After soaring to record highs in June, Xero shares have slipped more than 20%. After years of strong execution, Xero’s next chapter looks more complex. A bold US expansion and renewed spending are testing investor faith in its long-term growth story. Margins are tightening, question marks are being raised over execution, and competition remains fierce. So will its gamble on growth pay off? Let’s find out.

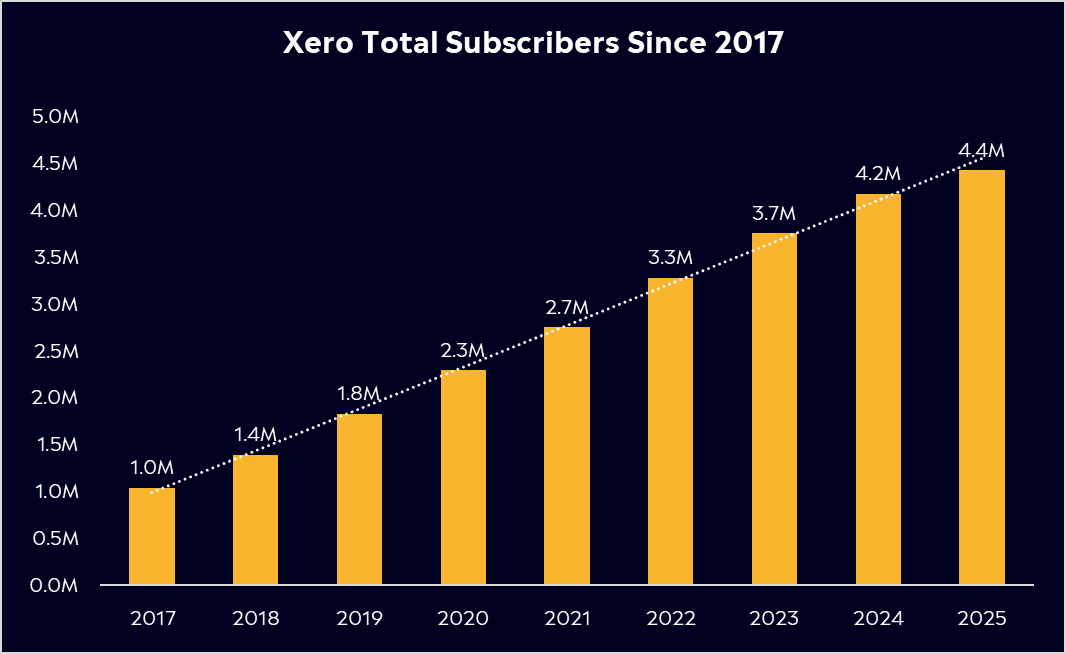

Xero has almost doubled its subscriber base since 2020 and, after dominating in ANZ, is now looking to aggressively expand into the US, with solid results continuing to support its growth.

Recent full-year results were strong, but they showed that margins were contracting after the company opened its purse to spend again after years of cost-cutting. According to Bloomberg’s Analyst Recommendations, Xero has 11 buy ratings, 4 holds, and 1 sell, with an average price target of AUD$193.63, signalling a 51% upside from current levels.

Explore Xero

The basics

Xero is a leading ASX-listed technology company that offers cloud-based accounting software. Founded in New Zealand in 2006, Xero connects small business owners with their numbers, their bank, and their advisors anytime, essentially eliminating messy paper or Excel documents. This has enabled businesses to simplify their everyday admin and automate day-to-day tasks, helping Xero become one of the fastest-growing SaaS companies globally.

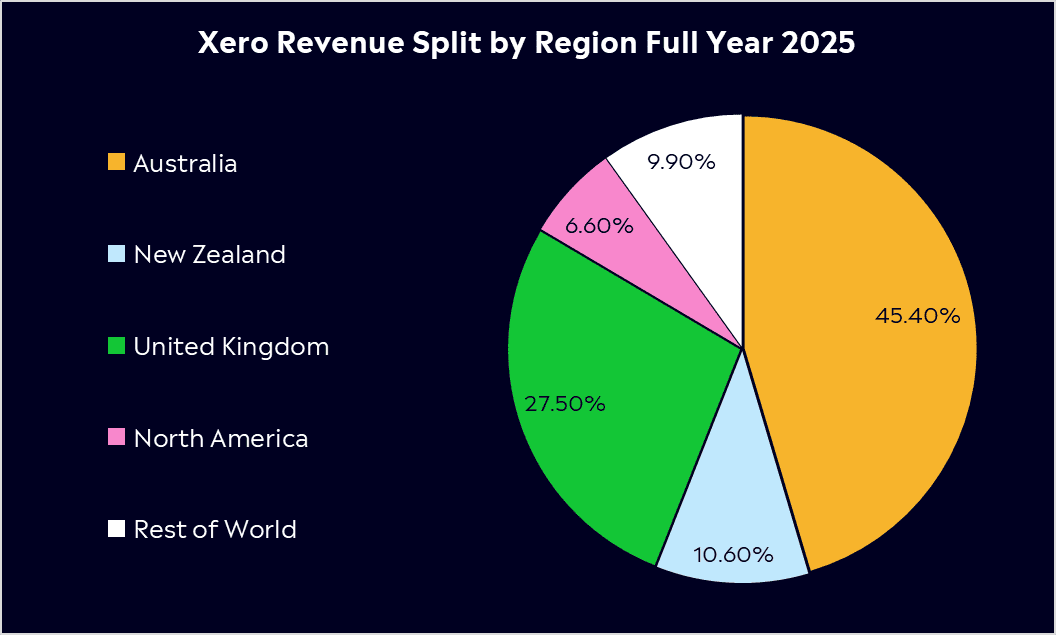

After years of solid growth, Xero now has 4.41 million subscribers globally. Subscribers are how Xero makes its money, and the revenue is split worldwide. The bulk of the revenue comes from Australia, making up 45% of revenue, while the rest comes from key international markets such as the UK and North America. International growth is key for Xero, with a strong footing established in Australia and New Zealand. It recently completed the acquisition of Melio in the United States, aiming for inorganic growth. While investments like this can crimp margins in the short term, they reflect Zero’s ambitions of showcasing its success in ANZ overseas. Xero is looking to combine Melio’s business-to-business payments tools with its own accounting software. Melio already has partnerships with Shopify, Capital One and Fiserv, giving Xero a much stronger distribution network in America.

Xero remains confident in its long-term growth trajectory by targeting both ARPU expansion and deeper product adoption. Management continues to execute on its FY25–27 strategy with a focus on profitable growth. After years of heavy investment, the company is now balancing growth with improving margins, evidenced by a 30% surge in net profit in FY25 and solid free cash flow.

Competitor Diagnosis

Xero offers a high-quality, scalable accounting product, but it faces fierce competition from industry giants. The accounting software space is crowded with big names like Oracle (NetSuite), Intuit (QuickBooks), and Sage, each commanding significant market share. North America remains a particularly tough nut to crack for Xero. Intuit’s QuickBooks entrenches itself as the clear leader in the US, capturing over 62% of the small-business accounting market.

The U.S. market represents a huge addressable opportunity for Xero, but Intuit’s sheer scale gives it a significant advantage through its financial muscle, allowing it to outspend on marketing and product development. Xero is responding by sharpening its offerings and innovation. It’s embracing AI to keep pace with competitors with a new generative AI assistant to help users automate bookkeeping tasks and gain better financial insights.

Under CEO Sukhinder Singh Cassidy, who took the helm in late 2022, Xero has doubled down on the US market. Cassidy’s strategy is to demonstrate more value to U.S. small businesses in order to chip away at QuickBooks’ lead. Still, these strategic shifts, from product enhancements to big-ticket acquisitions, will take time to bear fruit in terms of market share gains in North America, and some investors who cheered recent cost cuts and cash-flow gains may be wary of renewed spending. Management will need to justify its hefty investment with tangible market share wins to keep shareholders on side.

Financial Health Check

Xero had a strong FY25, with revenue up 23% and a particularly strong performance in Australia. Its recent inclusion in the ASX 200 has only bolstered its standing as the company to watch for retail investors seeking SaaS exposure.

Despite heavy investments in overseas growth, operational efficiency and cost increases across its product suite have driven margins higher, reaching 89% in FY25. However, after years of efficiency, Xero is opening up its purse again, and this will impact margins for fiscal year 2026, with gross margins set to fall.

Xero recently posted its H1 earnings for fiscal 2026, and while promising, they indicate that margins are contracting as expected, coming in below estimates at 88.5%. Capital expenditures in the quarter were higher than the market had forecasted. CFO Claire Bramley has already signalled that the focus is on prioritising revenue growth over near-term margin expansion. That revenue growth was strong, rising 20% year-on-year to NZ$1.19 billion, and subscribers climbed almost 10% to 4.59 million. Net profit was also healthy at N$Z134.8 million. These are solid numbers that show the core business ticking along nicely.

Buy, Hold or Sell?

Xero’s full-year results show they continue to move in the right direction, but the bottom-line near-term margin contraction is real, affecting profitability, and investors are worried about the execution of the Melio transaction. The US is Xero’s toughest yet most lucrative market. The deal is dilutive in the short term, but management believes it will double US revenue by FY28.

To add to that, expectations are high. Xero’s valuation is steep, trading 86x forward price-to-earnings, leaving little room for error. That valuation has left some question marks for investors, and shares have stalled in the last 12 months, down 9% as investors also digest a new wave of spending, lower subscriber growth and execution risk. After reaching a record high of $194 in June, shares are down over 20%.

According to Bloomberg’s Analyst Recommendations, Xero has 11 buy ratings, 4 holds, and 1 sell, with an average price target of AUD$193.63, signalling a 51% upside from current levels.

Xero is competing in a large addressable market with quality software, and they’re on a mission to build a platform that is too valuable and too embedded for customers to leave. There is a huge opportunity globally if Xero can execute its global expansion strategy effectively, but that’s the key: execution. While Xero’s long-term growth story remains intact, the market is clearly demanding greater proof that Xero can deliver growth without compromising its financial discipline.

Explore Xero

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. See PDS and TMD. This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.