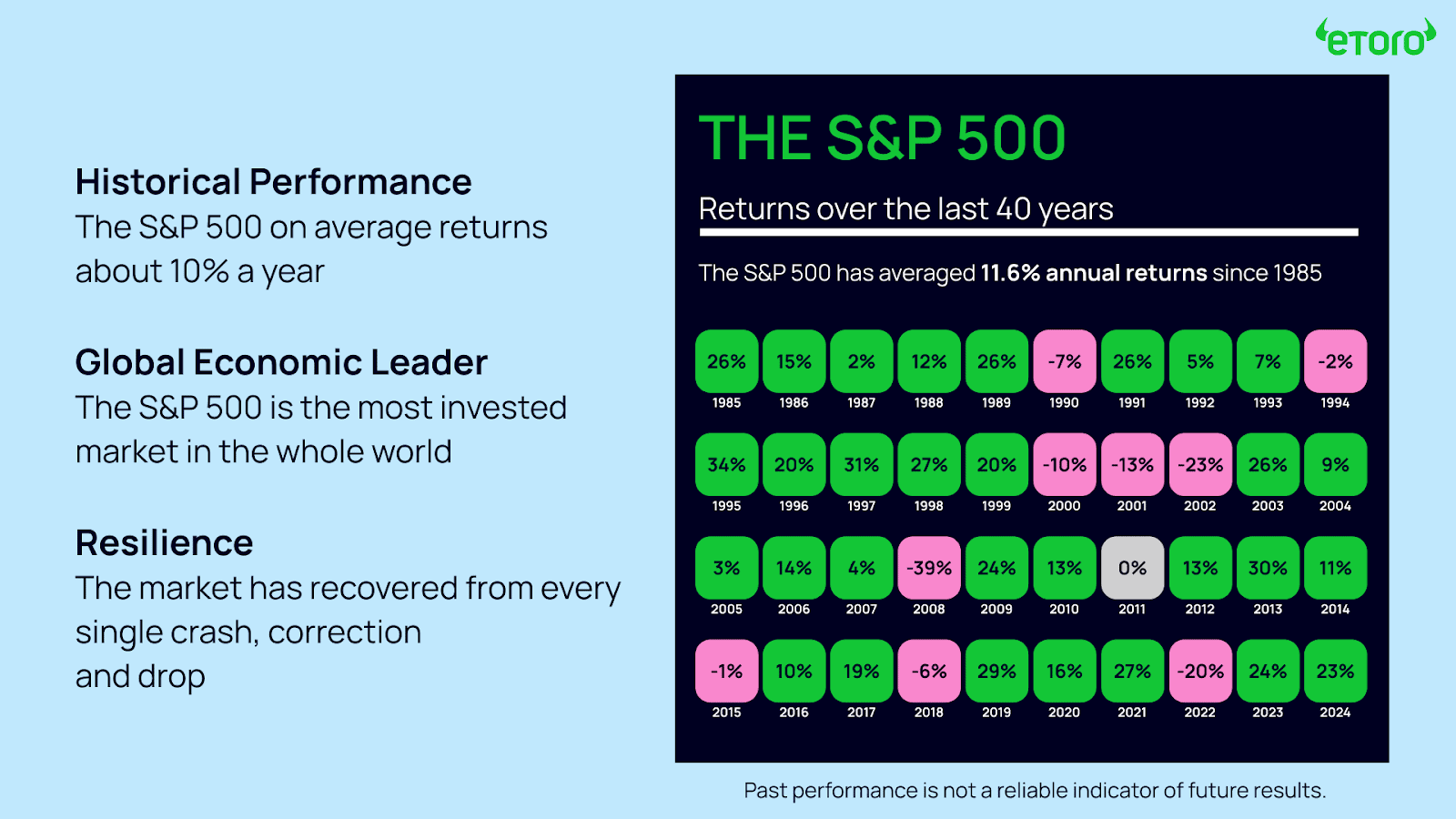

The chart below shows annual S&P 500 returns over the past 40 years. Some years are very strong, some are clearly not. But zooming out, the long-term picture is what matters. Despite corrections and periods of uncertainty, markets have continued to move higher over time. That’s why I always come back to the same idea, time in the market beats timing the market.

Habit 1: Have a plan (and keep it realistic)

When you start investing, create a plan and stick with it. A plan helps investors stick to the good ideas they came up with during calmer times. Investing also lets you work toward specific financial goals, whether that’s a nest egg for the future, a passive income stream or something else you care about. And the earlier you start, the more time your money has to compound and ease the pressure of trying to “pick the perfect moment”.

Your plan doesn’t need to be fancy. It just needs to answer a few basics:

- What am I investing for (wealth building, retirement, a home deposit, kids, freedom)?

- What’s my timeframe?

- How much risk can I actually handle, not in theory, but in real life?

- What’s my process when markets get volatile?

To invest responsibly, investors, whether they’re fresh-faced or seasoned, should only invest what they can afford to lose, adopt a long-term mindset, set realistic goals and ensure they research what they’re investing in before buying assets.

Habit 2: Consistency beats timing

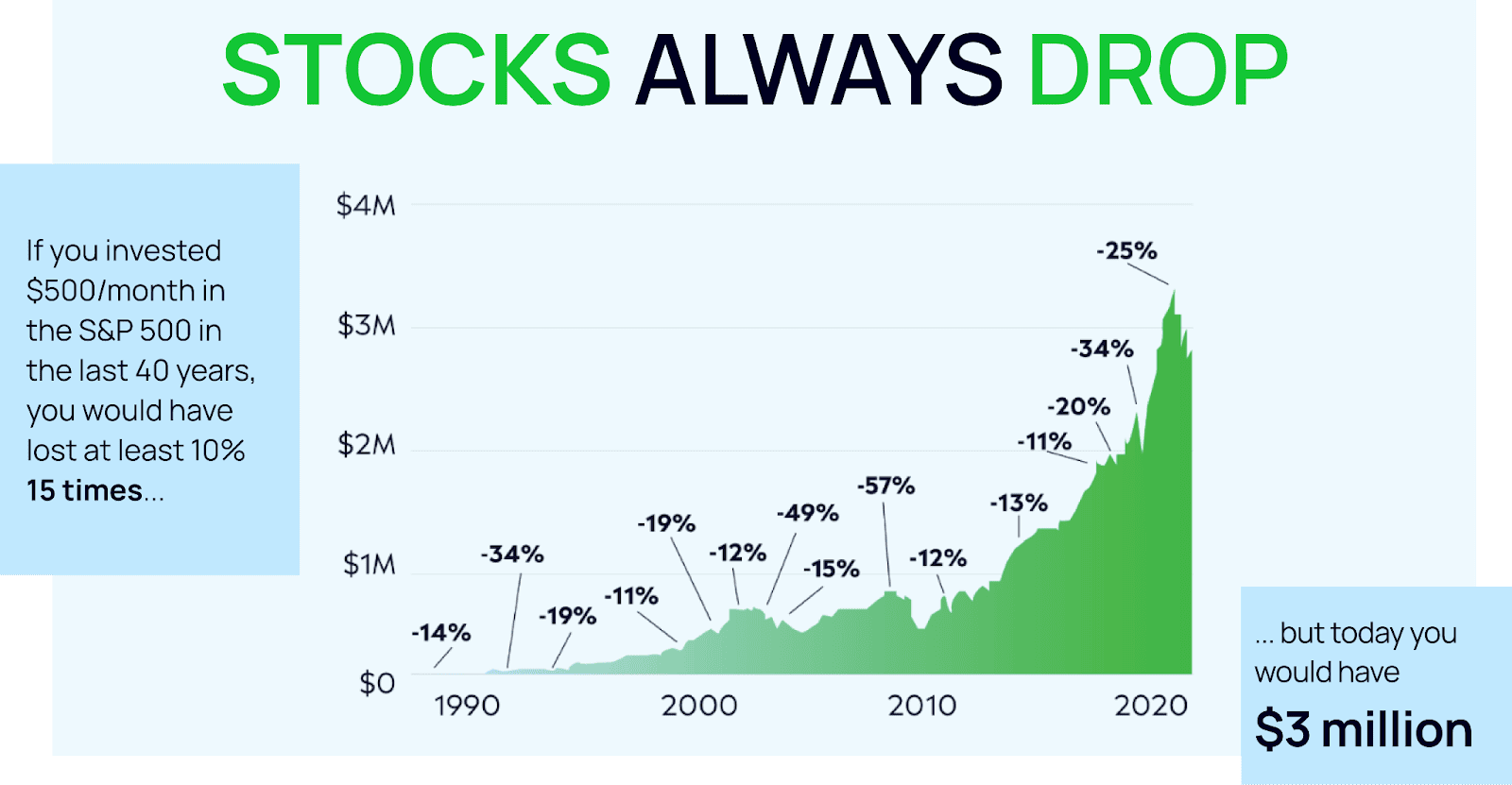

Timing the market is close to an impossible task, even if you’re experienced. That’s why dollar-cost averaging (DCA) is such a powerful habit. It rewards consistency over timing by spreading your investing over time, typically in even increments. Instead of trying to pick the perfect day to invest $1,000, you break it up and invest steadily across weeks or months. It can remove a lot of the psychological worry, especially in volatile markets.

One of the most effective ways to improve investing outcomes is by removing emotion from decisions. Automating contributions through recurring investments and sticking to a plan during both calm and volatile markets helps investors avoid common behavioural pitfalls, like panic selling or trying to time the market.

Habit 3: Start with what you know (keep it simple)

You do not need to be an expert in finance or sit in front of a computer for hours each day to be a successful investor. A little can go a long way, especially when it comes to building knowledge with investing. It’s always good to start with what you know, it makes the research and analysis a little easier.

Most of us use the products of big global companies every day. That familiarity doesn’t replace research, but it’s a practical starting point. Take a company like Apple. Most people use its products daily, which makes it easier to understand how it makes money, why its ecosystem is sticky and what could go right or wrong for the business.

It’s a philosophy famously backed by investor Peter Lynch, who believed that everyday investors often have an edge by investing in what they understand, simply because they see it in their daily lives. He has a book, One Up on Wall Street, that I would recommend anyone to read.

Habit 4: Diversification matters

Diversification sounds boring, but it’s one of the best risk management strategies you can employ. It reduces the impact of any single asset’s poor performance. In times of market turbulence, not all sectors or individual stocks react the same way; some may even see gains, which can help offset losses in other areas. This strategy smooths out the volatility in a portfolio, providing a steadier return over time and leading to better risk-adjusted returns.

A simple way to think about it:

- Don’t put all your eggs in one basket

- Mix sectors, mix regions, mix styles (growth, value, dividends)

- If you’re investing for the long term, you want to be able to stay invested when markets get uncomfortable.

Let’s take an S&P500 ETF as an example, such as SPY, VOO, or IVV. This type of ETF invests in the 500 largest publicly traded companies in the US, offering broad market exposure. The S&P500 includes a wide range of industries such as technology, healthcare, finance, and consumer goods, which means that the ETF is inherently diversified across multiple sectors. Within the S&P500, different sectors perform differently based on various economic conditions. For instance, during a pullback in the technology sector, other sectors like utilities or consumer staples may perform better, thereby cushioning the overall impact on the ETF.

A quick reminder about risk

Investing differs from saving because your money is put to work, which means there is often some risk. Markets drop, and they drop often. That’s normal. Historically, the average intra-year decline in the S&P 500 is around -12%, even in years that finish higher overall. In other words, volatility is a feature of investing.

Pullbacks can feel uncomfortable in the moment, but for long-term investors, they’re part of the journey, and they can also create opportunities to buy high-quality assets at lower prices. Understanding that markets move around along the way can make it easier to stay invested and stick to a plan when things get noisy.

The takeaway for your investing in 2026

It’s not about starting big, it’s about just starting, then building slowly and consistently.

If you do nothing else this week, do this:

- Write down your plan

- Pick a simple approach you can stick with

- Set a routine. Small and consistent.

- Diversify, and let time do the heavy lifting

- Subscribe to Investors Alpha to get all the latest on the top stocks around the world 👀

If you want to build your investing knowledge at your own pace, eToro Academy has a range of free courses and resources designed to help you learn the fundamentals and develop good investing habits over time.

eToro Academy

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.